April 17, 2022 - Weekly Market Summary

Markets are down, but there are pockets of outperformance if you know where to look.

This past week, Technology was the worst hit sector, down over -5%, followed by Communication Services and Healthcare. The winners this week were Energy up 3.17%, and Materials up 1.27%. GLD was up over 2% this week, and other commodities and business associated with farming continued to do well. The VEGI ETF was up 4%, MOO was up 1.63%, and DBA was up 2.54%. The dollar (DXY) is continuing to trade very strong, up over 2% the past couple of weeks, but getting into bought territory. DAL reported positive earnings last week up 14%, bringing the JETS ETF up over 6.30%.

Finviz

SPY

The S&P 500 (SPY) ended the week down -2.39%. It is trading below the 200 day EMA (red line) and the 50 day EMA (green line).

BTC

BTC ended the week down -6.5%, and could not hold above the 50 EMA (green line). There seems to be a battle between buyers and sellers at the psychological 40K mark.

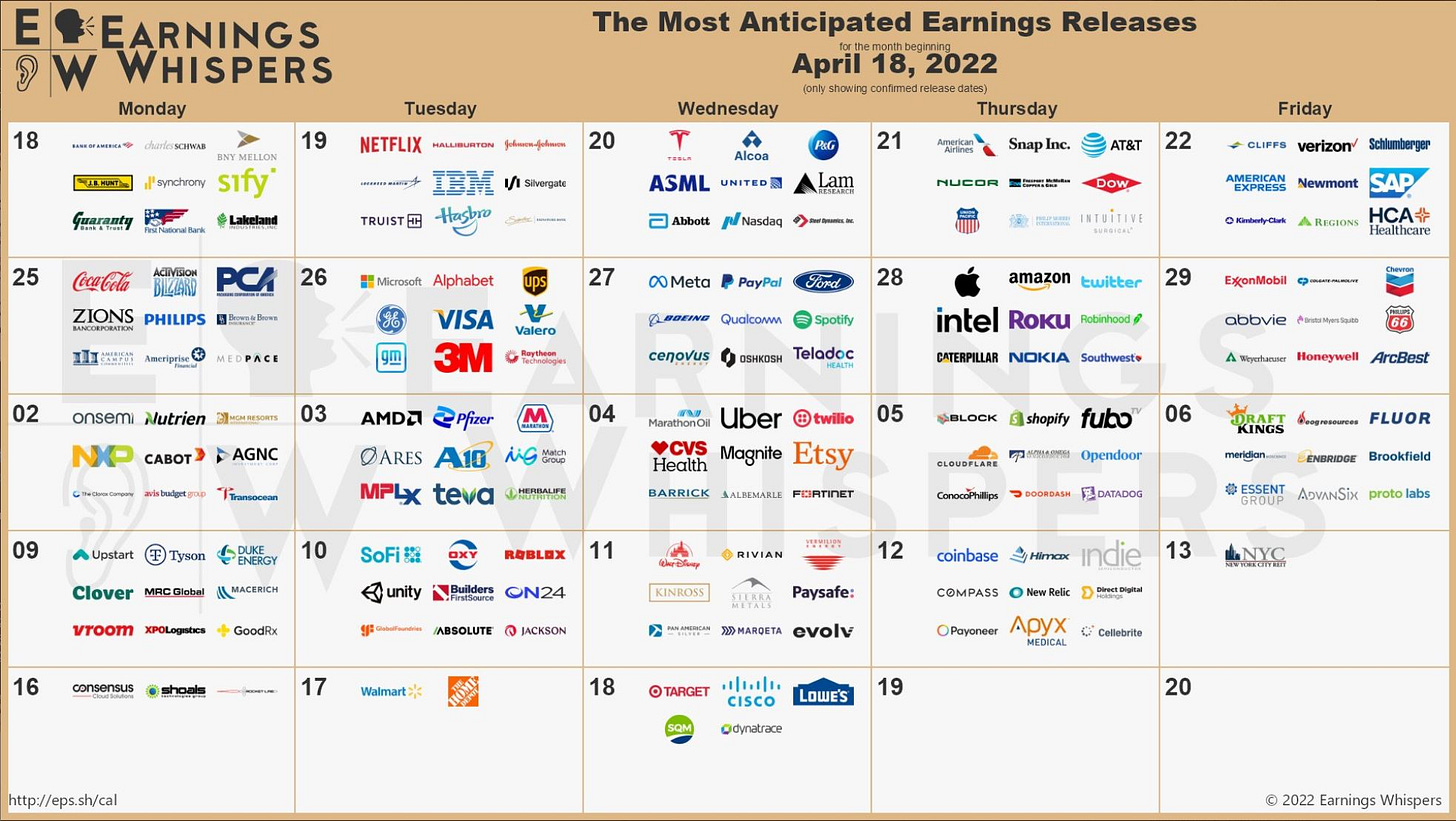

Earnings

Earnings season is about to get very busy over the next few weeks. If you are considering adding to positions in any of the stocks listed below, it's important to know that earnings can add lots of volatility and create huge price swings before the numbers are announced. Many of the stocks below are huge components of the S&P 500. If you are trading options in these, strangles and iron condors will pay you elevated premiums so keep an eye on the Implied Volatility Rank of these before entering trades.

Rates

The 30 year is close to 3% (2.91%), the 10Y is 2.82%, and the 2Y is 2.45%.