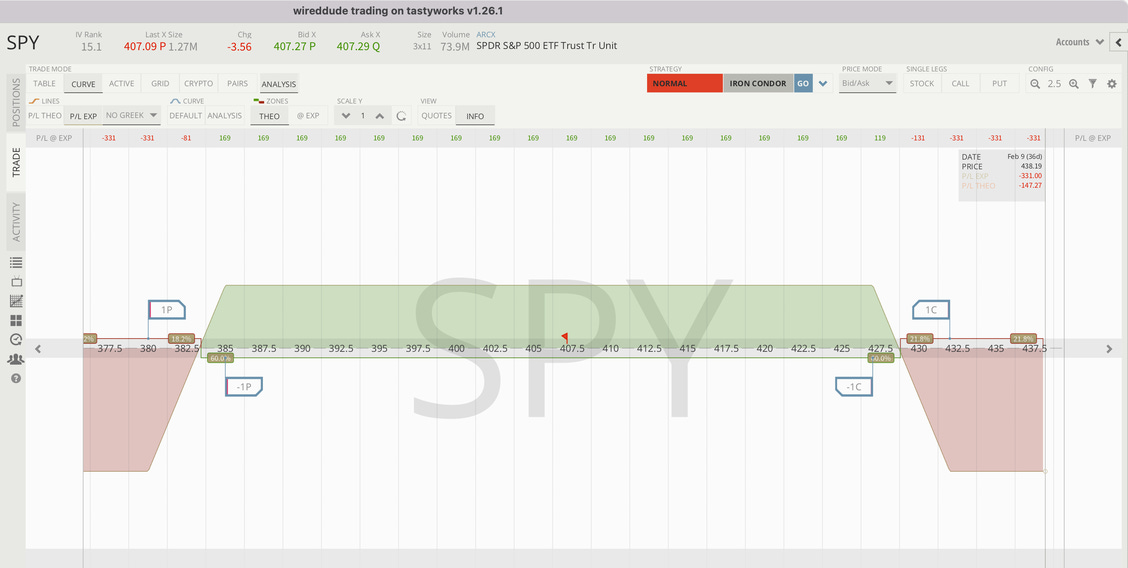

Hot Trades - SPY Iron Condor (CLOSED FOR PROFIT)

Trade #1: Close SPY IC. With the moderate decrease in volatility during the middle of this week, I decided to close my SPY Iron Condor for 19% of the maximum profit, or $31. (Image #1 above). Usually I go for $83 (or 50%), but I felt that volatility had gotten fairly low, and wasn’t going much lower so I thought I would take the opportunity to close the March Iron Conor in SPY for a profit.

To close the SPY Iron Condor For a 1.38 debit:

Bought 1 SPY 03/17/23 Put 385.00 @ 1.90

Remaining Instructions for Subscribed Members

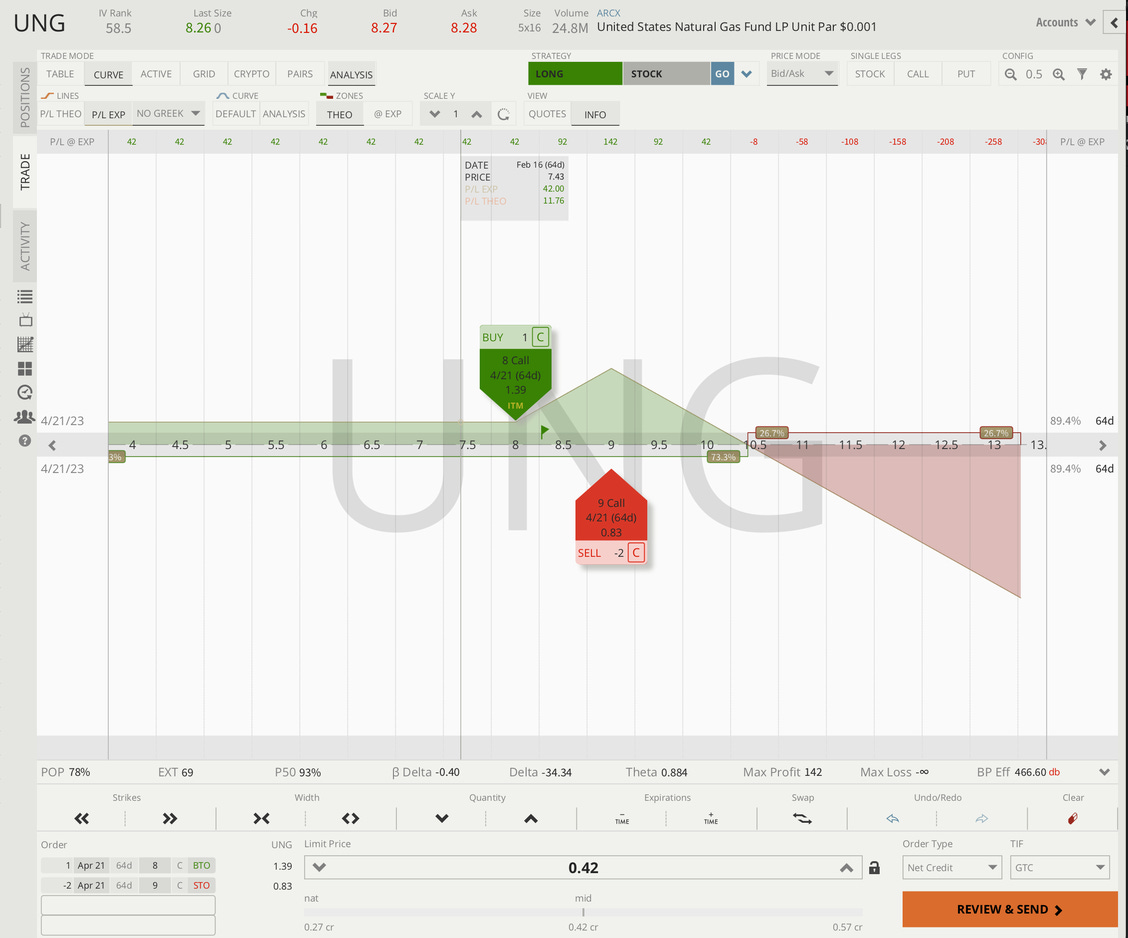

Trade #2: After a member pointed out the high IVR% in UNG (Natural Gas) this week I decided to also add a ratio spread. UNG is already very low and there is no risk to the downside in this trade. Should UNG reverse and head towards $9 on or before April 21st, I can make up to 1.42. My break even on the top is 10.50, and after that I’d be obligated to purchase 200 shares of UNG for whatever it’s trading at. Alternatively, I could close for a loss. My plan is to collect around 30-50% of profit and exit the trade quickly before I run into any sort of breach of the break even.

To Open the UNG Ratio Spread for a .50 credit:

Bought 1 UNG 04/21/23 Call 7.00 @ 1.56

Remaining Instructions for Subscribed Members

Other trades from this week:

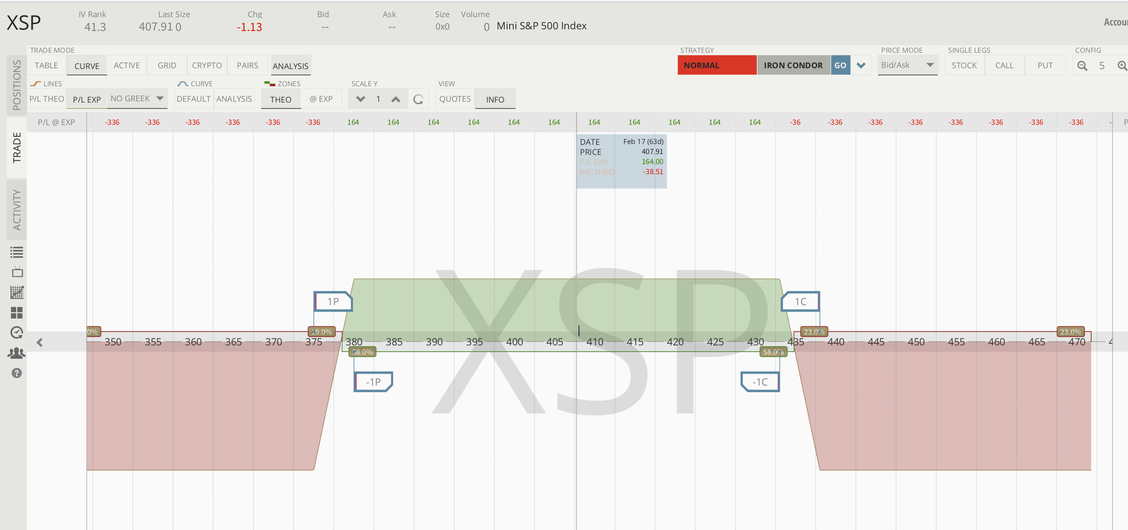

Opened a new “SPY-like” Iron Condor in April using XSP, the “Mini” S&P 500 Index. (See Image #3 above, and note the 41.3% juicy IVR%). Strikes for Premium Members, but hint, you can probably figure it out from the XSP image above! Collected 1.64cr on entry.

$38 profit in a 2nd Amazon covered call at the 105 strike. Closed for a 2.04db leaving me with $38 profit.

Opened a long 10 year short 2 year pairs trade, betting the yield curve would start to steepen.

Reset a Poor Man’s Covered Call in WBA

Did a Bearish QQQ Put/Debit Spread, recommended by our friends over at the Antagonist.

https://truewealth.moneyvikings.com

All rights reserved. Money Vikings, LLC is neither an investment or financial advisor. Money Vikings, LLC does not provide financial advice and none of the information being provided is to be seen as such. This is to include, but not limited to, any articles, videos and/or any other social media outlet presented by Money Vikings, LLC. All content is the opinions, beliefs, and personal strategies of the author(s) and owner(s) of Money Vikings, LLC (Greg and Jerry). Money Vikings, LLC recommends that everyone do their own research, technical analysis, and develop their own conclusions, prior to initiating any trade activity supported by their own understanding, abilities, and risk tolerance. All trades carry inherent risk and proper risk management strategies should be used accordingly. Money Vikings, LLC does not guarantee results and is not liable in any way for losses incurred by any person or organization. Periodically, we may highlight services we are using and may receive compensation from their respective affiliate programs.

Solid trades here. Congratulations! Love the iron condors, especially in this choppy environment.