March 27, 2022 - Weekly Market Summary

Finviz Weekly Market Map - Besides the usual suspects holding this market up (AAPL, GOOG, MSFT, AMZN, TSLA), we continue to see Energy, Insurance (BRK-B), Aerospace, Defense, and Materials climb. Financials are getting support from rising interest rates. Housing related stocks are dropping, possibly due to higher mortgage rates, increasing inflation, and decreasing home affordability. That being said, we continue to stay long REITs and Real Estate in general (VNQ) in the long term portfolio.

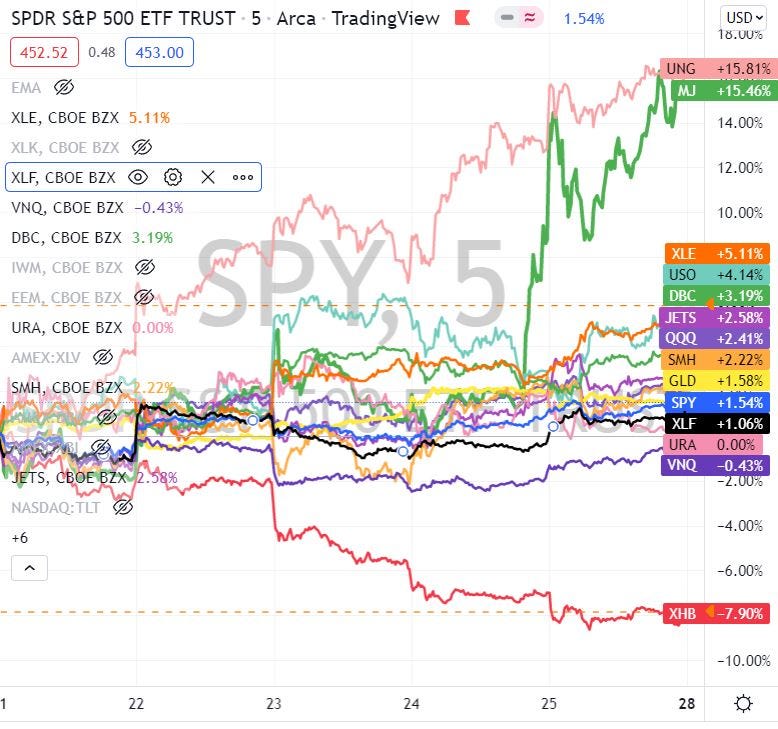

Market Sector Report - This week SPY continued its upward trend, exceeded by SMH, GLD, Airlines, Technology, Materials, Oil, and Energy. Also notable was the MJ ETF, up around 15% this week, as discussions around the SAFE Act Federal Legalization in Congress continue. Natural Gas led, up over 15% for the week. Uranium was flat, Real Estate was down a half-percent, and XHB (Homebuilders) lost over 7%.

Earnings Next Week - Source: Earning’s Whisperers

If you enjoyed this newsletter, please consider becoming a Money Vikings Premium Member for more insight, HotTrades, and health tips.