Money Vikings Investing - July 21st, 2024

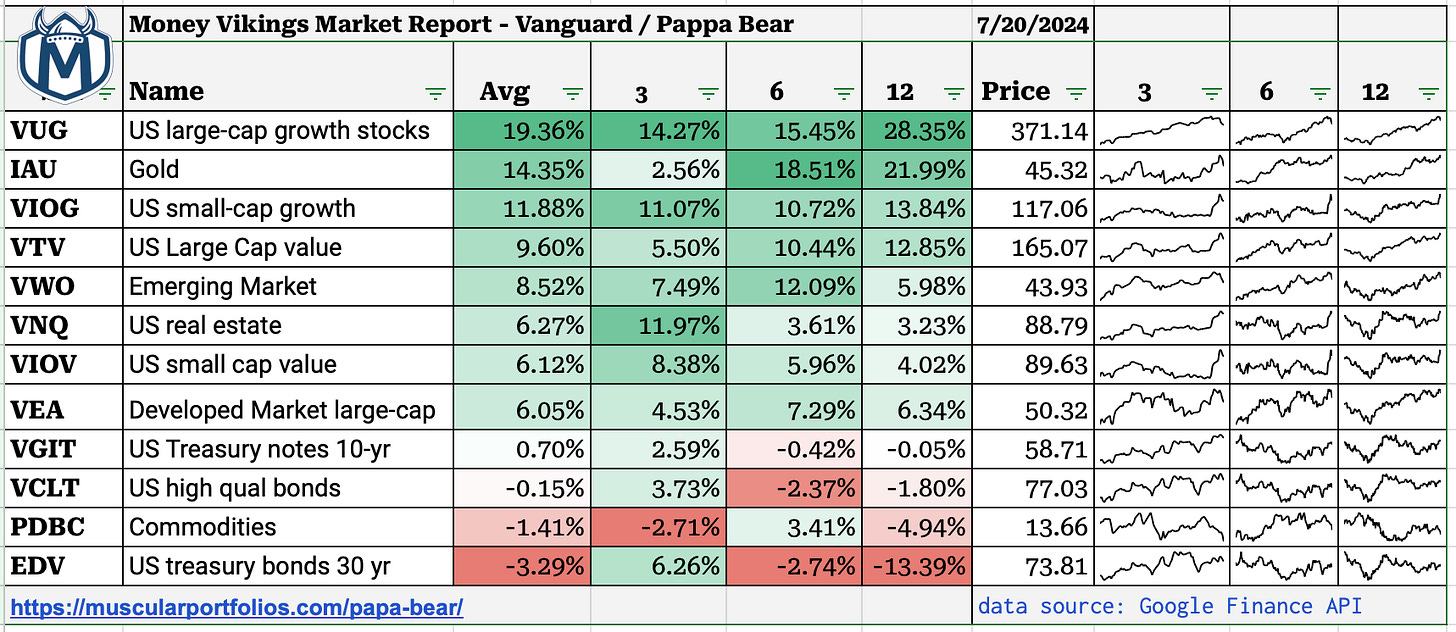

Market Report, Finviz/Sector Analysis, Sentiment, Earnings, Fear and Greed Index, Median 401K Balances by Age, How to Enter a Bull Call Spread (AR)🔥HotTrades: 🐻 SPY Puts. Covered Call Analysis.

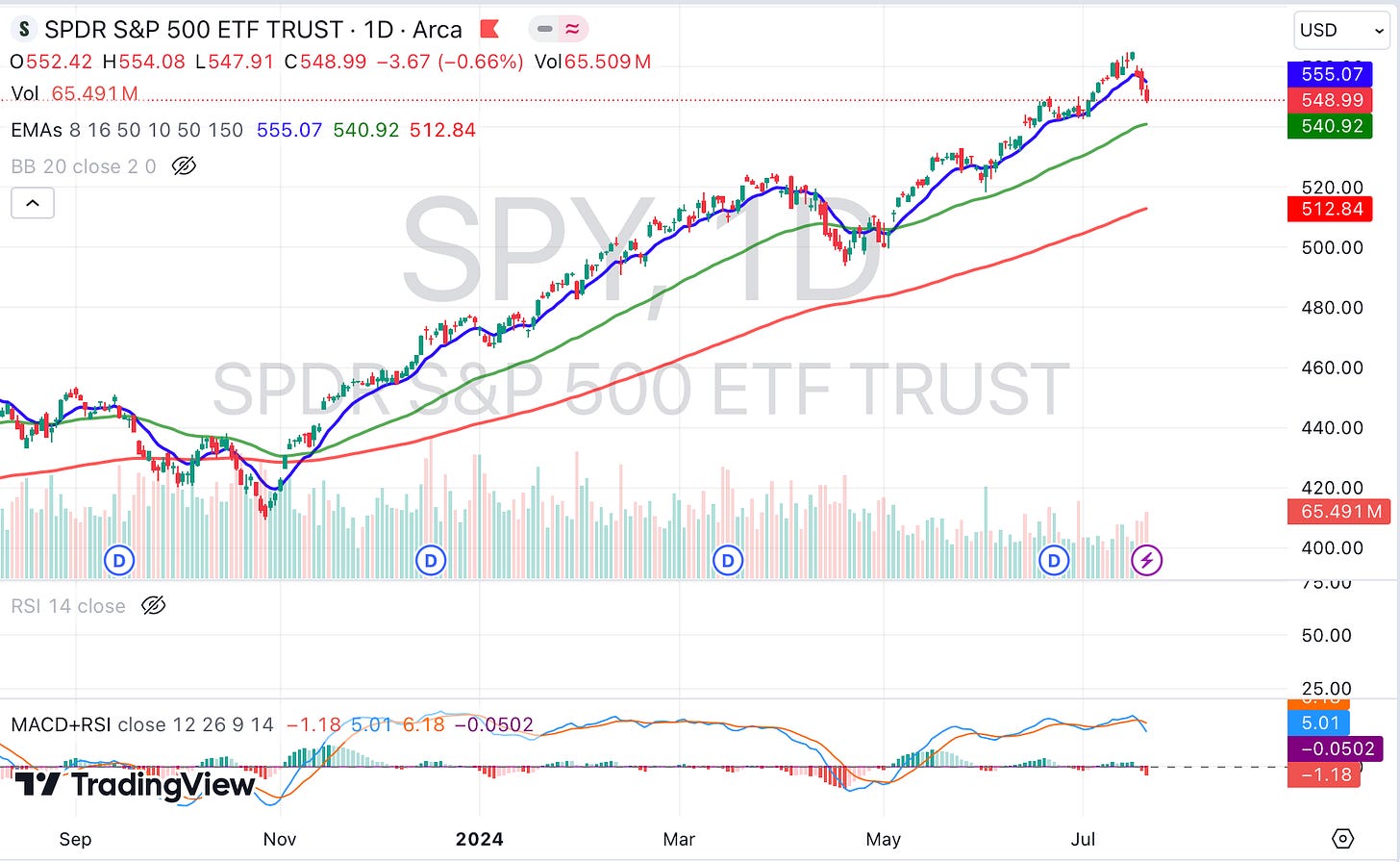

Hope everyone had a great trading week and was not too affected by the Crowdstrike issues that brought down airlines, banks, and government agencies. We continue to see volatility increase as we get into the heart of earnings season, an upcoming US election, and other geopolitical events. Markets had a pullback this week and time will tell if it was a “healthy” one or the beginning of the complete deterioration of society (I kid!)

For trading, we go into our thesis for identifying good covered call candidates, and share our top trades in this area. (Premium HotTrades section).

Greg & Jerry

YouTube | Blog | Book | Podcast | Discord | ☕️

Finviz Heat Maps Weekly View

The Fear and Greed Index, VIX

Median 401K Balances by Age

Greg goes over median 401K balances by age. How do you compare? Are these estimates a good proxy for how much you should have? Are they too small? Watch and learn more.

Earnings Next Week

Antagonist Research: How to Enter a Bull Call Vertical Spread in thinkorswim

Hot Trades - Bearish SPY Vertical, Cash Secured Puts and Covered Calls

On 7/11, I alerted traders that I bought to open a 559/560 bearish put spread for a $48 debit, then on 7/17, sold to close it for $58—a $10 profit. While not much money, it was fun to do a smaller timeframe (days) trade instead of my usual covered call and cash secured put trades which are over 1 or more months.