Money Vikings Investing - September Summary and Week of 10/1

In This Issue: Market Report, Finviz/Sector Analysis, Design Your Space for Wealth & Health, Weekly Sentiment Analysis, Knowing When to Sell (The Antagonist)

Seasonality in September, is usually bad. We have SPY down 5%. October and November are usually better, so there may yet be some hope for an end of year rally.

Bonds continue to suffer due to rising rates. The 10 year is highest rate in 16 years.

Gold is down over 3% for the month, but that’s is not stopping people from buying Costco gold bars at a record pace!

A government shutdown deadline looms: The Biden administration estimates that an estimated 2 million U.S. service members and more than 1.5 million federal civilian employees will go without a paycheck during a government shutdown. This includes our Money Viking co-founder, Greg. That is why we are working to maintain our emergency funds, and keep a well-diversified portfolio. Greg is not making any drastic investment changes as a result of this.

No new HotTrades this week (I tried for several in SLB 0.00%↑ COST 0.00%↑ and SOFI 0.00%↑ but none filled). The only thing I did was use the Pappa Bear Portfolio methodology and swapped from VTV 0.00%↑ to PDBC 0.00%↑ on Friday. I’ll continue to call out more trades for premium members on our discord and substack next week.

Finviz Heat Map 9/25-9/29 Weekly

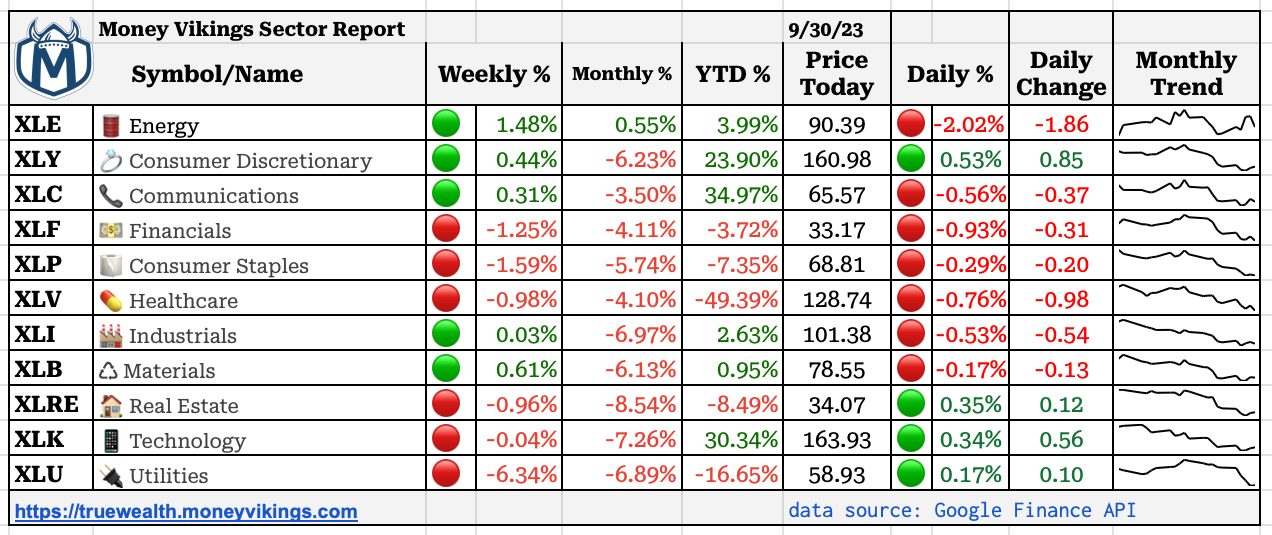

All sectors were down this month except for Energy, up .55%.

Fear and Greed Index

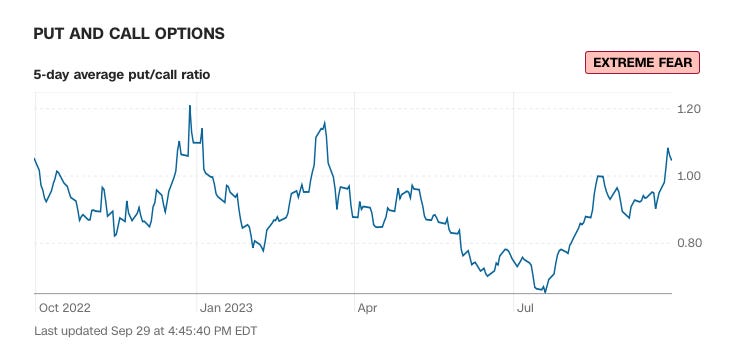

This week we declined from 34 to 28, a slight move towards fear. The VIX remains above 17. The Put Call Ratio is at 1.08 and rising, so that represents an increase in fear. When volatility is increasing and more people are buying puts than calls, it indicates a higher level of fear in the market. The Fear and Greed Indicator is a tool used to gauge the overall market sentiment based on several indicators. It provides valuable insights into investor behavior by analyzing factors such as volatility and options trading.

VIX

The VIX remains elevated. An increase from 17.25 to 17.51. The VIX, or the CBOE Volatility Index, is significant for several reasons. Primarily, it serves as an indicator of the expected 30-day volatility of the S&P 500, providing insights into the market’s sentiment and risk perception.

SPY in September

The performance of the S&P 500 September is seasonally weak, and that has been the case with a 5% decrease this month.

AAII Sentiment

AAII Sentiment Survey: Highest Pessimism Since Mid-May.

Interest Rates

Yields continued to rise, and bonds continued to fall. The next FOMC Meeting is in 32 days (Nov 1st). According to the Fed Watch Tool, there is an 18.3% chance of a hike.

Economic Events

Powell speaks Monday, JOLTs on Tuesday, Nonfarm Employment Changes and PMI on Wednesday, and more employment data on Friday.

Design Your Space for Wealth and Health

Checkout Greg’s latest YouTube video on How to Designs Your Space for Wealth and Health.

Knowing When To Sell

YouTube | Blog | Book | Podcast | ☕️

Copyright © 2023 Money Vikings. All rights reserved.

All rights reserved. Money Vikings is neither an investment or financial advisor. Money Vikings does not provide financial advice and none of the information being provided is to be seen as such. This is to include, but not limited to, any articles, videos and/or any other social media outlet presented by Money Vikings. All content is the opinions, beliefs, and personal strategies of the author(s) and owner(s) of Money Vikings (Greg and Jerry). Money Vikings recommends that everyone do their own research, technical analysis, and develop their own conclusions prior to initiating any trade activity supported by their own understanding, abilities, and risk tolerance. All trades carry inherent risk and proper risk management strategies should be used accordingly. Money Vikings does not guarantee results and is not liable in any way for losses incurred by any person or organization. Periodically, we may highlight services we are using and may receive compensation from their respective affiliate programs.

Gold bars at Costco?! I didn’t think anything could top the $1.50 hot dog and free samples.