Money Vikings Investing - Week of 10/15

In This Issue: Market Report, Finviz/Sector Analysis, Weekly Sentiment Analysis, Portfolio Construction, Investing outside the USA? Why I’m Buying Realty Income Hand🤚over Fist 👊! 🔥Hot Trades (CARR)

Welcome to the October 15th investing newsletter to help you stay on top of the market and prepped for next week. Overall we are half way through October and dealing with the seasonal pullback October usually brings. I’ve been using the recent decline to close covered calls in COPX 0.00%↑ , CARR 0.00%↑ , and have been looking at adding beat up dividend stocks and ETFs such as O 0.00%↑ , KO 0.00%↑, and KMI 0.00%↑ . No major changes to the portfolio right now, but I continue to dollar cost into my 401K and HSAs, and 429s each pay period. Next week brings us more financial earnings as well as big S&P stocks such as Tesla and Netflix.

Finviz Heat Map 10/9-10/13 Weekly

The Nasdaq, Dow, and S&P all traded up this week, while Small Caps declined. The 10 year rate declined about 3.50% while bond funds like TLT started to turn a corner.

Energy, Utilities and Real Estate performed extremely well this past week. Even financials caught a break with JPM reporting earnings, and additional banks such as Goldman and Bank of America reporting next week.

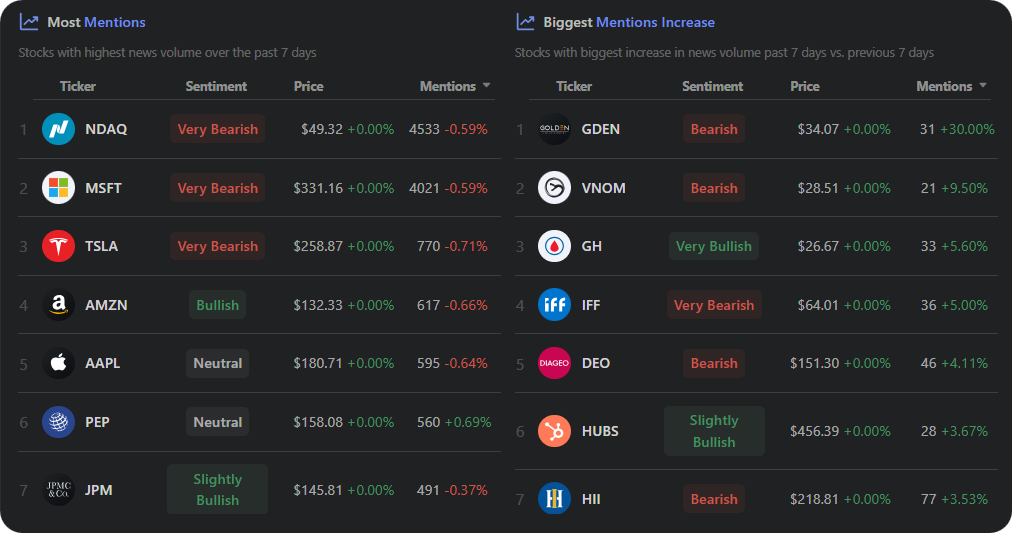

Trending Stocks, Uptrends.ai Market Sentiment

VIX, Fear and Greed

The VIX elevated from 17 to 19 (bearish), however the put call ratio came down below 1 (bullish), and these metrics caused the overall fear and greed indicator to subside around 4 points (bullish)

SPY, Last Week Price Action

Here’s a view of SPY over the past few months, with a box around this past week. We bounced off the 200 EMA Friday, up .92% for the week.

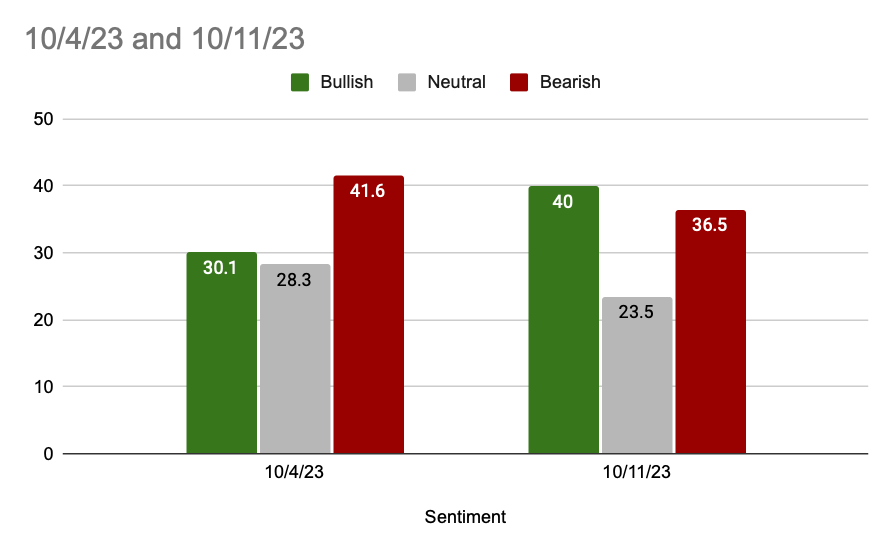

AAII Sentiment

Between week ending 10/4 and week ending 10/11, the AAII Sentiment showed a jump in bullishness by 10%, and a decline in bearishness by 5%.

Interest Rates

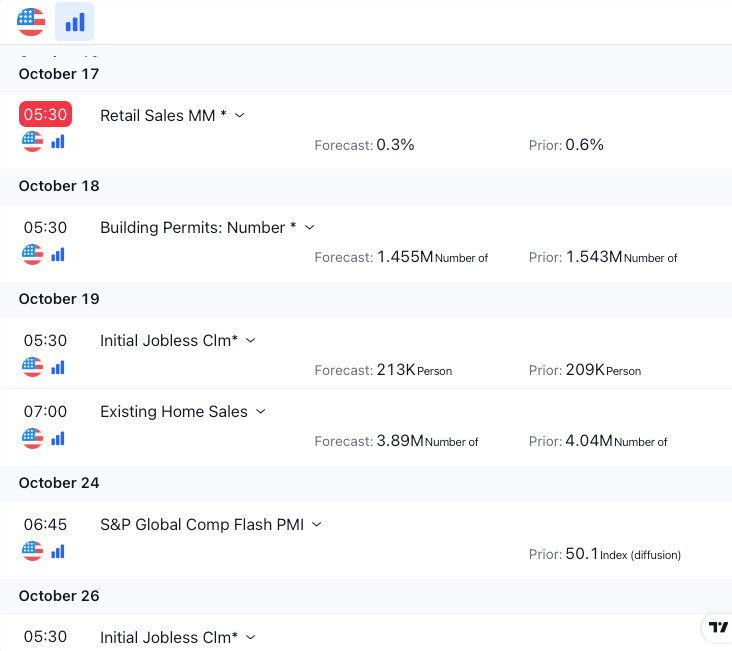

Economic Events & Earnings

Next week earnings starts to get a bit more busy with Tesla, Netflix, United, American Airlines, Goldman, Amex, Bank of America reporting. We'll also get retail sales, Building Permits, Initial Jobless Claims, and Existing Home Sales.

Why I’m Buying Realty Income Hand🤚over Fist 👊!

What’s the Risk of Investing outside the USA?

This week Antagonist Stocks and Options Research covers the Country Risk Map and what the Risk Premium is for investing outside the US.

HotTrades 🔥

Carrier Global (CARR) Covered Call