Money Vikings Investing - Week of 10/22

In This Issue: Reasons to Be Optimistic! Market Report, Finviz/Sector Analysis, Weekly Sentiment Analysis, 5 Heart ❤️ Healthy Habits.

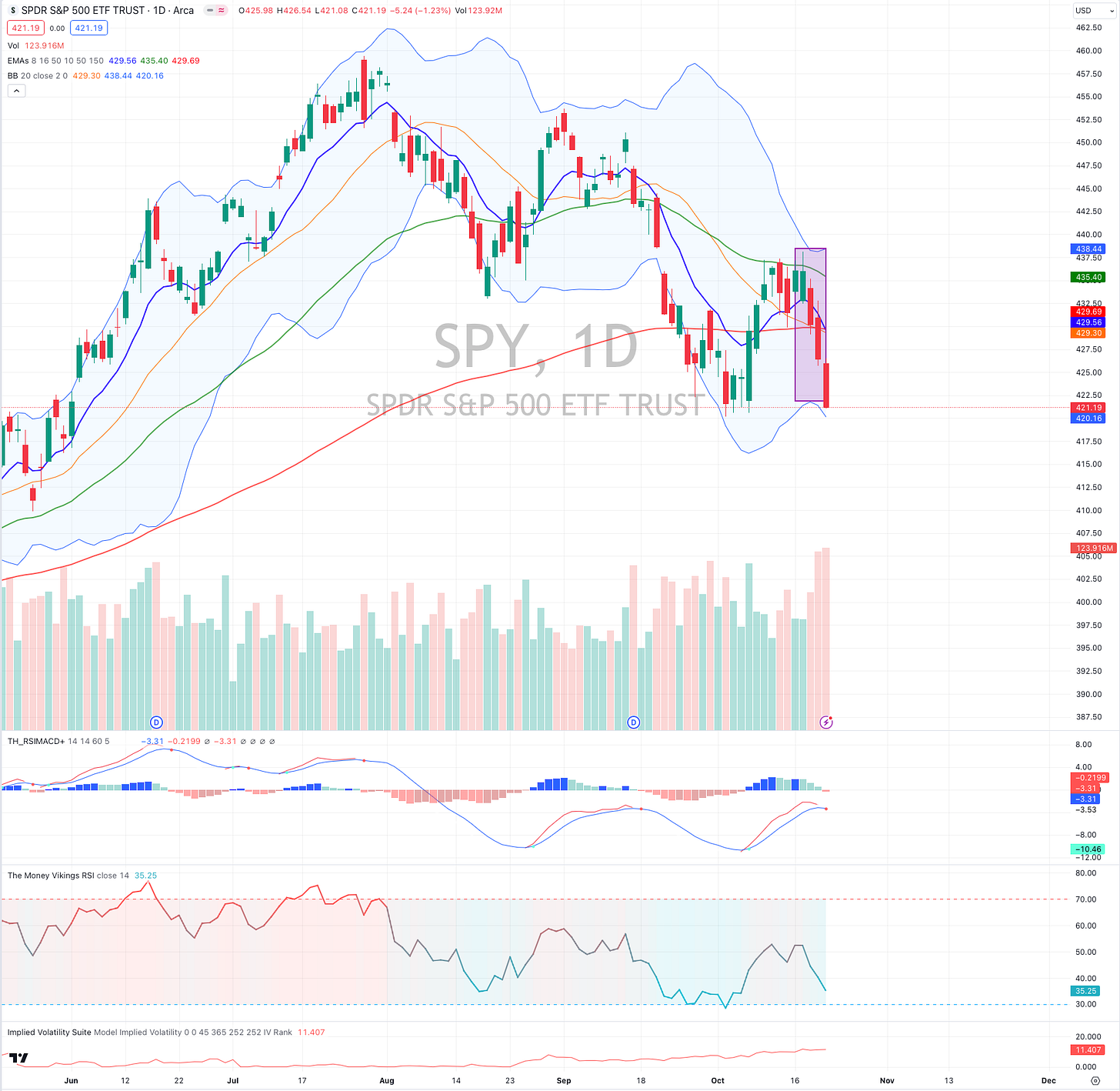

I know it’s been a tough week, SPY closed below the 200 EMA for the week with a bearish MACD crossover on the daily, but here are some reasons to be optimistic in the market:

SPY is trading near the lower Bollinger band, often a good place for a bounce.

The AAII bearish sentiment indicator went down 1.5%

Interest Rates might be topping out here.

MSFT GOOG AMZN META all report earnings next week which could perhaps give the market some love.

High volatility (currently 21) is great for selling options premium! I’m looking for more iron condors, strangles and my personal favorite - Covered Calls next week.

Those dividend paying stocks are paying even HIGHER Yields, so consider looking at your dividend stock watchlist for some deals.

The 30 year is paying almost as much as the 2 Year interest rate

Check out Gold & Bitcoin 🤘

You now have 5 heart healthy tips in this newsletter to take better care of yourself!

Finviz Heat Map & Market Summaries 10/16-10/20 (Weekly)

Trending Stocks, Uptrends.ai Market Sentiment

VIX, Fear & Greed Indicator

SPY, Last Week Price Action

AAII Sentiment

Interest Rates

Economic Events & Earnings

5 Heart Healthy Habits

YouTube | Blog | Book | Podcast | ☕️

HotTrades 🔥

SPY Iron Condor