Money Vikings Investing - Week of 10/29 🎃

In This Issue: Market Report, Finviz/Sector Analysis, Weekly Sentiment Analysis, Fear is our Friend

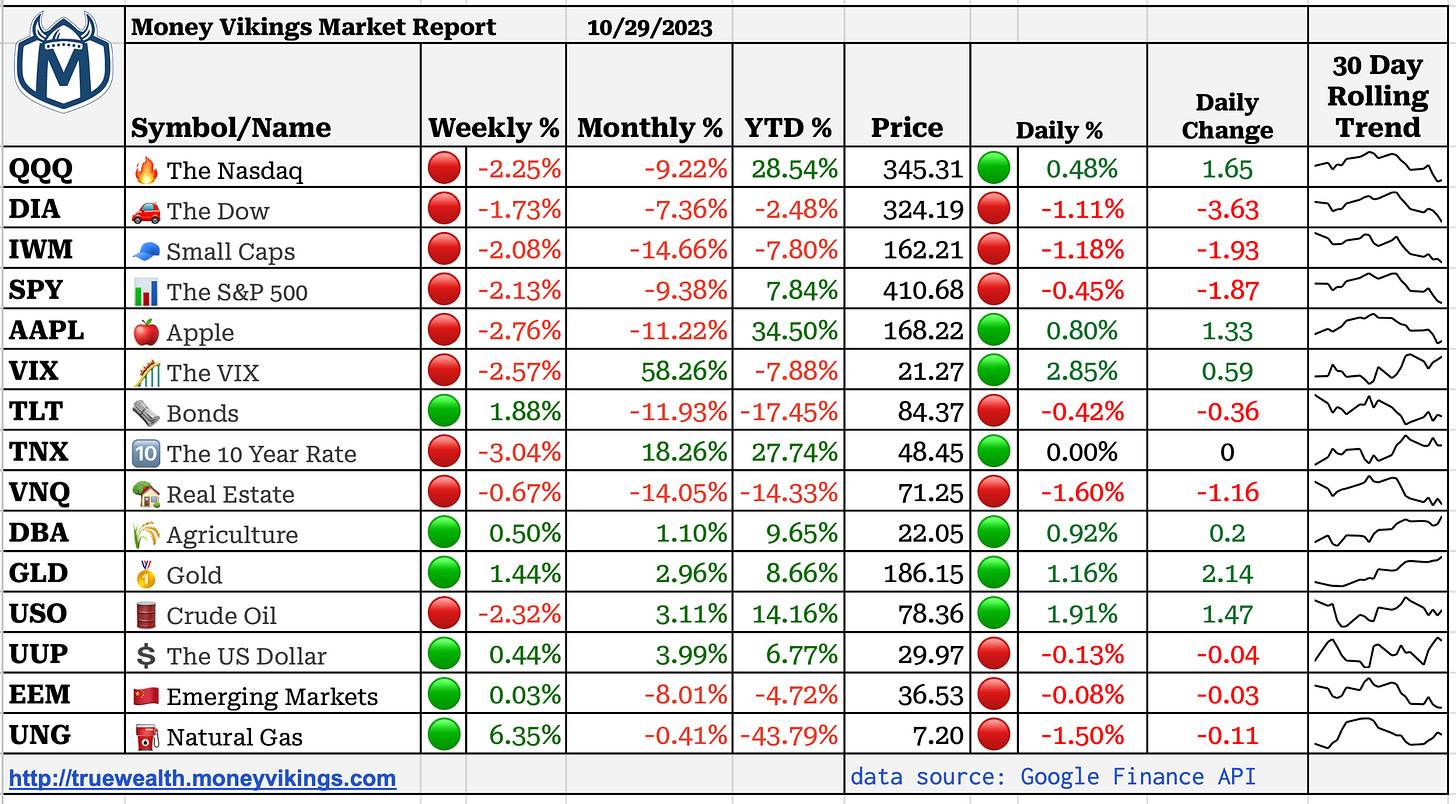

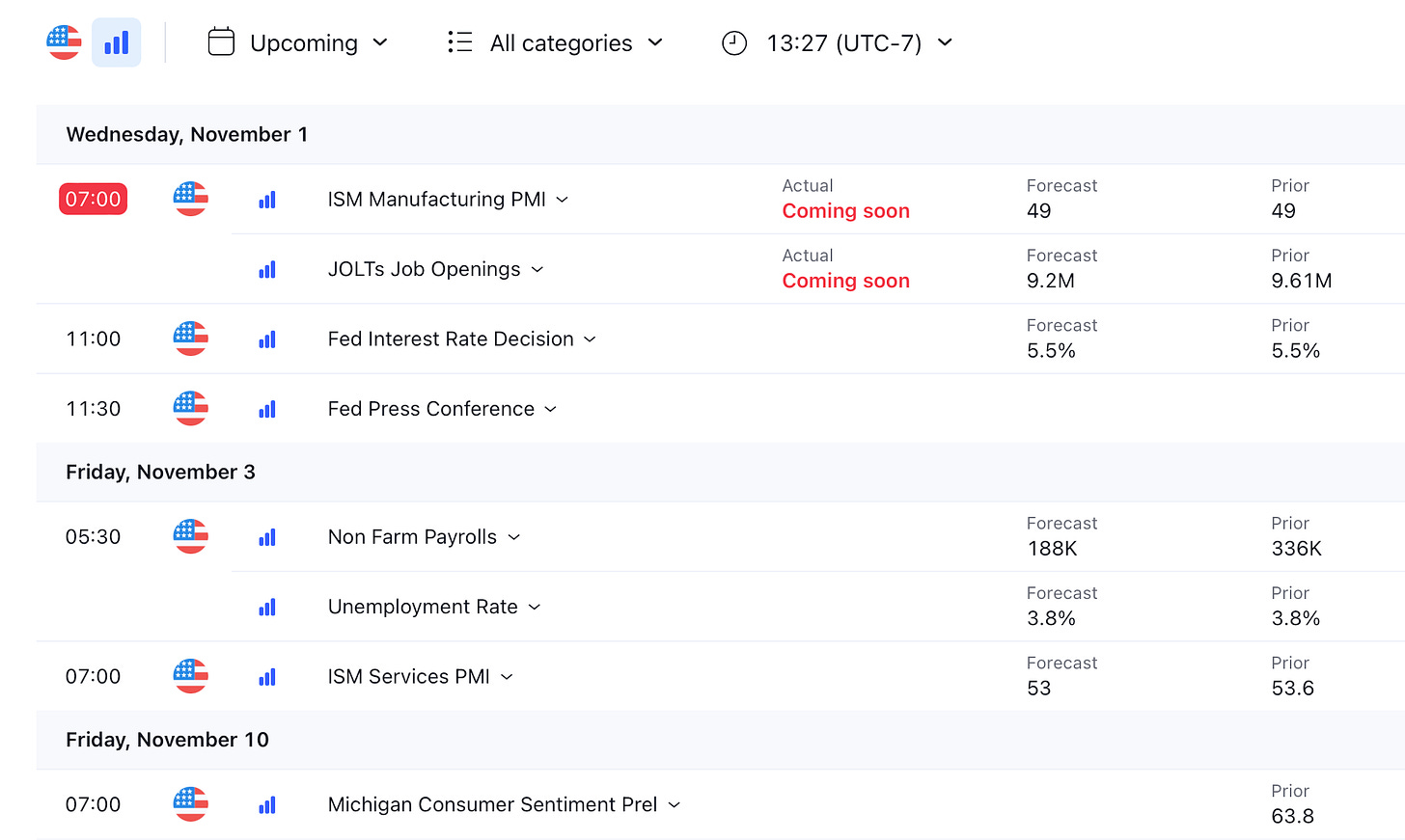

This past week had a lot of earnings, but was still not enough to pull the market back up. SPY, IWM, and QQQ all lost 2%, while DIA declined 1.73%. The VIX did retreat and Gold continues to ascend. Rates have not continued to climb, but I’m still enjoying close to 5% on my savings and money market accounts. I opened another Iron Condor out to December, and opened a 28/38 earnings strangle for INTC out to December for a $91 credit. A few covered calls were also closed and reestablished in AMZN. We continue to have a busy earnings week coming up with Apple, Starbucks, SoFi, AMD, McDonalds, Pfizer. We also have a Fed Rate Decision & Press Conference on Wednesday.

We have given our truewealth site a facelift, and have gone dark for halloween. We will try to keep market data and finviz heat maps updated daily, so be sure to check it out and give us any feedback you have.

Have a safe and Happy Halloween! 🎃

Greg & Jerry

Finviz Heat Map & Market Summaries 10/23-10/27 (Weekly)

VIX, Fear & Greed Indicator

SPY, Last Week Price Action

AAII Sentiment

Interest Rates

Economic Events & Earnings

YouTube | Blog | Book | Podcast | ☕️

HotTrades 🔥

(New!) SPY Iron Condor

Keep reading with a 7-day free trial

Subscribe to Money Vikings to keep reading this post and get 7 days of free access to the full post archives.