Money Vikings Investing - Week of 2/26/2023

In This Issue: Investing for World War III, Market Report, 2 Hot Trades: COIN and PYPL, Collecting: I’m Not One With Phyrexia, Health Benefits of Onions

Investing for World War 3

Hi There Investors and Traders!

We are essentially at the beginning stages of World War 3. Am I saying that full scale war will break out? Probably not. But the largest powers in the world are clearly jockeying for advantage with no end in site. This could have implications for our investing and wealth building activities, not to mention the many humanitarian crisis that will result.

I will always believe in the US and our ability to survive, thrive and prosper. But it is time to start thinking strategically and how to best prepare for future turmoil.

Best in investing and life,

Greg & Jerry

p.s. Hope to see you in our discord this week!

Weekly Market Report

Other than Bonds, Oil, and the US Dollar, there wasn’t much to celebrate this week. The S&P 500 remains up 3.12% for the year and continues to trade over the 200 day SMA, just barely. Bitcoin had a 6% pullback, The VIX traded as high as 23, but ended the week lower than it started this past Tuesday. The Dollar trended upwards over 1% and emerging markets pierced through the 200 Day SMA.

S&P 500

We are getting very close to piercing through the 200 SMA. Will it hold next week? Time will tell.

Finviz Heatmap

The entire market traded down this week, other than NVDA, MRK, ABBV, and a few other Consumer Defensive areas. Consumer Cyclicals such as AMZN, HD, SBUX, and NKE got stuck in the mud.

Bitcoin

Trading below the 20 EMA this week, we had a 6% pullback, but still remain well above the 50 and 200 EMAs.

10 vs 2 Yield Curve Spread

The yield curve continues to trade at extreme inverted levels. In the first chart, note that the 2Y is yielding 4.81% (black) while the 10% is only yielding 3.94% (blue). Being at multi-decade lows, last week I entered a Hot Trade week shorting the 2yr and going long the 10yr, betting we would begin to un-invert. On Tuesday we went as high -0.771 and I took off my trade for a profit. Thursday and Friday we continued to have a wider gap of up to -0.873. Glad I was able to take profits when I did. Will check again next week to see if we are low enough to attempt another one.

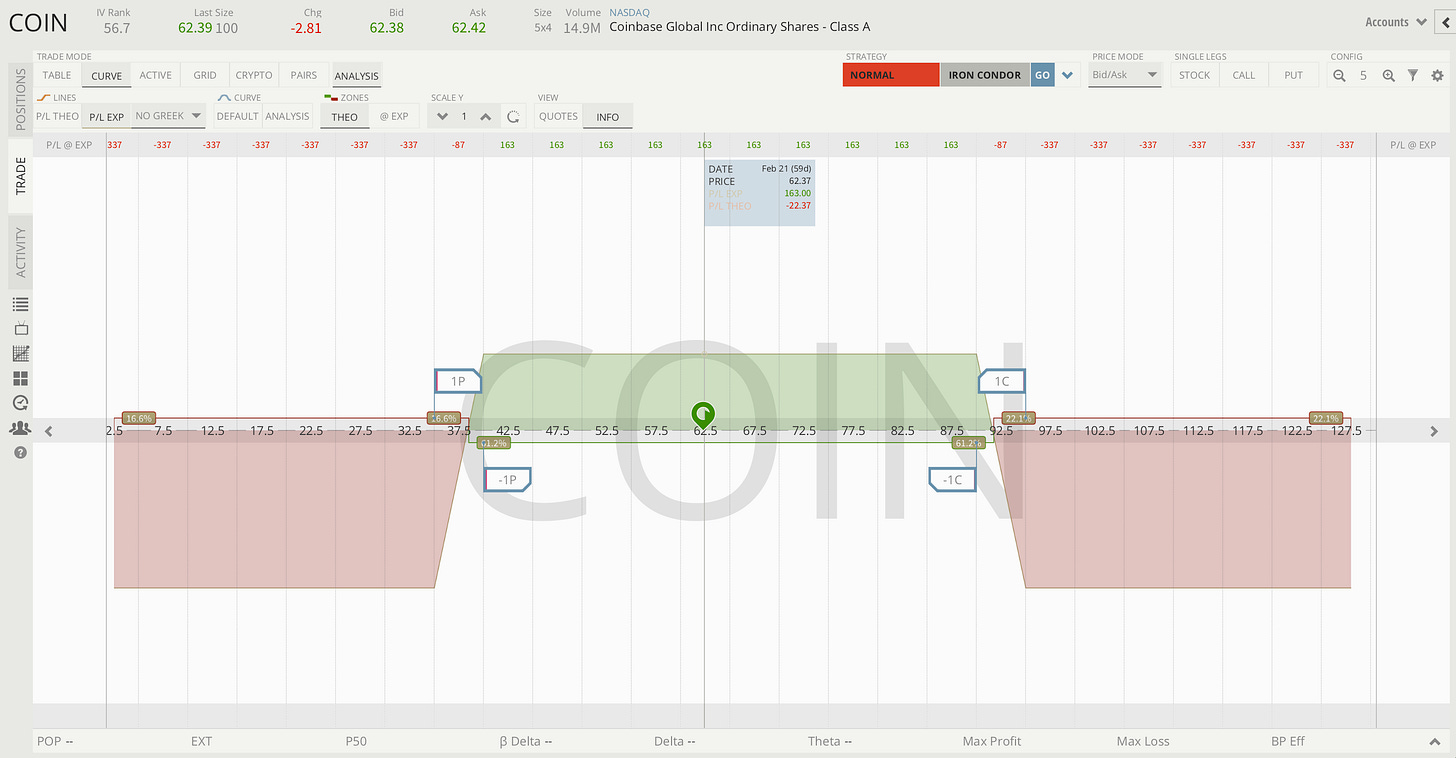

Hot Trade #1 - COIN Iron Condor

COIN Earnings Iron Condor. Last week I entered an iron condor in COIN, expecting an IV crush after earnings. The IVR% definitely decreased from 56%, but not enough to let me take the trade off the next day. I’m still holding it as IVR% is hovering around 35%. We have 55 days left, and COIN is paying us $1.85/day in theta decay.

To enter a COIN Iron Condor For a 1.54 credit:

Bought 1 COIN 04/21/23 Call 95.00 @ 3.12

Sold 1 COIN 04/21/23 Call 90.00 @ 3.76

Bought 1 COIN 04/21/23 Put 35.00 @ 1.66

Sold 1 COIN 04/21/23 Put 40.00 @ 2.65

Hot Trade #2 - PYPL Ratio Spread

PYPL Ratio Spread. One of our members noticed that the CEO of Paypal added some shares and took that as a bullish signal. I decided to play another ratio spread using puts. This trade will remain profitable over 60, with a max profit potential of $308 should PYPL trade down to 62.50 at expiration. Below 60 we start to lose money. There is no risk to the upside.

To open the PYPL Ratio Spread for a .58 credit:

Sold 1 PYPL 04/21/23 Put 62.50 @ 1.00

Bought 1 PYPL 04/21/23 Put 65.00 @ 1.43

Sold 1 PYPL 04/21/23 Put 62.50 @ 1.01

Other Trades from This Past Week

Did a calendar in YETI for earnings. I was able to close overnight for a $51 profit. Maybe I’ll get one of their mugs with the profits :)

Rolled out my covered call in VZ from March to April at the 41 strike (.50cr)

Did a 29.50/30.50 FXI bearish put spread for a profit on Chinese weakness.

Took off the Yield Curve short 2 long 10 year spread using futures for a profit.

Added a few additional shares of AAPL and GOOG on weakness

Established a new covered call in AMZN at the 115 strike out to April

Entered a risk defined long Healthcare XLV 130/131 bullish call spread. I’ll risk $50 to make $50 here.

Long energy in the IRA - Sold a Cash Secured Put at the 80 strike out to April in XLE for a 2.00 credit.

Earnings Next Week

Next week we’ll be watching Target, Costco, CRM, and Lowes earnings. Join our discord where we’ll be calling out trade ideas in these stocks and more.

Collectibles - I Am NOT One with Phyrexia

What are the Health Benefits of Onions?

Like garlic, onions are typically thought of us a gross food that makes our breath smell bad. BUT, in terms of health, onions are some of the most powerful foods in the world. Read more. . .

All rights reserved. Money Vikings, LLC is neither an investment or financial advisor. Money Vikings, LLC does not provide financial advice and none of the information being provided is to be seen as such. This is to include, but not limited to, any articles, videos and/or any other social media outlet presented by Money Vikings, LLC. All content is the opinions, beliefs, and personal strategies of the author(s) and owner(s) of Money Vikings, LLC (Greg and Jerry). Money Vikings, LLC recommends that everyone do their own research, technical analysis, and develop their own conclusions, prior to initiating any trade activity supported by their own understanding, abilities, and risk tolerance. All trades carry inherent risk and proper risk management strategies should be used accordingly. Money Vikings, LLC does not guarantee results and is not liable in any way for losses incurred by any person or organization. Periodically, we may highlight services we are using and may receive compensation from their respective affiliate programs.

This is excellent. Amazing how you’re able to go so deep on so many different asset classes. Very impressive! Thanks for another awesome post. Really enjoying your work