Money Vikings Investing - Week of 3/12/2023

SVB, Market Report, Hot Trades: SPY Iron Condor, Long Gold.

Weekly Market Report

Thank you to all the new subscribers who have checked us out coming from The Antagonist this week, we’re happy to have you! This week’s newsletter includes 2 Hot Trades that usually only paid subscribers receive. I hope you enjoy it and consider subscribing to both publications!

If it wasn’t enough that the SVB failure caused concern with a mixed jobs report, the S&P 500 lost over 4% and volatility ticked higher to close over 22. Bitcoin lost over 9%. Gold and longer dated bonds ascended 1% and 4% respectively.

We breached the 200 SMA on the Daily (pictured below) which doesn’t look great. The next recent low is 374 in December. If you flip to the weekly chart, there is a semi-encouraging support at 371.73 (200 SMA). Some members are calling for 350.

For the week all sectors declined. Consumer Defensive lost 2.41%, and Basic Materials lost and 7.98%.

Bitcoin

The 200 SMA at 19,699 as well as the 20K remain the psychological line in the sand in terms of the next levels of support. Note we did breach 20K briefly on Friday 3/10.

Yields

Yields fell while the spread between the 2 year and 10 year exceeded -1%, then bounced back to -0.88%.

The Dollar

The US dollar, having been in an uptrend since February is starting to show some weakness. A weaker dollar could be good news for large US multi-national companies.

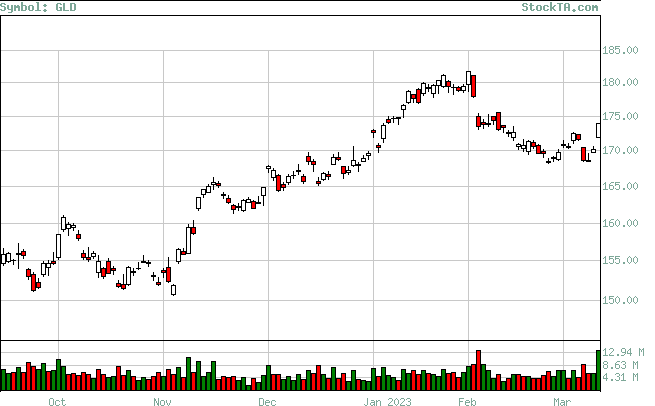

Gold (Hot Trade)

It is worth noting that Gold continued to rise this week, gapping up on Friday. We called out a long bullish GLD 170/174 call spread to May on 3/9 for a $200 debit:

Bought 1 GLD 05/19/23 Call 170.00 @ 5.02

Sold 1 GLD 05/19/23 Call 174.00 @ 3.02

So far this trade is up 19% so you may want to adjust the strikes a bit higher on Monday.

The VIX

The VIX rose 8% this week, up to levels not seen since December. Look for premium selling strategies this week such a selling cash secured puts, covered calls, strangles, and iron condors.

Fear and Greed Index / Put-Call Ratio Above 1

This week we left Neutral territory, skipped Fear, and moved into Extreme Fear territory. Note in the 2nd chart below the trend of the put-call ratio at 1.11. This means for every bullish call someone buys, there are 1.11 bearish puts bought, a sign of fear.

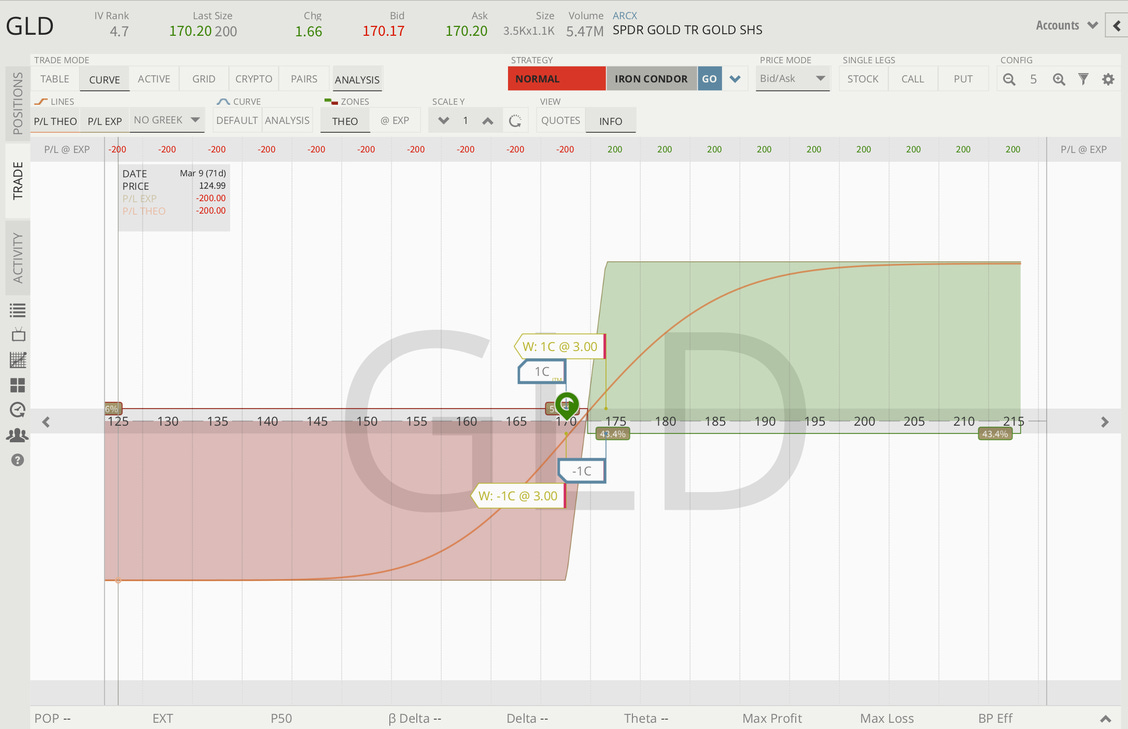

Hot Trade - SPY Iron Condor (OPENED)

SPY Iron Condor. On 3/9 I called out in discord a 5 dollar wide Iron Condor in SPY out to April 17th at the 362/367/413/418 strikes. I collected a $1.71cr. I set a GTC order to close for .86 db.

To open the SPY Iron Condor For a 1.71 credit:

Bought 1 SPY 04/21/23 Put 362.00 @ 2.66

Sold 1 SPY 04/21/23 Put 367.00 @ 3.41

Sold 1 SPY 04/21/23 Call 413.00 @ 2.62

Bought 1 SPY 04/21/23 Call 418.00 @ 1.66

Earnings Next Week

Join our discord where we’ll be calling out trade ideas in these stocks and more. Last week we made $77 overnight in a CRWD Iron Condor, see YouTube video above going over the entry. And don’t forget to subscribe to our YouTube channel https://www.youtube.com/@MoneyVikings

All rights reserved. Money Vikings, LLC is neither an investment or financial advisor. Money Vikings, LLC does not provide financial advice and none of the information being provided is to be seen as such. This is to include, but not limited to, any articles, videos and/or any other social media outlet presented by Money Vikings, LLC. All content is the opinions, beliefs, and personal strategies of the author(s) and owner(s) of Money Vikings, LLC (Greg and Jerry). Money Vikings, LLC recommends that everyone do their own research, technical analysis, and develop their own conclusions, prior to initiating any trade activity supported by their own understanding, abilities, and risk tolerance. All trades carry inherent risk and proper risk management strategies should be used accordingly. Money Vikings, LLC does not guarantee results and is not liable in any way for losses incurred by any person or organization. Periodically, we may highlight services we are using and may receive compensation from their respective affiliate programs.

These weekly reports are so helpful. Thank you! That VIX chart looks like my heart monitor when I actually get up from my computer.