Money Vikings Investing - Week of 4/9/2023

In This Issue: Market Report, GenX Retirement Tips, Oil Surges, Rates Lower, Gold Shines, HotTrades 🔥

It was a shortened trading week, but there were some interesting developments. SPY hung out around 410 for most of the week, not doing a whole lot. The 10 year rate was down to 3.29% which caused bond prices to increase. Oil rallied to 4 month highs, continuing to boost the energy sector. Gold continues to trade near highs not seen since last year.

Discord & Substack Chat (see link below)

Indexes and Macro Indicators

S&P 500

Weekly Finviz Heat Map

Communication Services led, up 4.45% for the week (and 18% for the quarter!), while Industrials lagged, down -2.19%. Even though Tech was down this week, it is the best sector for the quarter, up over 22%.

Yield Curve & Rates

Rates are falling to 7 month lows, but the spread levels have not changed much for the week, as we remain inverted around 58 bps below 0. The 2 year still trades above the 30 year and 10 year.

The VIX

The VIX continued to remain low this week, below 20. I usually like to take off as many premium selling strategies as I can at this time and pounce when volatility spikes again. There is less Fear and more Greed in the market as last week we were at 49 (neutral) and this week we’ve moved to 57 (greed).

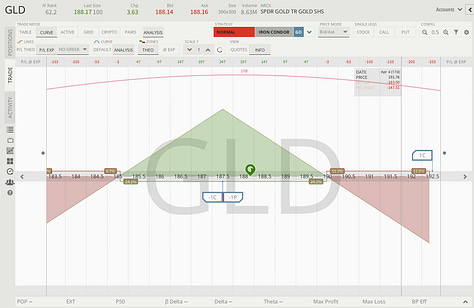

HotTrades - Closed GLD Iron Condor for a Scratch

Iron Condors don’t always win. In fact, I expect to lose around 25% of the time because I try to take trades with at least 75% or higher POP. The trick is to manage the losses and not let them get out of control. After wrestling with this GLD Iron Condor for a few weeks, it ended up being managed into an Iron Fly, where the most profit is pinned at 187.5. Since we had less than 21 days to go and I could close for a scratch (-$1), I decided to take this one off, and perhaps reestablish a new GLD trade next week.

GLD Iron Condor. To close the iron condor for a scratch ($-1) (3.56 debit or less):

Sold 1 GLD 04/21 Put 182.50 @ 0.79

Bought 1 GLD 04/21 Put 187.50 @ 2.73

Bought 1 GLD 04/21 Call 187.50 @ 2.62

Sold 1 GLD 04/21 Call 192.50 @ 1.00

All rights reserved. Money Vikings, LLC is neither an investment or financial advisor. Money Vikings, LLC does not provide financial advice and none of the information being provided is to be seen as such. This is to include, but not limited to, any articles, videos and/or any other social media outlet presented by Money Vikings, LLC. All content is the opinions, beliefs, and personal strategies of the author(s) and owner(s) of Money Vikings, LLC (Greg and Jerry). Money Vikings, LLC recommends that everyone do their own research, technical analysis, and develop their own conclusions, prior to initiating any trade activity supported by their own understanding, abilities, and risk tolerance. All trades carry inherent risk and proper risk management strategies should be used accordingly. Money Vikings, LLC does not guarantee results and is not liable in any way for losses incurred by any person or organization. Periodically, we may highlight services we are using and may receive compensation from their respective affiliate programs.

Copyright © 2023 Money Vikings LLC, All rights reserved.

I love The gauge - it’s made up of so much more than just vix, like advance/decline, put/call ratio and many other indicators.

I appreciate how you include the VIX and fear gauge readings. I find it very helpful to watch those