Money Vikings Investing - Week of 5/14/2023

Market Report, Finviz/Sector Analysis, 🔴 META Earnings, Hot Trades, Earnings WMT TGT HD

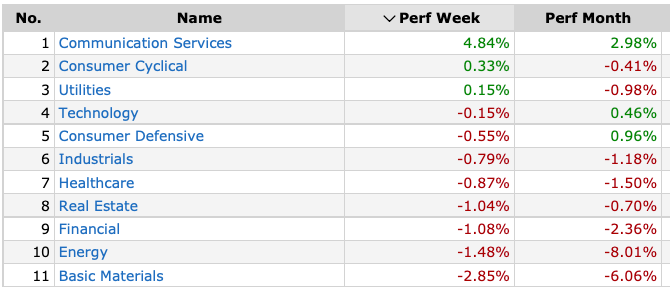

SPY continued to trade in a range this week between 408 and 415, no doubt propped up by large tech stocks. Communication Services were up 4.84%.

CPI numbers met expectations at .04

The Dollar was up over 1% on debt ceiling concerns, the banking crisis, and comments from Fed Governor Michelle Bowman that rates may need to stay higher if inflation continues. (duh?)

Debt Ceiling talks between Biden and McCarthy were postponed.

Google had their I/O Conference and removed the waitlist for BARD, their free AI tool. Their stock is up 31% for the year helping boost the tech sector and the overall market.

Continued fears in small banks like PACW brought the KRE ETF down -4.42% for the week, and contributed to IWM’s 0.76% decline. The XLF (Financial) sector is down over 1% for the week, but over 7% for the year.

The market is forecasting an 83% probability of no rate hikes at the next Fed meeting

While BTC lost 9% this week, PEPE, the new ethereum based token is up over 955% since its launch in mid-April of this year! Is the 🎉 starting?

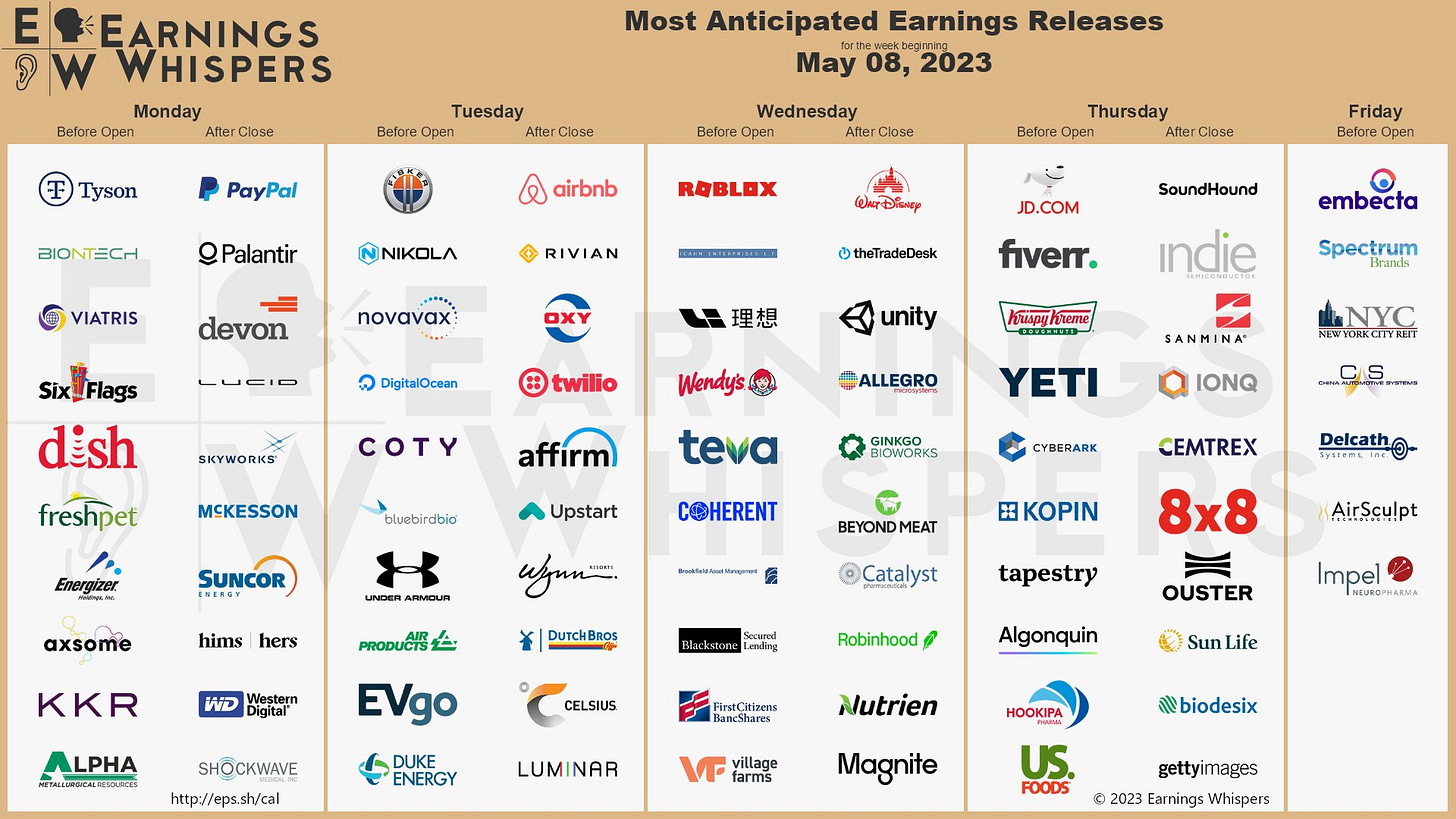

We will hear retail earnings next week from Target and Walmart.

Tuesday we will see May PMI and New Home Sales for April

YouTube | Blog | Book | Podcast | Discord | ☕️

Finviz Heat Maps and Sector Analysis

Indexes and Macro Indicators

Yield Curve & Rates

The 2 year rate and 10 year spread has generally been trading in a range about -60 to -40 BPS. I was able to make a small profitable pairs trade on Wednesday betting the 10 year would rise while the 2 year would decline. Check out discord or substack chat premium users are on for more trades like these.

The VIX

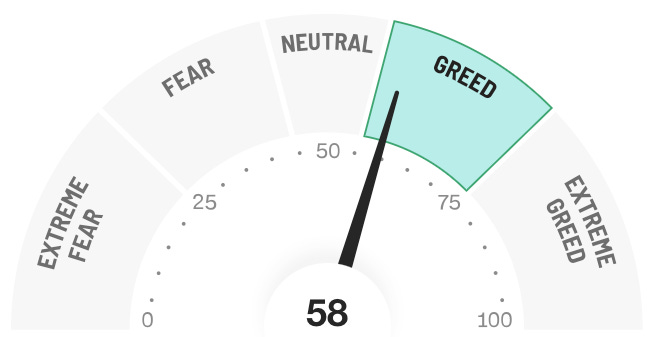

Closing around 17, the VIX stayed mostly between 17 and 18 this week while the Fear and Greed index is at 58. Not much change.

Earnings & Economic Events Next Week

Watching Target and Walmart next week.

HotTrades - 🔴Closing a META Iron Condor

Well you can’t with them all, here’s the story of the META Iron Condor for earnings last week that set me back $12. Although this is a loser, I’ve explained to premium members how we proactively managed iron condors like it to make that loss as minimal as possible during the trade. In the meantime, here are some other trades I made this week:

🟢XLU - closed the May/June 69 strike calendar call spread for $19

🟢QQQ (intraday) hedge on Friday - with the market trading down, I was able to buy then sell a cheap QQQ 317 put for $52, and sell later in the afternoon for $81, (a $29 profit. ). Not much of an intra-day trader, so this was an exciting one!

⚪️CVS - 65/80 short strangle opened for earnings out to June. Sold the 80 short call for $9, and still have the 65 short put open. CVS, please stay over 65 and everything will work out!

🟢SPX - Each day this week in the morning, I sold a “0 DTE” iron condor, making around $100 on each Monday-Thursday. On Friday, my luck ran out, and the 5th was a $175 loser. All in all, still a profitable strategy though for the week.

⚪️ XLE - opened a June monthly strangle on 5/12 which I sold for 1.60cr (74p/86c)

⚪️ DIS - June strangle for earnings - 5/9 - Sold 90/120 for 1.30cr. On 5/11 after stock declined around 10%, I bought to close the 120 call for .02 db. Need DIS above 90 for this strategy to work out.

🟢 COPX - covered call. On 3/21, I collected a $60 credit for selling the 41 strike out to 5/19. On 5/11 I closed the short strike for $4. ($54 profit).