Money Vikings Investing - Week of 5/20/2023

Market Report, Finviz/Sector Analysis, 🟢 Hot Trades 🔥 Earnings 🎯 TGT

⬆️ S&P 500: SPY was up 1.36%. Ready to party? 🎉 Here are some “under the hood” reasons to stay cautious:

56% of the overall market is declining

52% of the market is below the 50 day SMA

SPY itself is pushing up against the 2 Standard Deviation Bollinger Band of 419.75, which could be a strong resistance

We did not hold a close over 420, also a strong resistance.

💼 Bonds: The TLT declined around 2% for the week.

🎢 Volatility: The Vix declined almost 2%

💸 Debt Ceiling: Talks Friday ended shortly after starting without any conclusion, pushing down markets. On Saturday Kevin McCarthy said that talks have gone backwards. That can’t be good. 😱

🛢️ Commodities: Natural Gas rose over 15% on smaller than expected rise in US inventories and hotter weather. Perhaps there’s a trade next week, as UNG only has a .31 correlation with the S&P 500. The folks on CNBC @OptionsAction offered a 7/9 debit call spread out to July 21st for .73db.

🏦 Banking Crisis: Yellen mentioned on Friday that there may be more bank mergers (indicating future defaults), while reaffirming the strength of the US Banking system 🤦🏻♂️ . KRE lost over 2% on her comments.

💵 Earnings: We will hear earnings next week from Nvdia and Costco, Intuit, Toll Brothers, Lowes, Zoom, and Palo Alto Networks

📈📉 Economic Events Next Week:

5/24 - Crude Oil Inventories, FOMC Meeting Minutes

5/25 - Initial Jobless Claims, Pending Home Sales

5/26 - Core Durable Goods Orders and PCE Price Index

YouTube | Blog | Book | Podcast | Discord | ☕️

Finviz Heat Maps and Sector Analysis

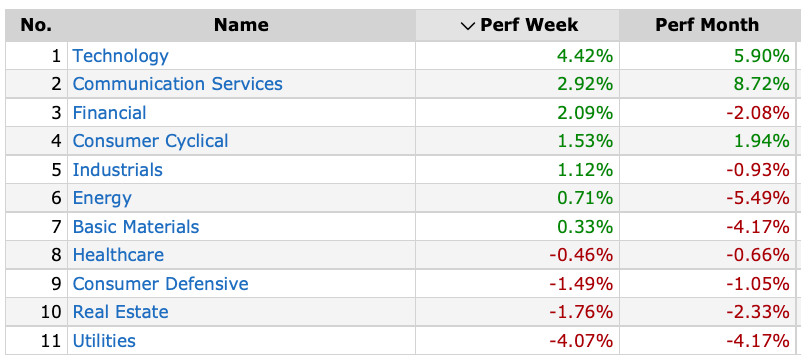

Technology/Communication Services continued to pull the market up while Real Estate (-1.76%) and Utilities (-4.08%) lagged

Rates

The ten year rate gained over 5% this week pushing bonds down on the short end of the curve. When the 10-year Treasury yield rises, it can lead to higher borrowing costs for businesses and consumers, which can slow economic growth

The Fear and Greed Index

This week, although the vix declined 16, we moved up from 58 to 67. Still in Greed.

Earnings

We will be watching Zoom, Palo Alto Networks, Nvdia, Costco, Ulta, and Intuit. We will be calling out earnings trades such as the 27% ROI we made on TGT Earnings last week.

HotTrades - OPEN and CLOSED an Earnings 🎯TGT Iron Condor - 27% ROI

Before we get to the Hot Trade, here are some other I made this week:

⚪️CVS - 65/80 short strangle opened for earnings out to June. Sold the 80 short call for $9, and still have the 65 short put open. To save some buying power, I used some of the profits from the short call on a 60p for a $26 debit.

⚪️O - Sold a covered call (short call) in O for $53 at the 62.50 strike out to June

🔴 MSFT - closed the iron condor for a $175 loss

⚪️ XLE - opened a June monthly strangle on 5/12 which I sold for 1.60cr (74p/86c). Currently watching as the theta (price left in the option) decays daily.

⚪️ DIS - June strangle for earnings - 5/9 - Sold 90/120 for 1.30cr. On 5/11 after stock declined around 10%, I bought to close the 120 call for .02 db. Need DIS above 90 for this strategy to work out. To save on buying power, I used some of the profits from the short call to add a 6/16 long put at the 80 strike for a $31 debit.

Key

🟢 = PROFIT

🔴 = LOSS

⚪️ = Trade Still Open