Money Vikings Investing - Week of 5/28/2023

Market Report, Finviz/Sector Analysis, 🟢 Hot Trades SPY 🔥 Earnings

Key Points From Last Week and Next

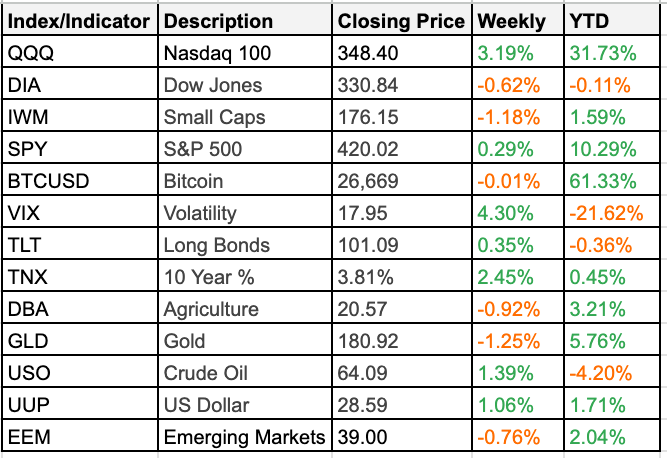

⬆️ S&P 500: SPY had very little change since the week started, but did manage to close over 420. 51% of the overall market is at new lows. 61% of the market is below the 200 day SMA. SPY is up against the 2 Standard Deviation Bollinger Band. Small caps lost over 1%.

🏎️ The Nasdaq rocketed higher over 3% no doubt assisted by NVDA, and anything else related to AI.

💼 Bonds: TLT declined around .35% for the week, while the 10 year rate gained 2.45%, going up to 3.81%.

🎢 Volatility: The VIX increased over 4%

💸 Debt Ceiling: Seems we have a bit more time, but a deal could happen by June 5th, according to McCarthy.

🛢️ Commodities: Agriculture and Gold were down, while Oil was up over 1%. Natural Gas retreated.

💵 Earnings: We will hear earnings next week from Salesforce, Chewy, and Dollar General.

📈📉 Economic Events Next Week:

5/29 - Memorial Day, no Trading

5/30 - Consumer Confidence

5/31 - JOLTs Job Openings

6/01 - ISM Manufacturing

6/02 - Confirm Payrolls

YouTube | Blog | Book | Podcast | Discord | ☕️

Finviz Heat Maps and Sector Analysis

Technology continued to pull the market up 4.68% while Basic Materials (-3.36%) lagged

The Fear and Greed Index

No change from past week, still in greed

Earnings

HotTrades - OPEN SPY Iron Condor