Money Vikings Investing - Week of 5/7/2023

Market Report, Finviz/Sector Analysis, GLD Hot Trades, Debt Ceiling Investment Opportunities, Podcast.

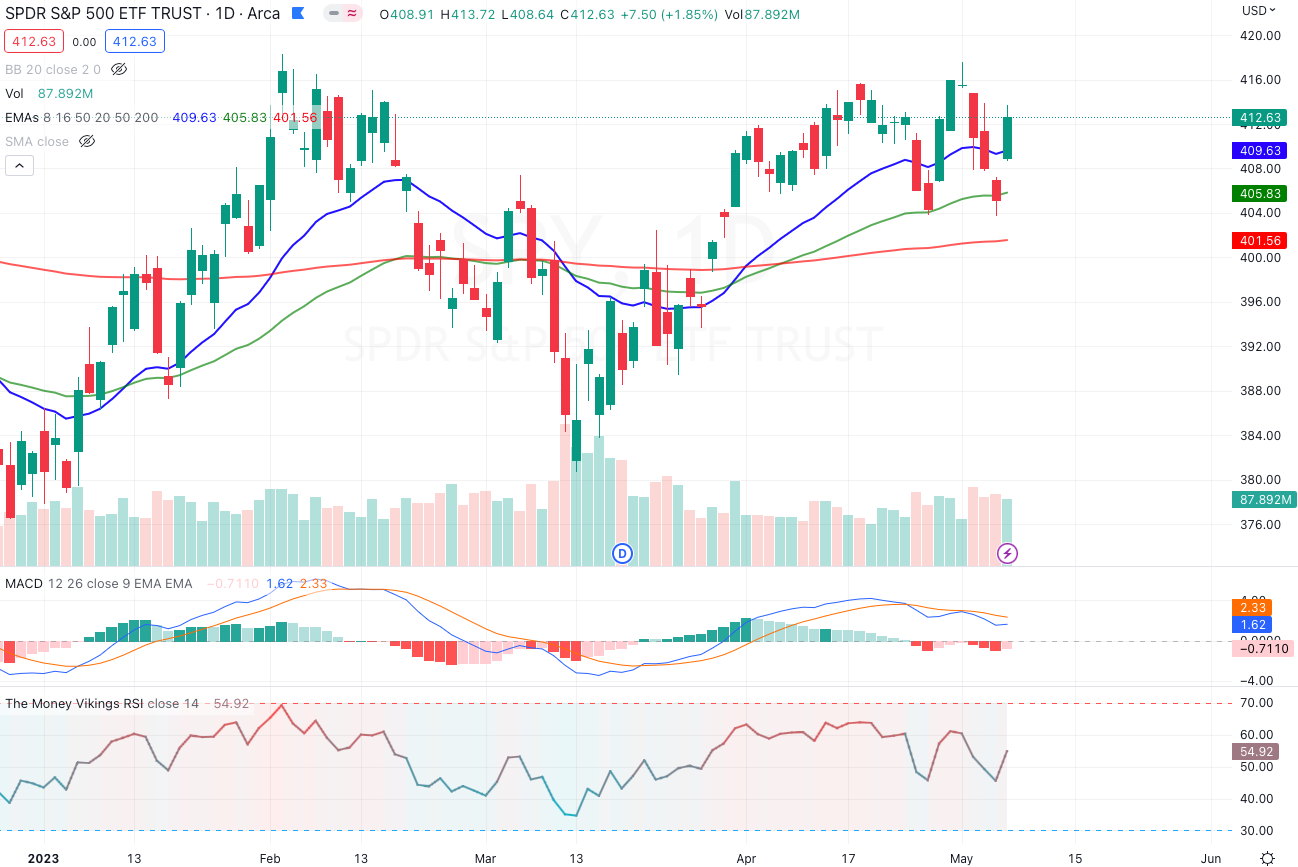

The first part of the week was fairly bearish with SPY sinking 3 days in a row and gapping down below the 50 EMA (green line) on Thursday. The Fed raised rates .25%

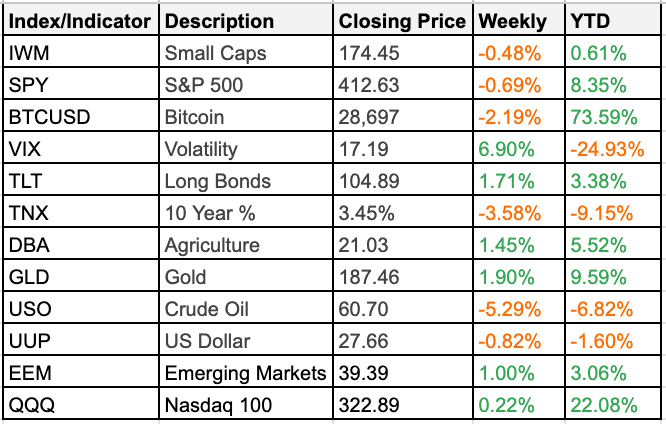

Mega Caps led over Small Caps

Gold was up almost 2% for the week, and almost 10% for the year.

Oil took a spill, losing about 5% of its value this week.

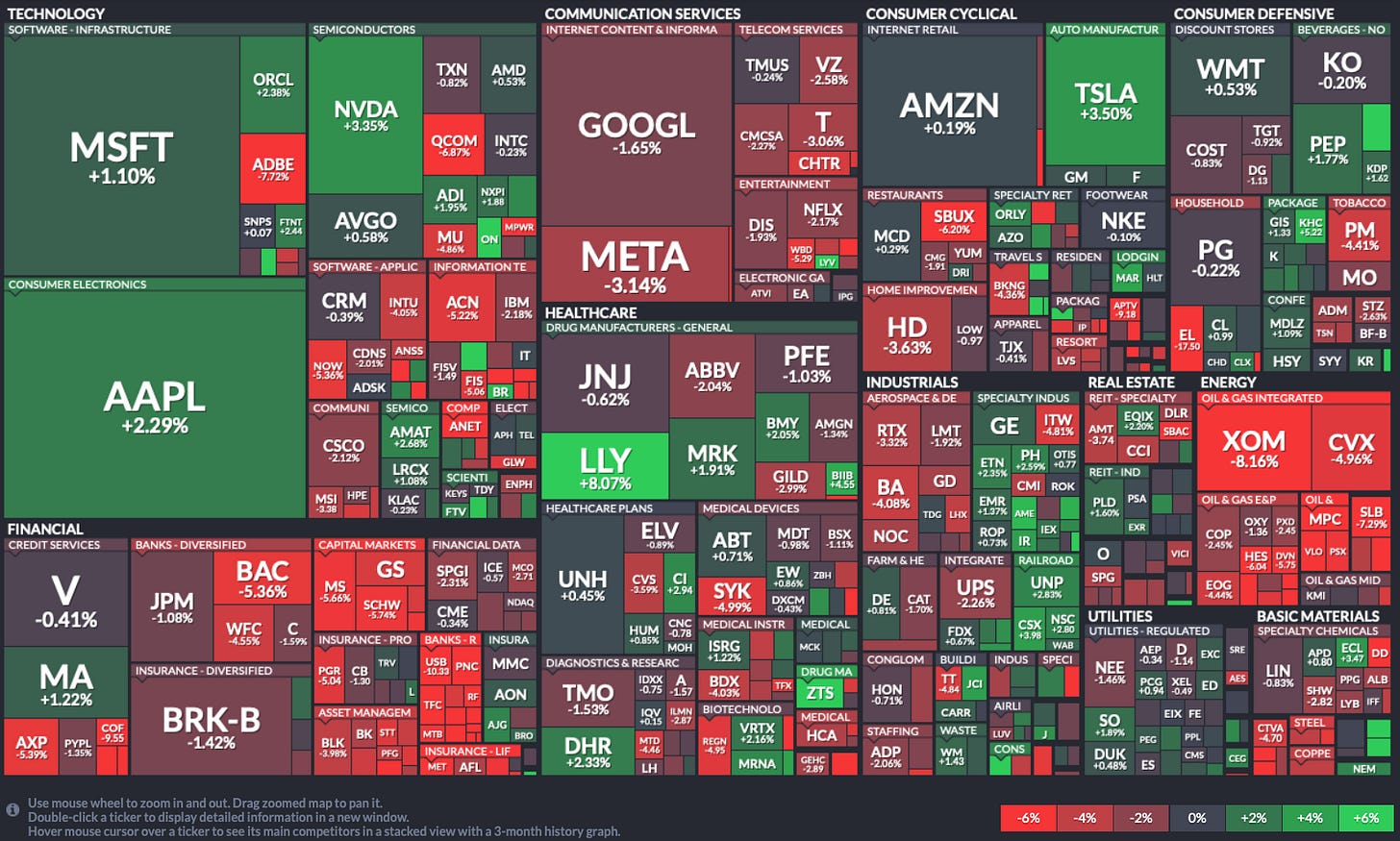

Tech and Healthcare led while Financials and Energy lagged.

Financials were hurt by the First Republic Bank failure, and fears of other ones collapsing as well.

With a very short term memory, Friday we gapped back up almost 2% on positive Apple earnings, a good jobs report.

YouTube | Blog | Book | Podcast | Discord | ☕️

Finviz Heat Maps and Sector Analysis

Indexes and Macro Indicators

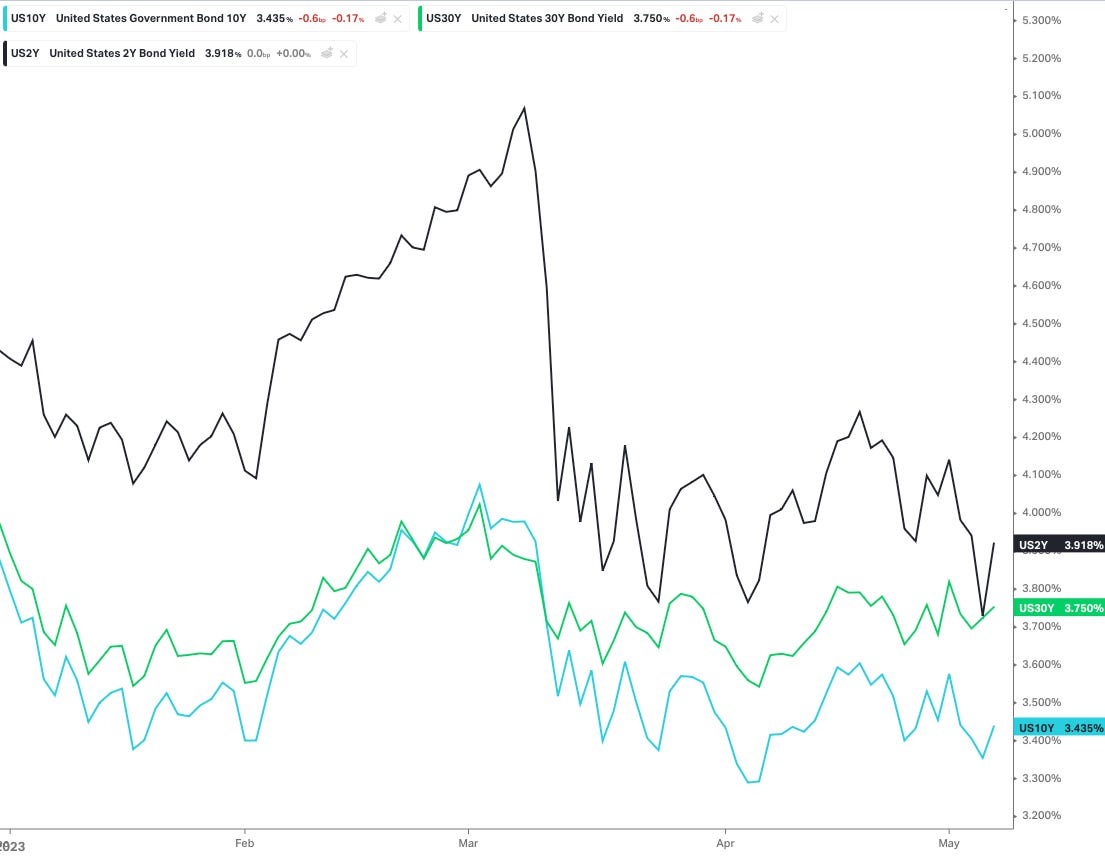

Yield Curve & Rates - Flattening

The 30 year rate is catching up (but still under) the 2 year rate. The 2 year hit its lowest level since September 2022. The 10/2 spread flattened by about 10 bps.

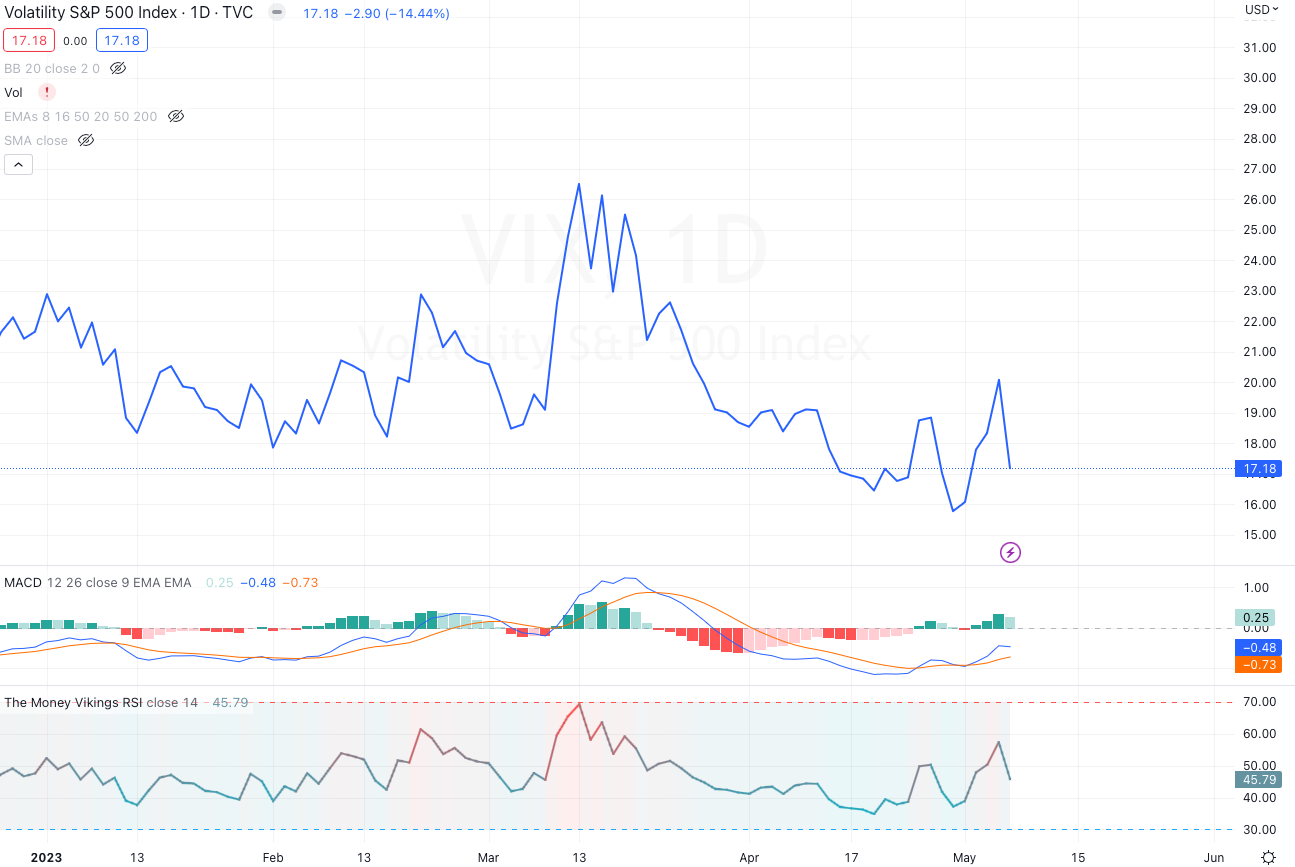

The VIX

The VIX touched over 21 this week, but retreated on Friday with the rally in the S&P. Fear and greed index retreated towards neutral, but remains in Greed territory.

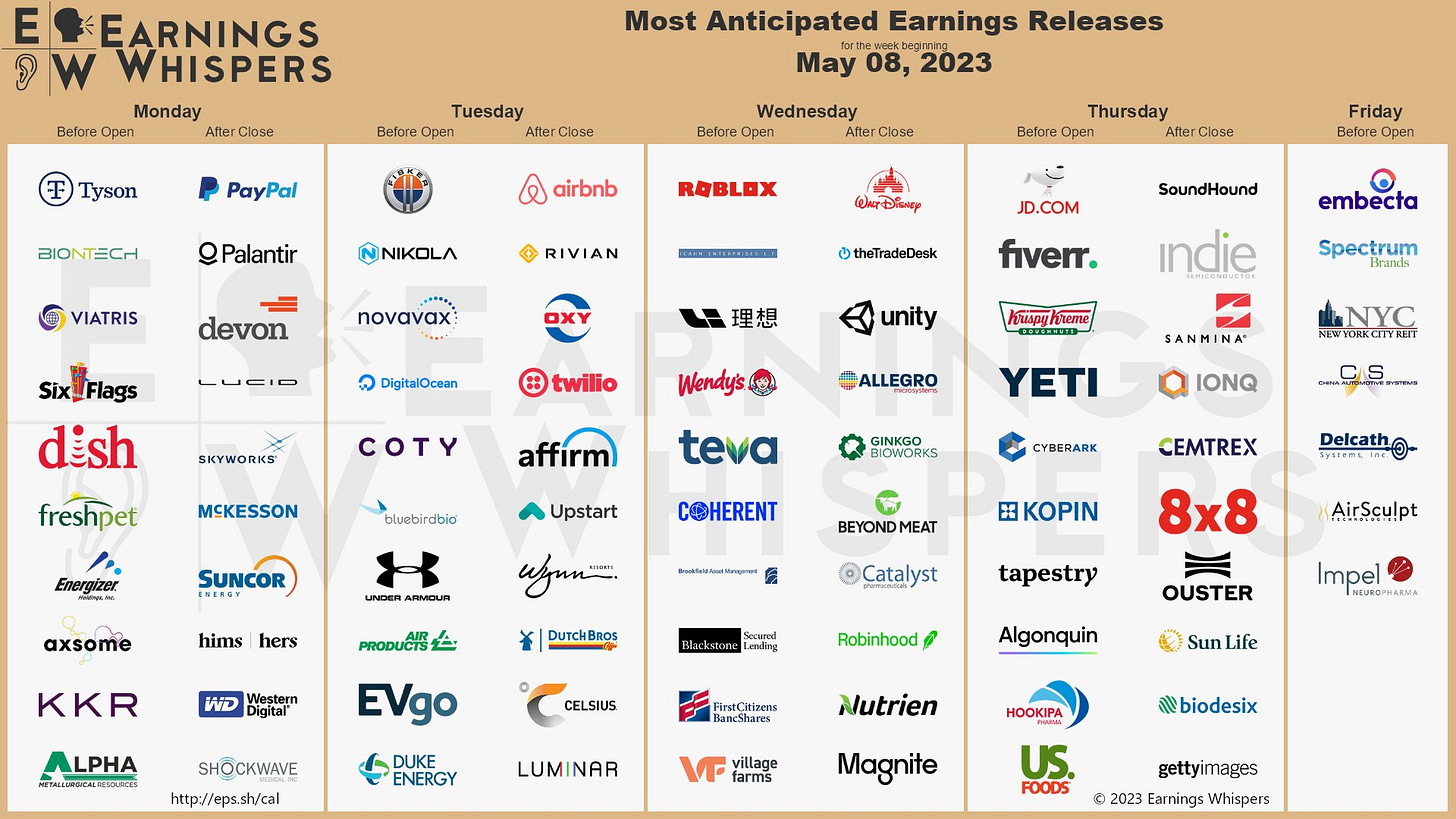

Earnings & Economic Events Next Week

The major earnings have completed, but we still have a few interesting ones next week to watch such as Disney, Under Armor, Roblox, Airbnb, and Paypal.

HotTrades - Adding a GLD Iron Condor