Money Vikings Investing - Week of 6/11/2023

In This Issue: Save Us!, Market Report, Finviz/Sector Analysis, 🟢 NVDA Hot Trades🔥, Coping with Stress, Health - Intermittent Fasting

Key Points From This Past Week and Next

⬆️ S&P 500: Up over half a percent this week due to multiple headlines telling us we are in a bull market now. For more on this and Antagonist Stocks and Options Research check out his deep dive.

✈️ Dow was up almost 1% for the week.

🧢 IWM Small caps gained over 3% on this week, beating the SPY, Dow, and Nasdaq.

🏎️ QQQ Fairly flat this week with more recent rotation out of technology and into other sectors such as consumer cyclical, energy, and utilities.

💼 Rates/Bonds: TLT rose around .12% for the week, while the 10 year rate closed at 3.71%, up almost one and half percent.

🚩Fed Watch: The CME FedWatch tool (see image below) is reflecting a 70% chance of no rate hike at the Fed's June meeting in 3 days (down about 5% from the prior week). Will the 6/13 CPI reading for May change this?

🎢 Volatility: The VIX continues to decline to 13.83 to lows not seen since Feb 2020.

🛢️ Commodities: Agricultural Commodities were up 1.63%. Gold was fairly flat, while Oil was down almost 2% on OPEC+ reducing output.

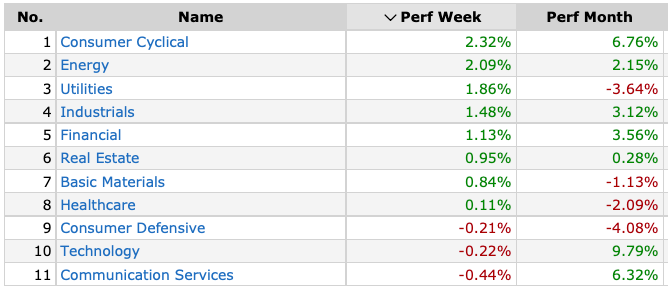

🍔Most Sectors were up this week, with Consumer Cyclical and Energy leading the pack while Technology, and Communication Services declined.

💪 AAII Sentiment Indicator 44% Bullish, 31% Neutral, 24% Bearish : “Optimism shot up and is above average for the first time since February 2023 in the latest AAII Sentiment Survey. Neutral sentiment decreased, while bearish sentiment plunged below average after a 15-week streak of above-average readings.”

📈📉 Economic Events Next Week:

6/13— CPI (May)

6/14 —FOMC Statements

6/15— Retail Sales

YouTube | Blog | Book | Podcast | Discord | ☕️

Finviz Heat Maps and Sector Analysis

The Fear and Greed Index & Market Temperature

Large move in the last week from Greed (61) to Extreme Greed (77). The vix is down to 13.65 (bullish). The Put/Call ratio is around .74, and that is bullish as more people are buying calls that puts. Note the Babbl Market Temperature is bullish in overall news sentiment and the S&P 500. The Russell is just a bit below neutral even though it was the leading index for the week.

Health - Intermittent Fasting, Coping with Stress

Coping with Stress - 5 Ways to Help Yourself

HotTrades - NVDA Iron Condor for 20% ROI