Money Vikings Investing - Week of 6/25/2023

In This Issue: Summer Opportunity, Market Report, Finviz/Sector Analysis, Sentiment Analysis, 🔴🟢, VIX Multi Year Lows, 2 Hot🔥Trades in UNG and SPY, What’s a Broken Wing Butterfly?

Money Vikings Investing - Week of 6/25/2023

Hi,

Summer 2023, oh so sweet it is. I challenge you to seize the moments this summer to do something healthy for yourself and your family. I truly believe that seemingly small actions can become great results. And this can be true in all areas of a life of True Wealth.

What can we do today to help ourselves and each other? What small gesture can express that may help someone else? How can we incorporate more healthy foods and movement into our days?

These are some things on my mind as the summer of 2023 kicks off. A time to connect with friends, family, nature, health and more.

While we are on the topic of refreshing and relaxing, make sure to check out our 5 Ways to Destroy Debt or Ways to Increase Testosterone for optimal health.

Share our blog & YouTube channel with your friends and family and subscribe today!

Greg & Jerry

YouTube | Blog | Book | Discord | Podcast | ☕️

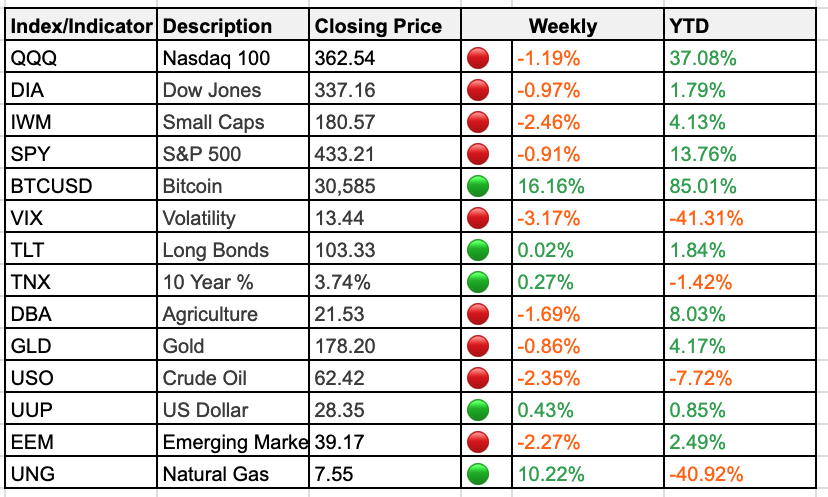

Weekly Market Report

⬆️ S&P 500: -0.91%

✈️ DOW -0.97%

🧢 IWM Small caps -2.46%

🏎️ QQQ -1.19%

💼 Rates/Bonds: +0.20% for TLT, Yield Curve Continued to Invert about -8 bps.

🚩Fed Watch: about 71% probability of a rate hike on July 26th

🎢 Volatility: VIX trading for 13.44, near multi-year lows.

🌕 BTC up +16% for the week on ETF filings, Supreme Court rulings in favor of COIN

🛢️ Commodities: DBA (Agriculture Fund) was down -1.69%, USO (Oil) was down -2.35%. UNG (Natural Gas) was up +10.22%

🍔All Sectors were down with Healthcare leading and Real Estate at the bottom, down almost -4.5%

💪 AAII Sentiment 42.9% Bullish, 29.4% Neutral, 27.8% Bearish, a 5% increase in bearishness since last week

Indexes and Macro Indicators

Last week was a shortened trading week, and next week we’ll have the end of the quarter. The market still remains in a bullish trend overall, but last week the S&P 500 retreated almost 1%. A pullback to 430 would be “healthy”, and a bounce off it would give more credit to the notion that this is a small pullback in a market rally, and not the market completely reversing. IWM (small caps) were one of the worst performers down almost 2.5%. Watch the 178 ad 170 levels carefully to see if they hold support. Despite the pullback, the VIX is down to 2020 lows. USO (oil) and EEM (emerging markets, lots of China) are also both down over 2% this week. UNG on the other hand was up over 10%. See our hot trade in UNG below! Bitcoin was also the up 🌟 gaining over 16% for the week!

Why do we care? Is there a rotation going on from Tech to more Defensive sectors?

The 10/2 Yield Spread Continues to Decline

Why do we care? The 10/2 inversion is a a lack of confidence in the future. Short term we believe we’ll earn more from treasuries than over the long haul. Many take this to be a sign of a recession, but we’ve been this way for a long time. Shouldn’t we be bottoming out soon, and starting to normalize?

The Fear and Greed Index, Market Temperature

Image #1 : The Fear and Greed Indicator showed that we retreated from Extreme Greed (79), to Greed (74).

Image #2: The VIX hit 3 year lows this week.

Image #3: The AAII Investor Sentiment Indicator reflected slightly more bearishness.

2 Hot Trades - UNG Long Call Spread / SPY BWB - Free for non-Premium Members This Week!

Long Call Spread in UNG to July 21

On 5/22 in Discord, I called out a long 7/9 bull call spread in UNG for a 0.55 Debit (Natural Gas ETF). Today, that same entry will cost you .68, but you could also move the strikes up to 8/10 if you believe this rally will continue.

To Open

Buy 1 UNG 7/21 7 Call

Sell 1 UNG 7/21 9 Call

SPY BWB (Broken Wing Butterfly) to July 21

In SPY, there is no risk to the downside, and if we get a rally, could potentially make some money. By the time this filled, I received .09 in credit. Today this trade is giving a .17 credit. For more info on Broken Wing Butterfly’s, check out our explainer video below.

To Open

Bought 1 SPY 07/21/23 Call 436.00 for 6.76

Bought 1 SPY 07/21/23 Call 446.00 for 2.13

Sold 2 SPY 07/21/23 Call 440.00 @ 4.49

Earnings Next Week

We will be watching Carnival, Micron, Nike…

Featured Articles

Financial Freedom to Kids : Financial Freedom to Kids: How To Decide Investing?

Antagonist Stocks and Options Research : Antagonist: Over the Weekend #25 - Student loan payments restarting, rising food prices, stock compensation, and more

Think and Invest : Think and Invest: Mastering Your Universe

5 Ways to Really Get Out of Debt

The Downsides of Real Estate Investing

Health - Naturally Boost Testosterone

Copyright © 2023 Money Vikings LLC, All rights reserved.

All rights reserved. Money Vikings, LLC is neither an investment or financial advisor. Money Vikings, LLC does not provide financial advice and none of the information being provided is to be seen as such. This is to include, but not limited to, any articles, videos and/or any other social media outlet presented by Money Vikings, LLC. All content is the opinions, beliefs, and personal strategies of the author(s) and owner(s) of Money Vikings, LLC (Greg and Jerry). Money Vikings, LLC recommends that everyone do their own research, technical analysis, and develop their own conclusions, prior to initiating any trade activity supported by their own understanding, abilities, and risk tolerance. All trades carry inherent risk and proper risk management strategies should be used accordingly. Money Vikings, LLC does not guarantee results and is not liable in any way for losses incurred by any person or organization. Periodically, we may highlight services we are using and may receive compensation from their respective affiliate programs.

Perhaps. It seems to be pretty volatile but also looks like it’s establishing a base.

Your UNG trade is awesome. Do you think there's also a buy-and-hold opportunity there?