Money Vikings Investing - Week of 6/4/2023

Market Report, Finviz/Sector Analysis, What are Telomeres? 🟢 Hot Trades 🔥

Key Points From This Past Week and Next

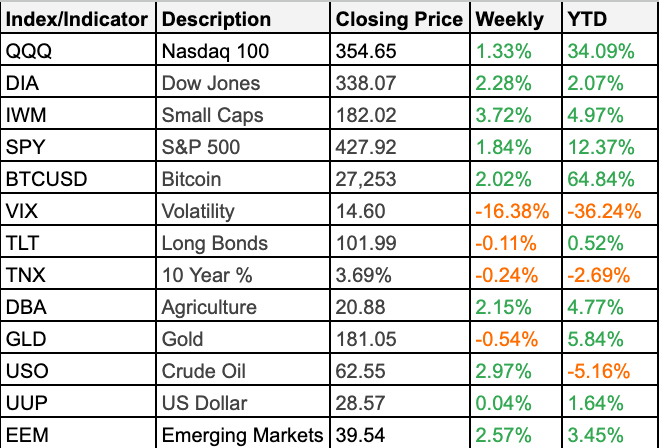

⬆️ S&P 500: Holding the 420 line in the sand, SPY rallied to 2023 highs, up 1.84% this week. On Friday, it gapped up and closed at 427.92. Note that 53% of the market is still below the 200 day SMA, but improving week over week.

✈️ Dow was up 2.28% for the week, with a huge rally on Friday, knocking out gains not seen since last November, trading above the 200 day moving average.

🧢 IWM Small caps gained over 3% on Friday, and 3.72% for the week. They are pretty beat up, but are holding the line.

🏎️ QQQ Gained 1.33% with Tech and AI, however other sectors are joining in this week.

💼 Rates/Bonds: TLT declined around .11% for the week, while the 10 year rate lost .24%, closing at 3.69%.

🚩Fed Watch: The CME FedWatch tool is reflecting a nearly 75% chance of no hike at the Fed's June meeting in 11 days

🎢 Volatility: The VIX declined over 16% and is trading near 2 year lows (14.60).

🛢️ Commodities: Agricultural Commodities were up 2.15%. Gold was flat, while Oil was up over 2.97%. Natural Gas retreated almost 10%.

🍔All Sectors were up this week, with Consumer Cyclical and Real Estate leading the pack.

📈📉 Economic Events Next Week:

6/5 — Services PMI

6/7 — Crude Oil Inventories

6/8 — Initial Jobless Claims

YouTube | Blog | Book | Podcast | Discord | ☕️

Finviz Heat Maps and Sector Analysis

The Fear and Greed Index

No change for past couple of weeks, still in Greed, the vix is down (bullish), and there are still some breadth concerns under the hood. The Put/Call ratio is around .75, and that is bullish as more people are buying calls that puts

Health

Improve your Telomeres? What are Telomeres?

HotTrades - O Covered Call for Options Premium and Dividend Income