Money Vikings Investing - Week of 7/23

In This Issue: Market Report, Finviz/Sector Analysis, REITs vs Real Estate, Sentiment Analysis, Events/Earnings, 🟢 70% ROI on a DIA HotTrade 🔥

Weekly Market Report

The rally continues, and many are describing what we are witnessing as a bull market with investor sentiment over 50% bullish as shown in the latest AAII Survey. The major indices DIA, IWM, and SPY were up for the week, while QQQ had a weekly decline of 1.10%. Energy was the top performing sector for the week up 3.87% while Communications was down -2.37%. Bitcoin struggled to hold 30,000, but Gold, Oil, Natural Gas, and other agricultural commodities (DBA) continued to ascend. This week check out Greg’s new video outlining REITs vs Real Estate Investments, and be sure to subscribe to our partner Antagonist Stocks and Options Research to learn more about the Nasdaq’s Special Rebalance, and his take on the expanding market breadth. Premium Members can follow along on the DIA 🔥 HotTrade for a 70% ROI on a bull call spread.

REITs vs Private Real Estate

Greg takes a look at investing $100,000 in a REIT vs investing in a home and renting it out. Which came out ahead? Which was less of a hassle? The answer may surprise you!

US Interest Rates

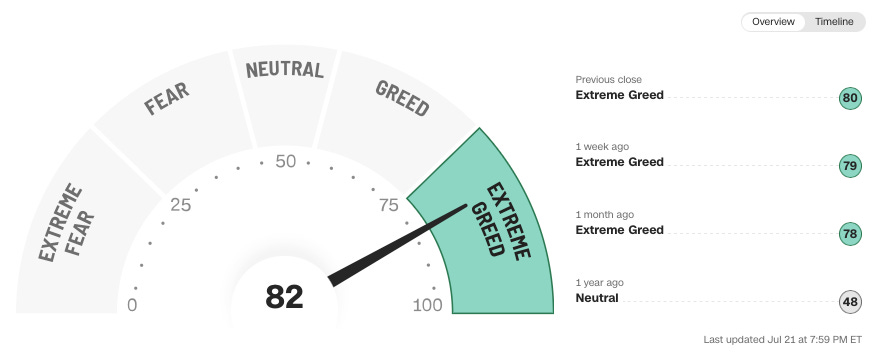

The Fear and Greed Index, AAII

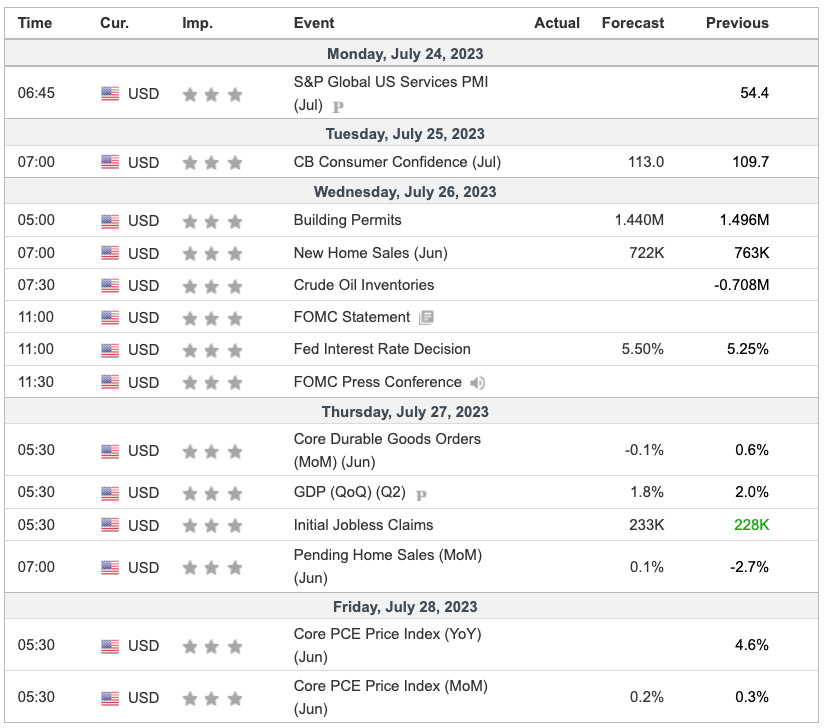

Earnings & Economic Calendar

Hot Trades (CLOSED DIA Bull Call Spread for 70% Profit)