Money Vikings Investing - Week of 7/9/2023

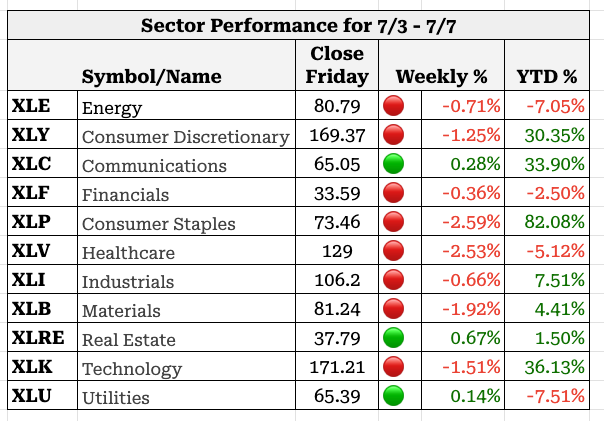

In This Issue: Market Report, Finviz/Sector Analysis, Sentiment Analysis, Events/Earnings, How Much House Can You Afford? 7 Steps to Build Wealth ASAP 🔴🟢 VIX Perks up, Hot🔥Trades AMZN Covered Call

One philosophy in life I like to apply to personal finance is the Stoic Way. Do what you can, with what you have where you are. It is about accepting the world for what it is and honoring the present moment. I am constantly trying to better manage my reactions and emotions in all aspects of my life. Often our emotions are a knee jerk ego based response, when in reality no response may be required. Same holds true for investing. Here are a few concepts of Stoicism that may be of interest for further thought:

Accept what you can and cannot control (position size / % of risk you’re taking per trade)

Accept that your happiness is your responsibility and business (Why are you trading and does it rule your emotions? Are you blaming other or unrelated events for your losses?)

Accept that life is change and you can only take action in the now and present

For more, check out our The Money Vikings Blog, our YouTube channel for topics such as 7 Ways to Build Wealth ASAP and How Much House Can You Afford?

Greg & Jerry

Weekly Market Report

The 10/2 Yield Spread - Reversion

The Fear and Greed Index, AAII

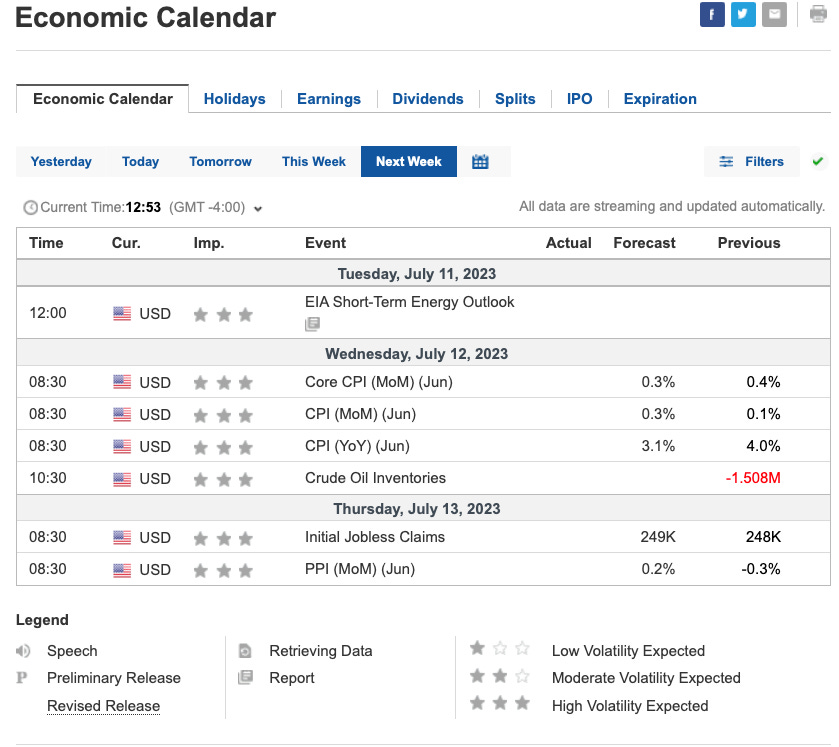

Earnings & Events Next Week

Earnings from Delta, PepsiCo, Conagra on Thursday morning. Friday morning we will hear from JP Morgan, Citigroup, Wells Fargo, and Blackrock.

Featured Articles

Portfolio Charts: How Investing Personality Types Frame Your Money Perspective

Antagonist Stocks and Options Research : OTW #27 - Small Caps are a bargain; declining earnings, chocolate, & more

7 Steps to Build Wealth ASAP