Money Vikings Investing - Week of 8/20

In This Issue: Market Report, Finviz/Sector Analysis, Climate Change Real Estate Investing, Weekly Sentiment Analysis, QQQ & O Hot🔥Trade.

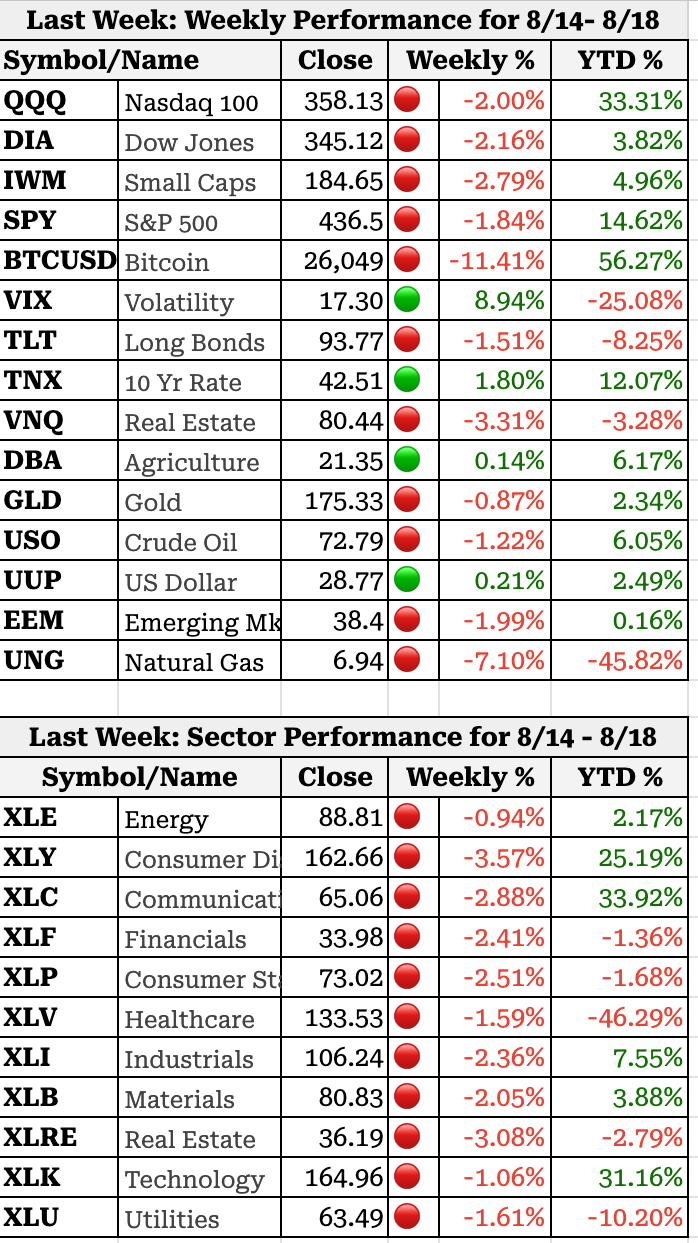

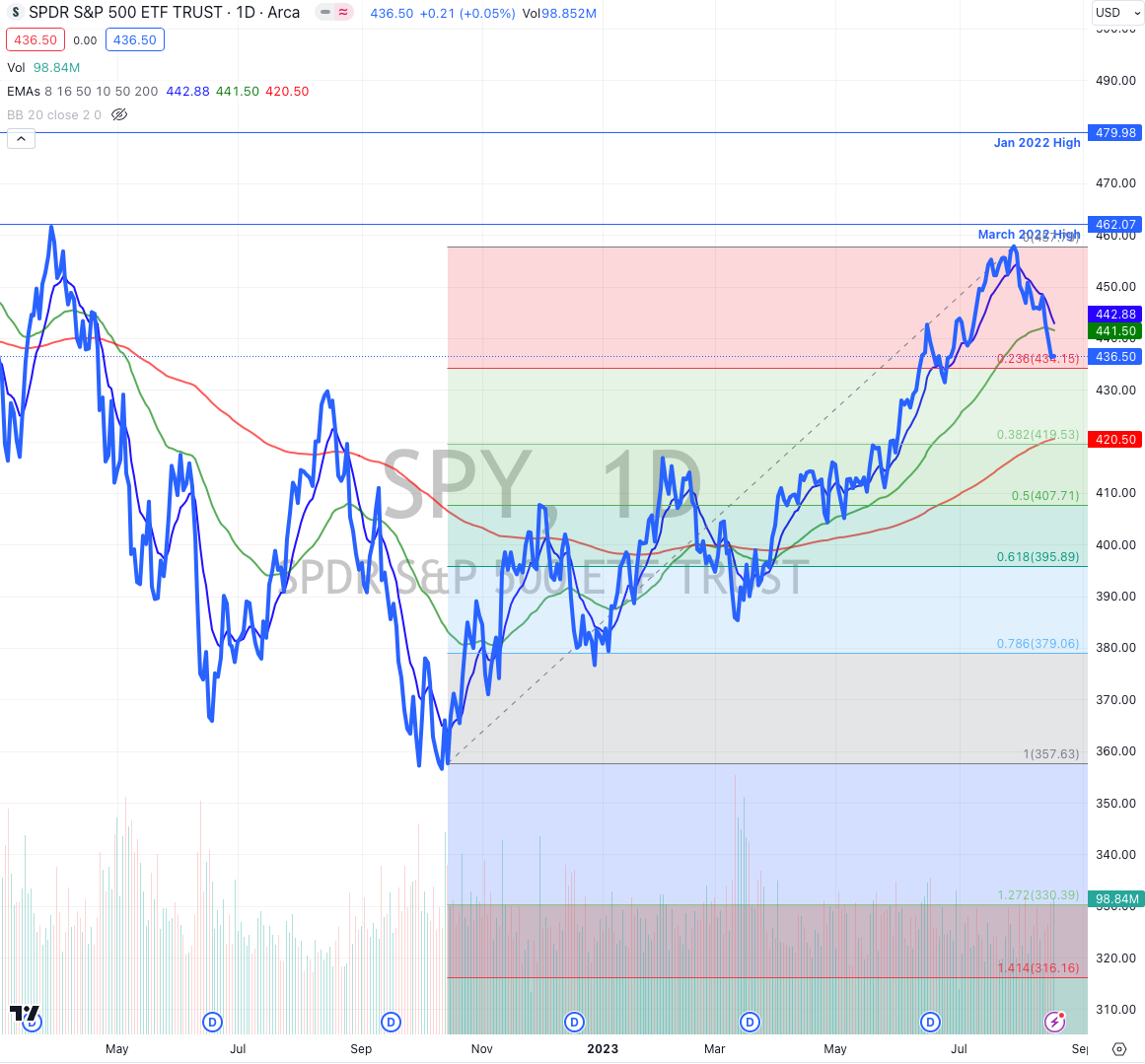

Some technical damage this week with SPY, QQQ, DIA, and IWM all breaking the 50 day EMAs. BTC also surprised with an 11% drop from 29K to 26K. The 10 year interest rate also hit a high of 4.32%, which could mean further challenges for technology stocks in the coming months. Every single sector was down this week with Consumer Discretionary and Real Estate down the most, and Tech/Energy being the least hit. The Dollar index, as represented by UUP continues to ascend, up .21% this week.

All this being said, let’s not forget that QQQ and SPY are still up 14% and 33% respectively, and seasonality shows us that August is a challenging month for the markets. As Hurricane Hillary gets ready to make landfall on Southern California, check our our video about Real Estate Investing with Climate Change in mind. Did we get it right? Leave us a note in the comments!

5 Best Climate Change Regions for Real Estate

The Fear and Greed Index and AAII

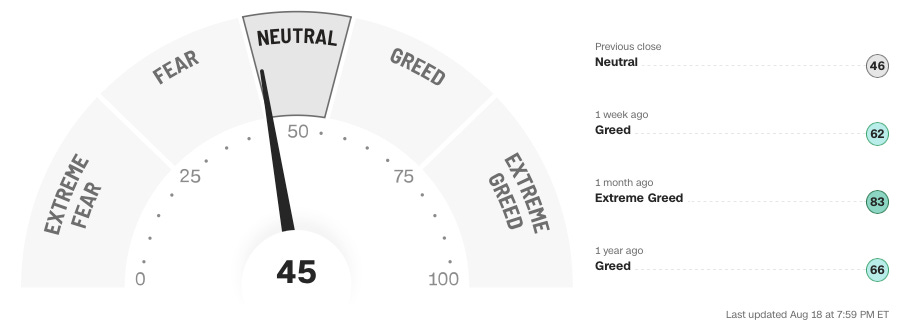

The Fear and Greed indicator took a massive slide this week from 62 to 45, landing on Neutral, just a few ticks away from Fear. Note the put/call ratio continued to raise from .88 to 1, meaning an equal number of investors are buying calls and puts. If this number continues to rise (as it has the been the last several weeks), we’ll clearly have more options investors hedging/speculating on a downward move than an upward one.

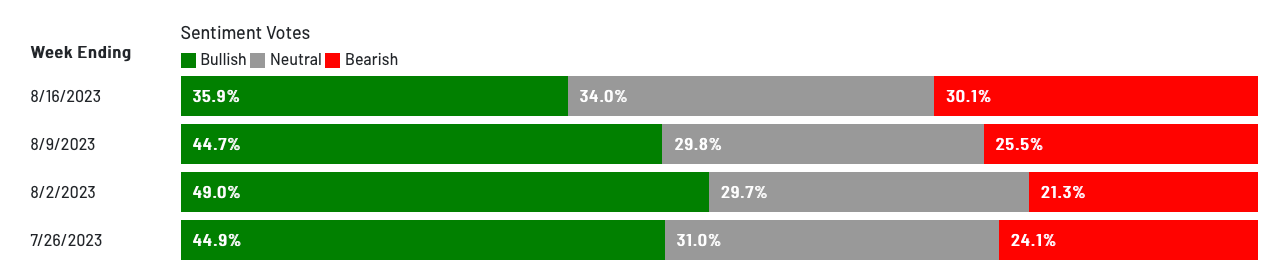

The AAII Bullish Sentiment levels continued to decline about 10%, which bearishness increased 5% and neutral increased 5%.

The VIX

The VIX continued to increase from 14 to 17 this week.

Earnings & Economic Calendar

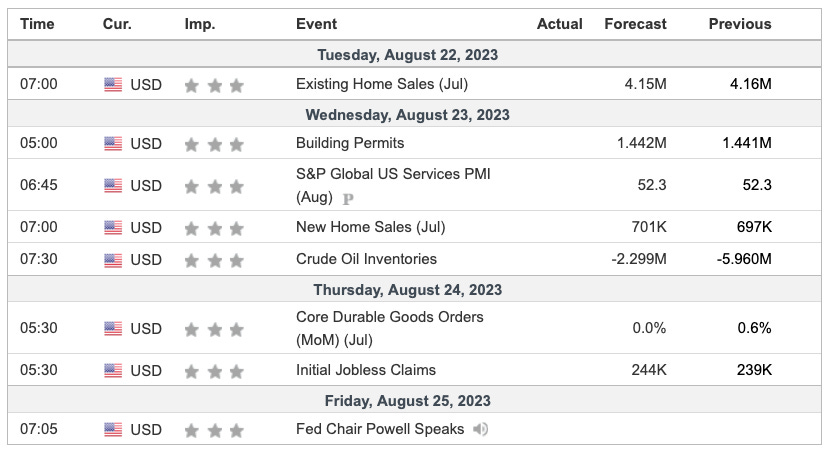

We will be watching Zoom, Lowe’s, Dicks, and NVDIA, Dollar Tree, Alta, and Intuit.

In addition to home sales, PMI, Core Durable Goods orders, and Jobless Claims, Friday 8/25, Fed Chair Powell Speaks, perhaps giving hints into what he will do at the 9/20 FOMC meeting. Currently the CME Fedwatch Tool is predicting an 11.5% chance of hikes, up from 0% in prior weeks.

HotTrades QQQ Iron Condor Closed, O (Reality Income) Covered Call Closed