Money Vikings Investing - Week of 8/27

In This Issue: Is the pain over? Market Report, Finviz/Sector Analysis, 5 Estate Planning Basics, Weekly Sentiment Analysis, 3 New Hot🔥Trades out to October!

Is the pain from the last few weeks over? SPY 0.00%↑ seems to have found some level of support around 440 (but could not close above it Friday). On Friday, Powell indicated rates could still go up in Sept. Gold GLD 0.00%↑ was up almost a full percent for the week. Jason Milton of Antagonist Stocks and Options Research asks: Is money pouring into Commodities? The 10 year rate (4.24%) is pretty high, but seems to have hit some resistance at 4.36%. TLT 0.00%↑ (iShares medium to long term bonds) was up almost 3% this week. The VIX declined. The dollar UUP 0.00%↑ has gone up for several weeks in a row. Tech XLK 0.00%↑ was the best performing sector of the week (+1.75%), no doubt helped by Nvdia’s NVDA 0.00%↑ amazing climb after another amazing earnings report. Real Estate XLRE 0.00%↑ held 2nd place, up almost 1%. Energy XLE 0.00%↑ was the worst sector down almost 2% as oil USO 0.00%↑ declined 1.32%. Also notable was Emerging Markets EEM 0.00%↑ up about a percent and a half.

5 Estate Planning Basics

Estate Planning?! Hang in here with me, because I promise to make this straightforward and painless. Estate planning is one of those things most people see the title and their eyes 🙄 glaze over. I understand, but lack of foresight and preparation could cost families a lot of money and massive amounts of problems down the line. Check out our video below for a primer on how to get started.

The Fear and Greed Index and AAII

Hard to believe 1 month ago we were at 86 (Extreme Greed) on the Fear and Greed index. The AAII survey shows bearishness increasing by 5%.

The VIX

The VIX actually declined by the end of this week.

Looks like our Friends at Compounding Quality are up to something big! Here’s a great set of links to bookmark including some of their best posts.

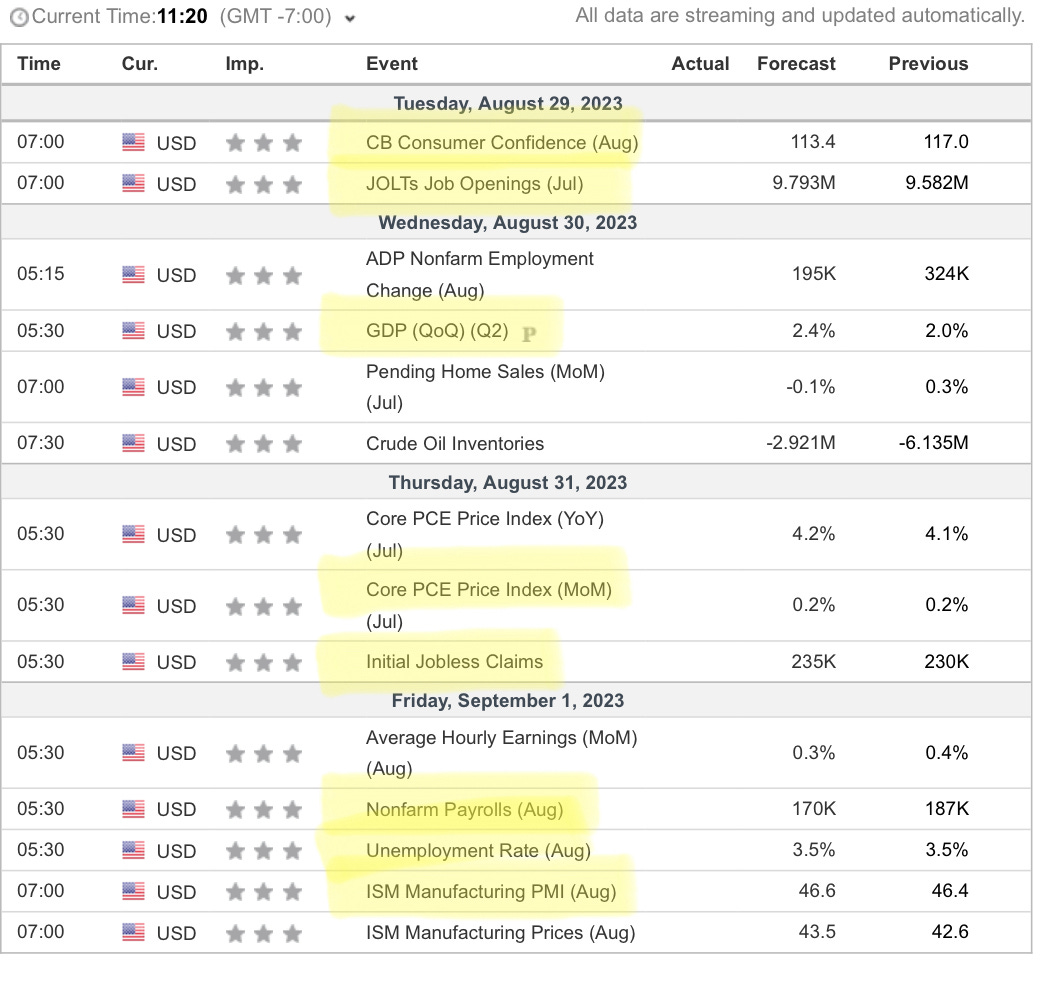

Earnings & Economic Calendar

Looking forward to earnings from Salesforce, Crowdstrike, Chewy, Dollar General, Broadcom, and Lulu Lemon. In the economic calendar for next week, I’ve highlighted the data that I believe could have most impact on the markets.

HotTrades - 3 New Covered Calls out to October