Money Vikings Investing - Week of 9/10

In This Issue: Market Report, Finviz/Sector Analysis, Financial Self Care, Weekly Sentiment Analysis, Hot🔥Trade Ideas

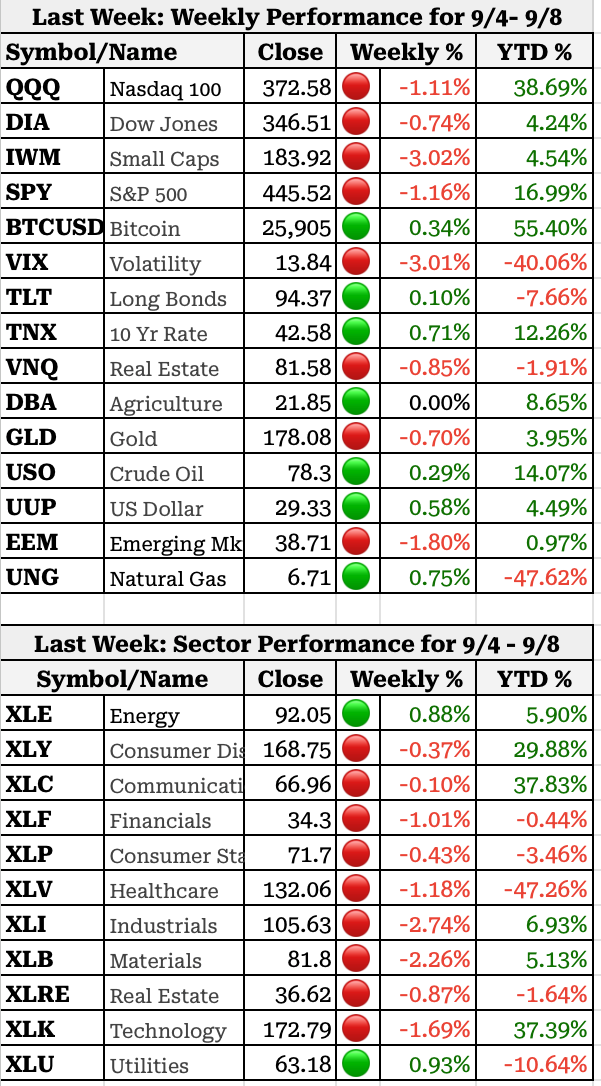

9 days left until the Fed Makes its next interest rate decision and there’s a 93% chance they will not hike. Although it seemed like a wild week, the VIX closed below 14, which is still pretty low. For the week all the market indexes were down between -0.75% for the Dow, and -3.02% for the IWM. Apple down over 5% did not help. The 10 year continues to trade near highs. The Dollar continues to ascend. The best sectors last week were Utilities and Energy, and the worst was XLI.

5 Ways to Practice Financial Self Care

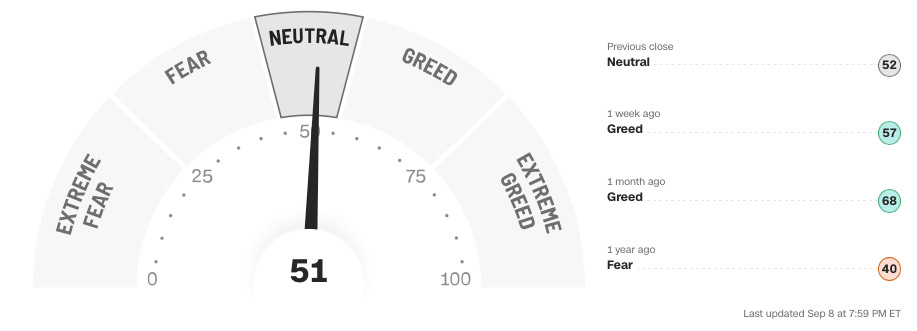

The Fear and Greed Index and AAII

A small drop in the fear and greed indicator, but curiously more bullish sentiment from the AAII Investor Surveys. The Put/Call ratio stayed around .93.

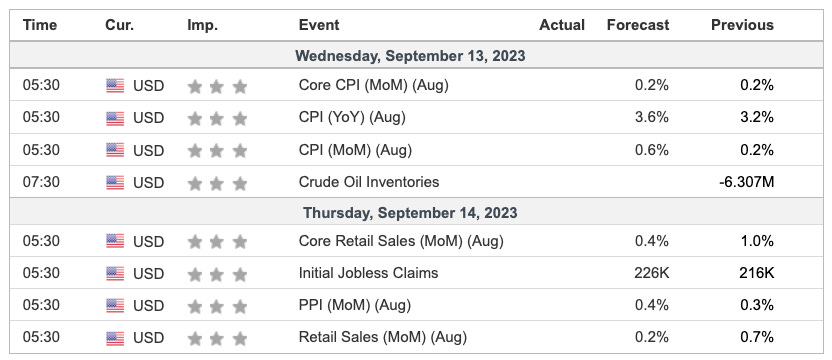

Economic Events

Watch for CPI data on Wednesday, and PPI on Thursday.

HotTrades