Money Vikings Investing - Week of 9/4

In This Issue: Market Report, Finviz/Sector Analysis, Ride My Bike Portfolio, Weekly Sentiment Analysis, QQQ Hot🔥Trade out to October!

Happy Labor Day! While SPY 0.00%↑ was down for the month from Aug 1 trading as high as 456, we closed the week in positive territory, gapping up over 1% on Tuesday, closing the week at 451. Small Caps IWM 0.00%↑ had a terrific week, closing above 190, up 3.25%. The star of the week was Oil USO 0.00%↑ up over 6%. To learn more about why Oil is moving, check out Antagonist Stocks and Options Research and Jason’s free report on the energy sector. The technology XLK 0.00%↑ sector led the week up 3.65% while Utilities XLU 0.00%↑ lost 1.73%.

Ride My Bike Investment Portfolio

More Info here: https://truewealth.moneyvikings.com/2023/02/money-vikings-dividend-portf/

The Fear and Greed Index and AAII

Not a huge change in investor sentiment since last week, however the overall Fear and Greed Index moved from 47 Neutral to 56 Greed. This was probably driven by the decline in the VIX, the rise in the market indices, and the fall in the put-call ratio.

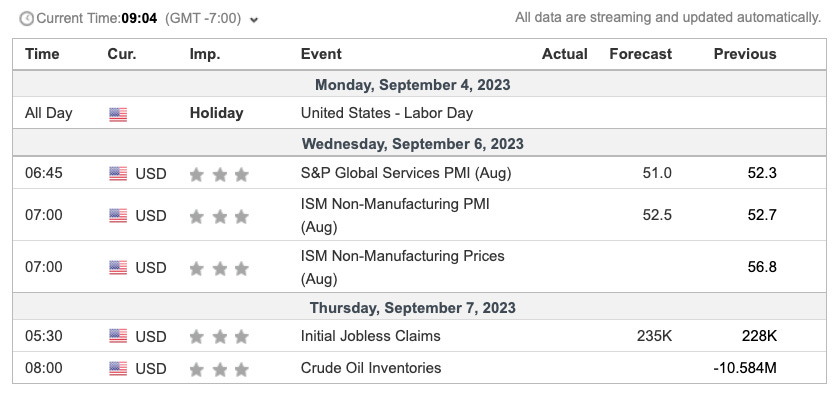

Economic Events

HotTrades - QQQ Iron Condor