Quick Hits - 7/11/2022

In this issue: SPY, BTC, XBI, GLD, QQQ, Weekly Heat Map, Sectors, Yields, VIX, Dollar, Hot Trades

After spending many years in Wall Street and after making and losing millions of dollars, I want to tell you this: it never was my thinking that made the big money for me. It was always my sitting. Got that? My sitting tight!

- Reminiscences of a Stock Operator by Edwin Lefevre

Hope you had a most excellent trading week! I entered an Amazon covered call at the 130 strike out to 7/29, watched GLD blow below my short put on my iron condor and opened an XBI (Biotech) Bull Call Spread. The market went up, volatility came in, and that was awesome for premium selling strategies. This week we bring you 3 Hot Trades. I've also made my first comic book investment: highly graded Wonder Woman Future State #1. Watch Greg's video to learn more. On the earnings front we have financials on Friday with Wells Fargo, Citi, and Blackrock reporting before the market opens.

We would love to have you join as a premium member for access to our discord group, hot trades, and custom technical indicators, and trading cheat sheets. Money Vikings LLC has been helping investors and traders since 2017, with over 70 years of investing experience combined. Subscribing through this link will give you access to our articles, FULL newsletters, and discord. You will also get 1 week free trial before being charged. Or go the substack way and hit the Subscribe Now button below.

Enjoy the newsletter and join us in Discord for more discussions on stocks, options, comics, and vintage guitars.

Rock On 🎸

Jerry

Note: In the graphs below: Red is the 200 EMA, Green is the 50 EMA, and Blue is the 20 EMA.

Weekly Market Report

Weekly Market Report - SPY gained over 3% this week. On the daily, we blasted through 20 EMA. Overall, we are still in a downtrend and have the 50 EMA (397.48) the prior high of 393.16, and the psychological 400 resistance levels to contend with. Not gonna get too bullish unless those are broken.

Weekly Crypto Report

Weekly Crypto Report - Trading around 21K this week, we definitely made progress and broke through the 20 EMA as SPY did above. We're still fairly rangebound between 19K and 22K, touching up against the top of a Bollinger Band that was called out last week.

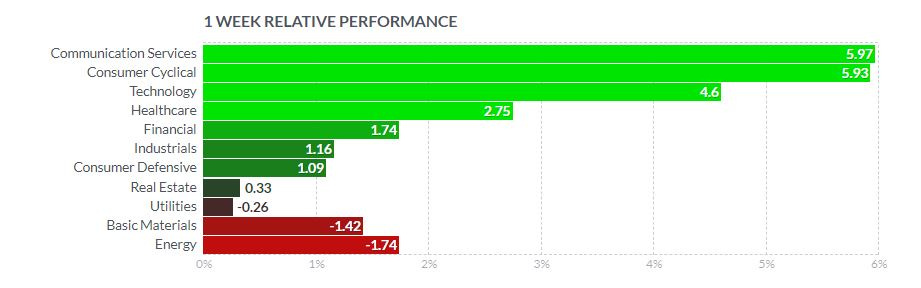

Finviz Weekly Market Heatmap

source: finviz

Interest Rates

Interest Rates moved up this week and the 2 year/10 year yield spread inverted, showing less confidence in the longer term (3.10%) than the short term (3.12%).

The VIX

The VIX (Volatility Index for S&P 500) lost around 16% this week, heading towards the June lows of 23.74. This was good for the market, as well as our Iron Condors. The Fear & Greed Index still can not make up its mind from week to week if we should be Extremely Fearful (last week: 24) or just plain 'ol Fearful (this week: 30).

The US Dollar

The dollar is trading near its 52 week highs, up around 1.53% for the week.

Two ways to Subscribe!

Substack - Subscribing through this link is $10/month or $100/year for premium articles and newsletters.

Moneyvikings.com — Subscribing through this link will give you access to our articles, FULL newsletters, and discord. You will also get 1 week free trial before being charged.

HotTrades

3 Hot Trades were called out for premium members this week: 2 Iron Condors, and 1 Bull Call Spread. To find out which ones they were and how we’re managing them, please subscribe.