Quick Hits - 7/17/22

In this newsletter: Deep Thoughts from Deep Space, Market Report, REIT- More "O" Realty Income, FINVIZ Heatmap, Hot Trades, Earnings, Collectibles - 3 Comics for Investing

The ups and downs of financial markets are historical and virtually unavoidable. Stock and bond values change every single day—it’s a fact that most people who invest understand and accept.

Making smart decisions during prolonged periods of uncertainty can be challenging. Each of us has our own investing time frame, financial goals, and comfort level with risk. You may get the sense that the market will never go up again or that you need to do something to help preserve your investments.

- Charles Schwab

Deep Thoughts from Deep Space

Above is one of the images that came back to us Earthlings from the Webb telescope this week. In my opinion this is the most amazing news of the week. The images are absolutely gorgeous and really put things in perspective. We are clearly all part of something larger and amazing. We get to see and feel it with our own experiences. This reminded me to keep the big picture in mind when it comes to investing and life.

Two ways to Subscribe!

Substack - Subscribing through this link is $10/month or $100/year for premium articles and newsletters.

Moneyvikings.com — Subscribing through this link will give you access to our articles, newsletters, and discord. You will also get 1 week free trial before being charged.

Weekly Market Report

Note: In the graphs below: Red is the 200 EMA, Green is the 50 EMA, and Blue is the 20 EMA.

Weekly Market Report - SPY had a good day on Friday (+1.91%), but the fact of the matter is that we finished the week where we started and remain in an overall downtrend. We are barely above the 20 EMA (blue line) but seem somewhat range-bound between 370-390.

Bitcoin - Rangebound

The Weekly Bitcoin Report - BTC didn't significantly change much this week and seems rangebound between the 19,000 and 22,000. We're near the same top of the sideways channel we've been in for the past 30 days. The Bollinger Bands (blue lines) continue to show BTC in a "squeeze", so perhaps a big move due soon.

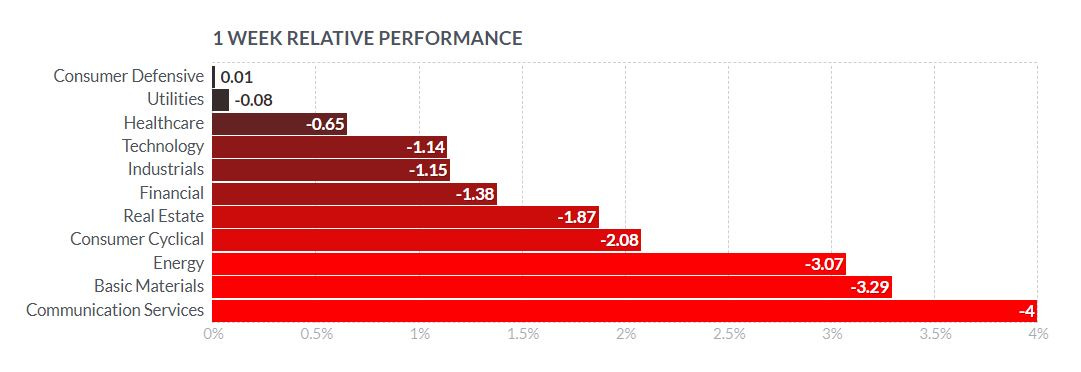

Finviz Weekly Market Heatmap & Relative Sector Performance

source: finviz

Interest Rates - Still Inverted

In the race for the highest yield, the 2 year yield (white line) is the winning horse this week, beating out the 10 year (blue) and even 30 year (green). Even though we're at 20 year extremes, the curve could continue to invert even more!

The VIX

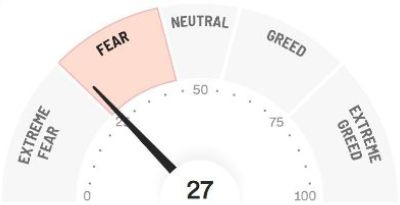

The VIX was down about 8% this week. The market may be getting used to this volatility. The Fear & Greed Index did not experience any significant changes from the prior week.

The US Dollar

The US Dollar continues to impress, up almost another 1% this week, near highs I haven't seen since the first Shrek movie opened in theatres. The chart seems to be indicating a potential reversal though. A downwards pointing oversold RSI indicator seems to confirm (see RSI: red line below chart). I'm looking at a bearish dollar trade I saw @Michael_Khouw recommend on CNBC Options Action, or may sell the small exchange Small Dollar /SFX future outright next week.

Earnings

Some big names report next week such as Netflix, Tesla, Abbott, Verizon, United, and American, and IBM.

Source: Earnings Whispers

Note earnings dates and times are subject to change, so always verify on the investor section of the company's website.

REIT - O O O O YES !!!!!!!

YES, I am adding to long term O (Realty Income) positions this week. They have a healthy 4.22% dividend and cash cow business. They have locked in low rates on their long term debt and have great growth prospects. I love reinvesting the dividend every month to build a future passive income machine.

Collectibles - 3 Hot Comics That Could Increase in Value

Check out our latest collectibles video showing 3 hot comics that might increase in value over the next few years, and are just fun reads. If you are into collectibles, trading card games, fantasy art, classic toys, amazing art, or just like having fun, check out our Money Vikings Collectibles YouTube Channel.

Hot Trades - SPY Iron Condor - OPENED