Quick Hits 7/31/2022

Bear Market Bounce or Fed Fueled Fire?

The month of July has closed with SPY up +9.21%, a record not beat since the 2020 November election, up +10.88%. With many large tech companies reporting last week, and the Fed hiking rates an expected 75 basis points, we had plenty of catalysts for strong end to the month. Amazon ended the week up 10% and the 10 year rate fell around 2.9%.

You wouldn't know it, but the YoY revenue growth for many of the FAANG companies is slowing, and second quarter GDP is shrinking. The 10 year / 2 year yield curve remains inverted, often a predictor of a recession. The dollar continues to fall, and that seems to be helping commodities such as Oil, Gold and Silver. Anyone notice that Silver rallied over 9% this week?

Two ways to Subscribe!

Substack - Subscribing through this link is $10/month or $100/year for premium articles and newsletters. 7 day trial before being charged as well.

Moneyvikings.com — Subscribing through this link will give you access to our articles, newsletters, and discord. You will also get 1 week free trial before being charged.

Weekly Market Report

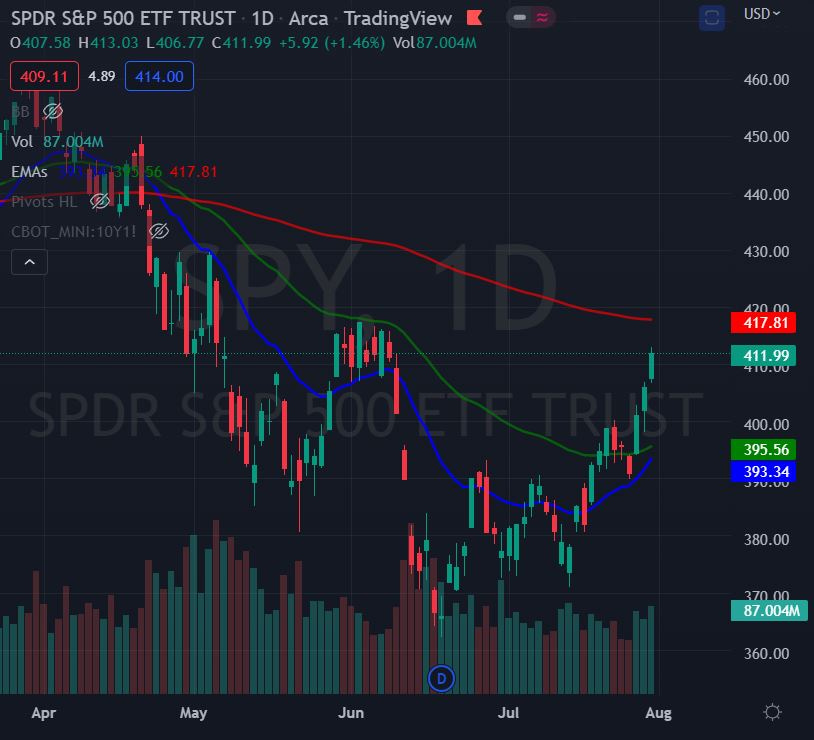

Note: In the graphs below: Red is the 200 EMA, Green is the 50 EMA, and Blue is the 20 EMA.

Weekly Market Report - S&P 500 up 4.42%. Inspired by the Fed's announcements, a very strong week for the stock market with the SPY blasting past 400, and inching towards the 200 day (417 - red line). Clearly breaking a downtrend this week, I'd like to see the 417 June 2nd high broken, and the 419.63 50% Fibonacci retracement exceeded. Currently I'm still very cautious.

Bitcoin

The Weekly Bitcoin Report - The Fed announcement apparently helped push BTC up almost 8% this week. Not to be outdone, DOT investors no doubt enjoyed their 18% rally.

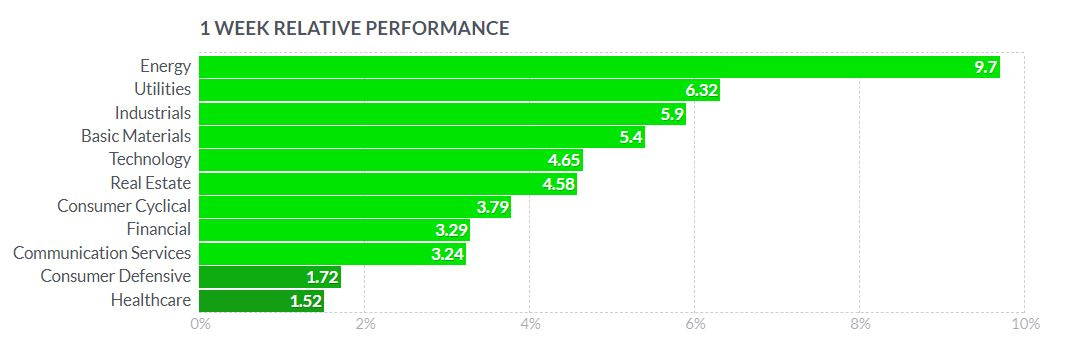

Finviz Weekly Market Heatmap & Relative Sector Performance

Meta reported a YoY revenue decline. Intel hit a 52 week low. Every sector was up this week with energy back in the lead by a wide margin.

source: finviz

Yields

The 10 year dropped about 14 basis points and the 30 year only lost around 2. The 30 year is offering the highest yield at over 3%, while the 2 year (white) is still offering more than the 10 year (blue), an inverted state.

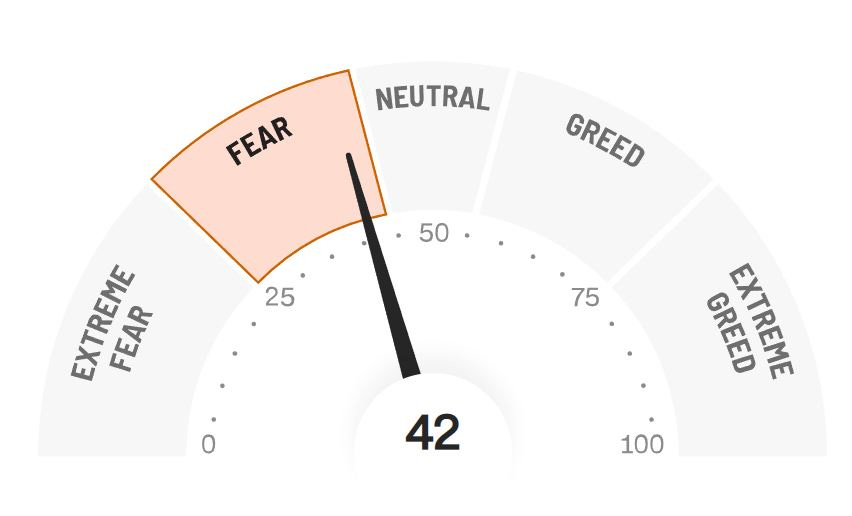

The VIX

The VIX was down another 8.5% this week, indicating less fear and volatility in the S&P 500. The Fear & Greed Index moved from 39 to 42 (less fearful).

The US Dollar

The US Dollar continued its decline, down -0.81% for the week. My bearish dollar trade--a bear put spread in UUP out to September (27/29 for .75 debit). is profitable by 6.7%.

Next we cover some REIT ideas, Hot Trades I made this week, and some ideas for collectibles that could appreciate in value over time… Star Wars!