Quick Hits 8/7/2022

Signs of Easing?

Hi Traders, Investors, and Market Watchers!

A few weeks ago I described the PAB (Passive Active bucket) method of investing. I would like to double down this week on some of the more passive activities that I believe pay off over the long run.

Every time over the last 25 years when the sky was falling, those who panicked and sold everything at the wrong time lost. No one ever knows when the bottom of a market cycle will hit.

"Passive Income Machine" I repeat this phrase all the time because I believe it is critical to our investing success. This phrase changed my whole view about market timing and fretting over what the market will do each week. For the vast majority of us, there will never be a magical day when we completely cash out of the market.

The victory is in building a passive income machine of well diversified assets over time. The victory day comes when we start drawing a consistent income that can last our entire retirement or beyond.

If you really think this way, you end up not caring what the market is doing. In fact, you cheer when it falls because you know you can buy more quality shares on sale and strengthen the long term effectiveness of your passive income machine.

Another thing to look for is diversification. I like to pay attention to the correlation with SPY in all of my positions. While I obviously have iron condors in SPY and enjoy active trading with a smaller % of my assets, for longer term, I do like to invest in other assets like AGG (.21), DBA (.24), UUP (-.50), GLD (.19), SLB (.54), Bitcoin (.21) which have low correlations to SPY. This helps a passive income machine continue running smoothly because they all don't go up or down at the same time. At any time, some assets will be up and some will be down, and there's no need to actively trade them in a long term investment portfolio.

Best in investing and life to you,

Greg & Jerry

Weekly Market Report - Signs of Easing

Note: In the graphs below: Red is the 200 EMA, Green is the 50 EMA, and Blue is the 20 EMA.

Weekly Market Report - SPY was up 1.45% this week, but did not continue with the same excitement as the prior week. It's consolidating below the the 200 day (417 - red line) and did not overtake the May/June highs where it last spent time consolidating before a big drop. The 20 EMA (blue) and 50 EMA (green) are pointing upwards, but the 200 day is still sloping downwards, indicating a shorter term counter-trend rally within an overall downtrend.

Most of the largest components of the S&P 500 have already reported earnings

528,000 new jobs were added this week, beating expectations

CPI numbers come out next week which could increase market volatility

Keep an eye on the events in Taiwan

Oil trades below 90 and has hit lows not seen since February of this year

Bitcoin

The Weekly Bitcoin Report - BTC was down around -2.5% for the week, but its cousins BAT and AVAX were up over 8% for the week. With a .21 10 day correlation to SPX, BTC is certainly not the hedge it was once hyped up to be.

Finviz Weekly Market Heatmap & Relative Sector Performance

Technology took the lead this week, while Energy lagged. Real Estate finished in second to last place.

source: finviz

Two ways to Subscribe!

Substack - Subscribing through this link is $10/month or $100/year for premium articles and newsletters. 7 day trial before being charged as well.

Moneyvikings.com — Subscribing through this link will give you access to our articles, newsletters, and discord. You will also get 1 week free trial before being charged.

Yields & Rates

The 2 year (white) is offering the highest yield at over 3.2%, while the 30 year (green) and the 10 year (blue) offers less -- an inverted state. The .40 bps spread between the 2 and 10 is at highs not seen since around 2003. Australia and the Bank of England have both increased rates 50 bps.

The VIX

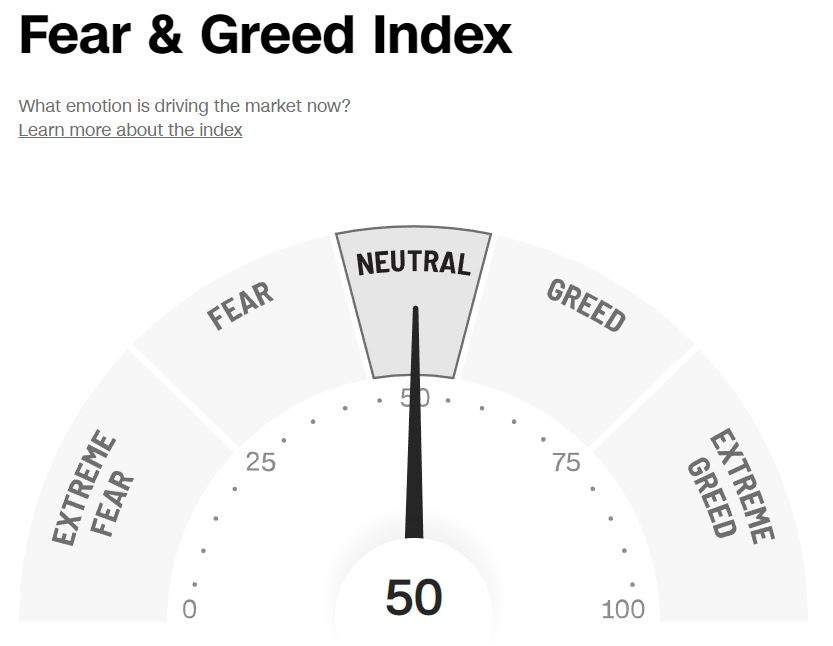

The VIX was down another 4.47% this week, indicating less fear and volatility in the S&P 500. The Fear & Greed Index moved from 42 to 50 (less fearful), and now is in total balance at "Neutral" label. For options sellers this will be a good time to close trades. For options buyers, it's a good environment to buy new debit spreads (either bullish or bearish).

The US Dollar

The US Dollar bounced off the 50 EMA (green) on Monday, gaining .14% for the week.

In the next section we cover recommended REITs, HotTrades, Earnings, and Health Tips for paid subscribers.