Quick Hits for the Week of 10/23/22

The Death of the 60/40 Portfolio is Greatly Exaggerated

The Death of the 60/40 Portfolio Is Greatly Exaggerated

I’ve seen so many articles, and listened to so many podcasts this week about the death of the 60/40 portfolio (60% Equities / 40% Bonds). Now I’m not saying it’s right for everyone, however just taking a look at the past 12 months is not how one should be judging it. Bonds are currently at all time lows. Someone who is considering a bond fund like TLT for the next few years may actually do very well if we are truly at the lows. Same with Equities, someone just entering now or sometime in the next few months could possibly do really great if they can handle some short term volatility.

Weekly Market Report

SPY, had a volatile but decent week, up over 4%. On the daily, it closed above the 20 EMA (blue line — 369.78). Could the 20 EMA become the new support? With options expiration this past Friday most expected to see a down move, however we had a nice surprise to the upside. Also notable is that on the weekly (not pictured) we closed about the 200 SMA, indicating a possible support. I’m not getting bullish or bearish, just trying to stay small and nimble, taking appropriate risks for the size of my portfolio. I may actually start dollar cost averaging into TLT or using options to play for a bounce soon.

This week I asked a question (21:47) on Engineering the Trade about a covered call in SLB and got some great expert advice and a deep dive into how to use the TastyWorks platform to track an options Intrinsic Value.

Weekly Market Report

PY, had a volatile but decent week, up over 4%. On the daily, it closed above the 20 EMA (blue line — 369.78). Could the 20 EMA become the new support? With options expiration this past Friday most expected to see a down move, however we had a nice surprise to the upside. Also notable is that on the weekly (not pictured) we closed about the 200 SMA, indicating a possible support. I’m not getting bullish or bearish, just trying to stay small and nimble, taking appropriate risks for the size of my portfolio. I may actually start dollar cost averaging into TLT or using options to play for a bounce soon.

SPY

Bitcoin - Stuck in the Middle With You

Basically unchanged this week, still stuck in the 19,000 range, trading just below 20 day EMA. I did notice on the bollinger bands that we seem to be narrowing, indicating perhaps a sharp move up or down in the not too distant future.

Finviz Weekly Heatmap

source: finviz

All sectors closed green this week with Energy stocks leading, up over 8%, followed by Technology and Materials (both up ~6%). Consumer Staples and Utilities trailed the Market up around 2%.

Rates, Yields, and Bonds

With all 3 benchmark rates over 4% and rising for the week, we are monitoring the 30 year which was up this week over 32 basis points. The 2 year is leading at 4.483% but perhaps losing steam as the inverted curve seems to be flattening.

source: koyfin

Note the inverse impact on Bonds and Bond funds like TLT which lost 7% of the their value just this week. Time to look for confirmation of a bounce?

The VIX

Closing below 30, the VIX lost 6.93% this week indicating less fear in the market.

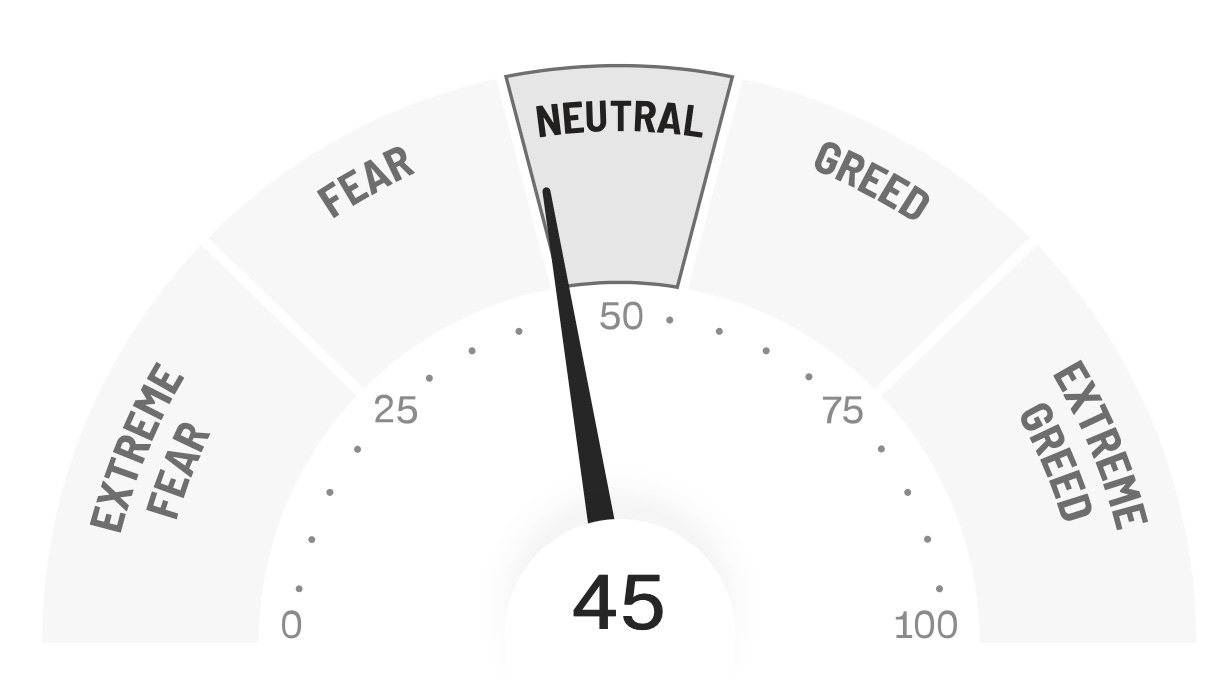

Fear and Greed index moved from 21 to 45 this past week indicating neutral sentiment, and trending towards "risk-ok" (right or wrong).

Hot Trades - SLB Covered Call - Managed

After buying SLB at 42.50 a few months back, I have been chipping away at my cost basis by selling monthly covered calls against it at the 42.50 November strike.