Quick Hits for the Week of 10/9/22

🥾 How Will You Thrive & The Great Reboot, Current Investment Watchlist (NEW💥 SECTION!), Hot Trades 🔥, Collectibles - 5 Reasons Flesh & Blood Will Thrive, Health - Ashwagandha

"Do what you can, with what you've got, where you are."

- Unknown

Weekly Market Report

We started this month and quarter with a bang up over 5% Monday and Tuesday, then gave most of it back by the end of the week, ending +0.27%.

Jobless Claims hit a 5 month low of 219,000. While this is good for those seeking jobs, it goes counter to the Fed's desire to curb inflation. As a result of this, the current thinking is that the Fed will stay on course to raise rates aggressively. This seems to have spooked the market.

SPY is hanging on by a thread trading above the 200 SMA and June lows.

The VIX retreated slightly, but we're still over 30. High volatility is the new normal.

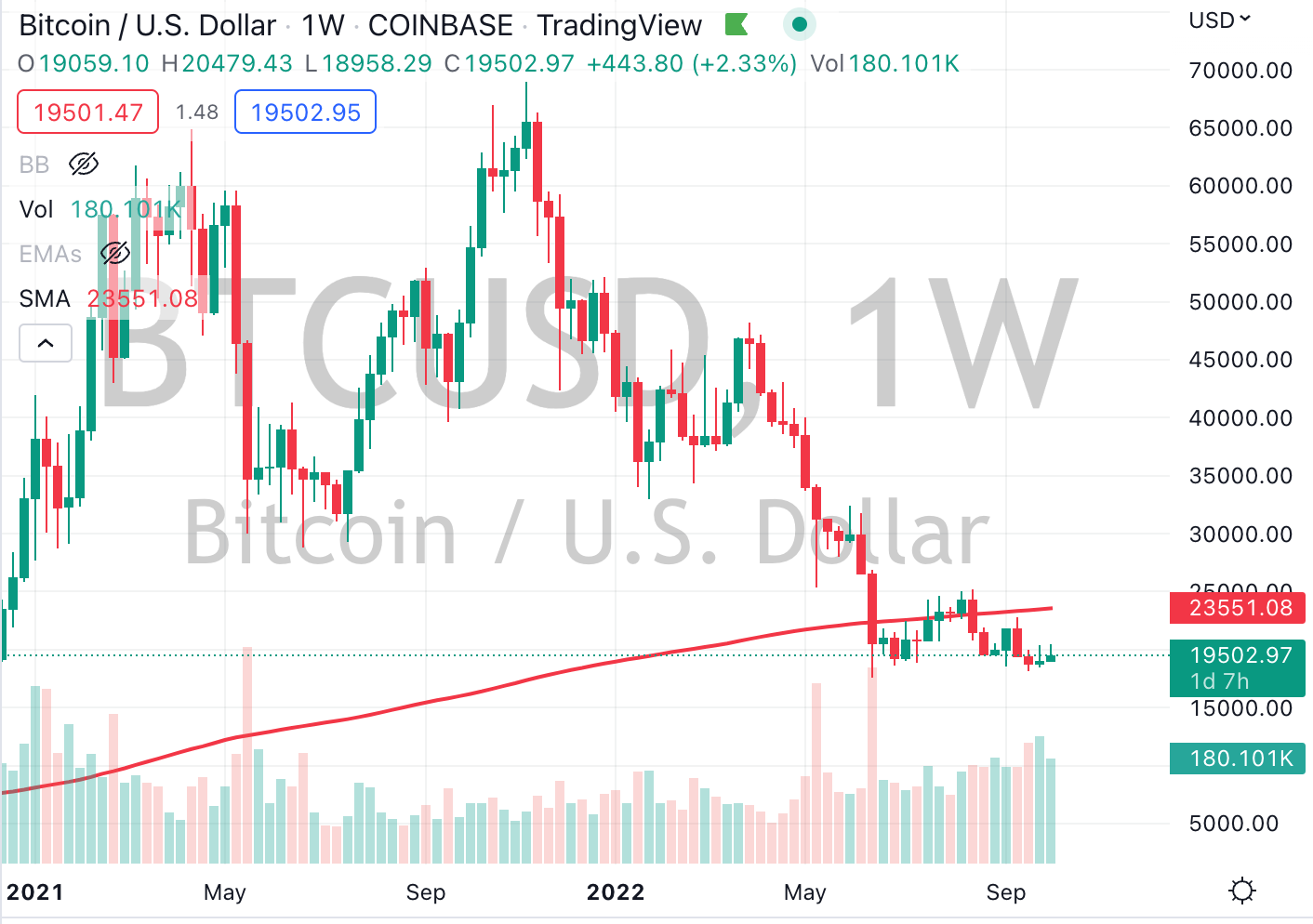

BTC continued to trade around 19K.

Also beating the S&P were commodities such as precious metals and crude: silver was up over 5%, gold was up about 2%, and crude was up a whopping 15% -- driving the Energy sector (XLE).

SPY

SPY had a wild ride this week. It gained more than 5% early in the week, then gave almost all of it back, ending the week up +0.27%. Closing on Friday at 362.79, it closed above the 200 SMA (358.66) and a hair above the June lows of 362.17.

Bitcoin

Still stuck in the 19,000 range, and trading below the 200 day SMA.

Finviz Weekly Heatmap

source: finviz

Energy led, up by 13%, while Real Estate (-4%) / Utilities (-2.5%) lagged.

How Can You Thrive? The Great Reboot

Our mission at Money Vikings is actually quite simple: present ideas & inspiration for you to thrive. That is what it is all about. We believe that when we put our heads together, share knowledge & tools, we all end up greater over the arc of our investing careers and lives.