Quick Hits for the Week of 8/14/2022

Are we out of the woods? In this newsletter: What We Bought, Market Report, REITs Crypto - ETH Merge, Hot Trades, Earnings, Collectibles - 4 Key Spiderman Collectibles

Just being surrounded by bountiful nature, rejuvenates and inspires us - E.O. Wilson

What Are We Buying? (ARE, WM, TMO, STAG, VZ)

Hi Everyone! Hope you're staying safe as we enter the last phase of summer 2022! Even though we had an exciting week with SPY up 4.26% on less than feared CPI (inflation) data, we continue to approach our portfolio with a mindset of risk management and quality. Last week we added 2 REITs: Alexandria REIT (ARE) and Stag Industrial REIT (STAG). I still see the long term value of income producing real estate and dividend stocks to build wealth and passive income machines. Other quality equities we're watching: Waste Management (WM), Thermo Fisher (TMO), and we're continuing to dollar cost into Verizon, which is paying a 5.67% dividend. For core foundational wealth building we believe in picking up small amounts of quality assets one step at a time. Also, do not forget the other side of wealth building: frugality. We continue to use thrift stores (even for collectibles) and Buy Nothing Groups to beat inflation.

Enjoy the newsletter, and join us on Discord for more discussions.

Best in investing and life to you,

Greg & Jerry

Weekly Market Report

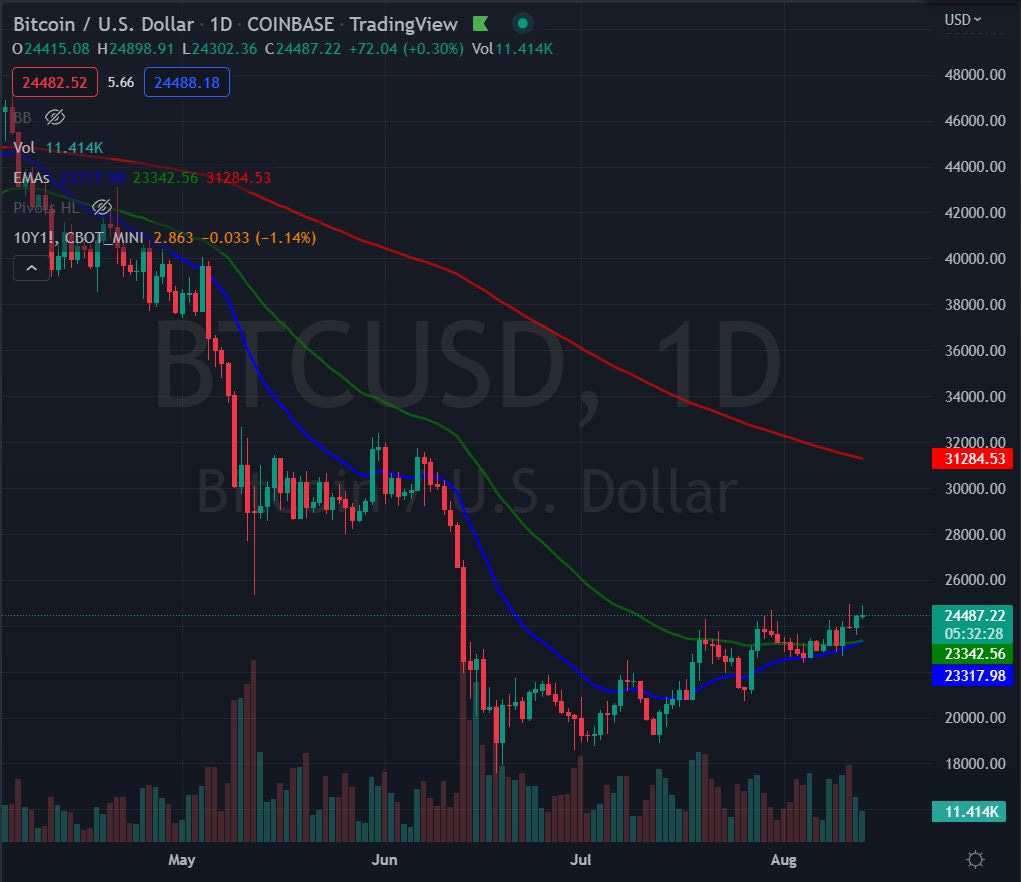

Note: In the graphs below: Red is the 200 EMA, Green is the 50 EMA, and Blue is the 20 EMA.

SPY was up 4.26% this week, an broke through the May through June highs, the 50% (412.12) and 61.8% (423.91) Fibonacci levels, as well as the red 200 day EMA (417.57).

All sectors gained with Energy and Financial sectors leading the pack

Small Caps beat SPY, up 6.88% this week

Commodities such as Corn, Soy, Natural Gas, Oil, and Precious Metals all rallied on dollar weakness

Bitcoin & Ethereum

BTC was up 6.72% this for the week, but ETH was the true star, up over 17% for the week as ETH 2.0 gets ready to launch on September 15th. We have been longtime Ethereum holders. Ethereum is close to switching from Proof-of-Work (PoW) to a Proof-of-Stake (PoS) model, which is meant to make the network more efficient and less power hungry. The transition is expected to increase the network's scalability and make it 99% more environmentally friendly. Will this increase the value of ETH tokens going forward? It should be interesting to watch, for sure!

Weekly Market Heatmap & Sector Performance

All green this week.

source: finviz, koyfin

Yields & Rates

The 2 year (white) is still offering the highest yield at over 3.2%, while the 30 year (green) and the 10 year (blue) offer less -- an inverted state at ~20 year records. All rates remained in an upward trend this week, and their spreads widened.

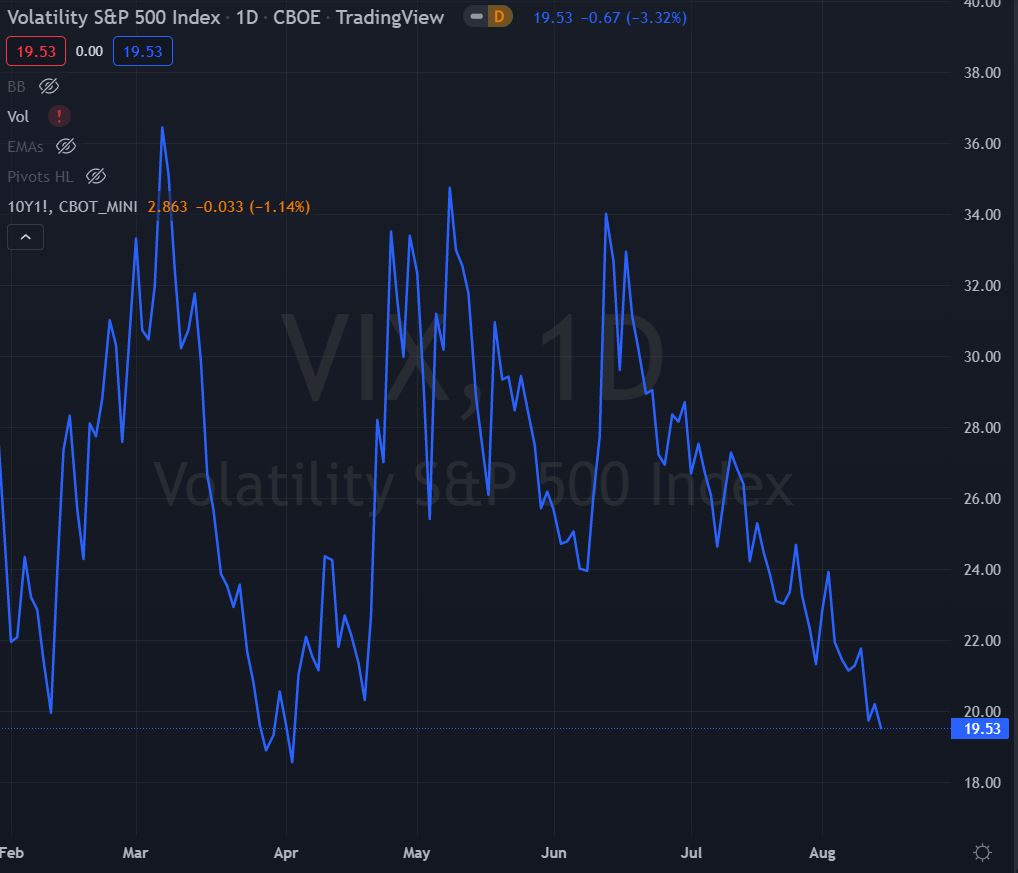

The VIX

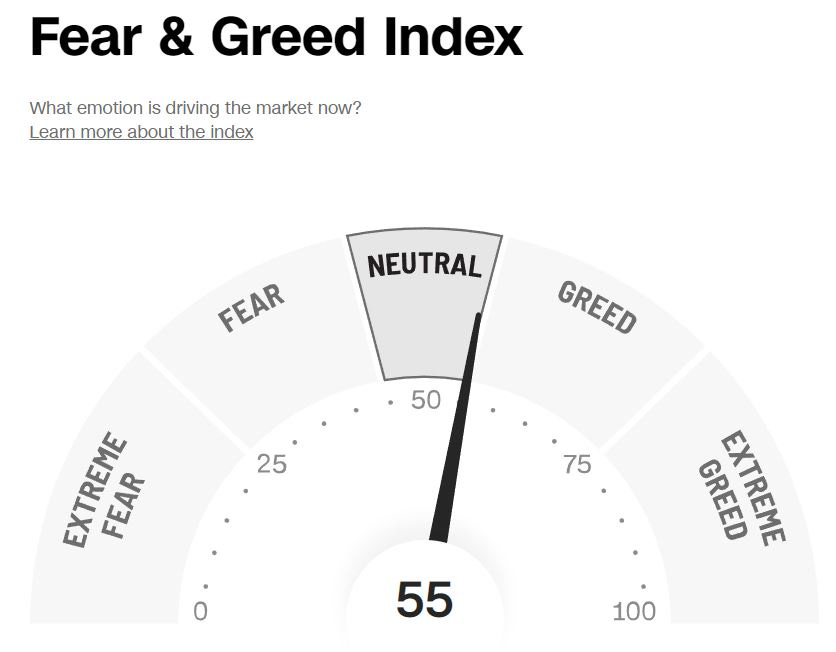

The VIX was down another 9.21% this week to lows not seen since April 4th, indicating less fear and volatility in the S&P 500 (or is that complacency?) The Fear & Greed Index moved from 50 to 55 (bordering on "Greed")

The US Dollar

The US Dollar declined slightly this week, down 1.02%.

Dividend Advantage - Stanley Black & Decker (SWK)

Stanley Black & Decker has launched a substantial cost savings push that aims to take $1 billion annually out of operating costs. With Stanley Black & Decker shares down 50% over the past year and cheap on peak earnings potential, insider buying could be signaling that there might be good long-term value here. Here are some additional reasons why we like it:

A 3.29% yield

Share price could grow substantially over next couple years

A "Dividend King" that rarely goes on sale

With the stock trading at a current P/E of 13.2 and forward P/E of 11.2, the market may have reacted too strongly concerning current business challenges.

To keep reading about trade ideas, REITs, Earnings, Health Tips, and Collectibles subscribe!