Quick Hits for the Week of 9/11/22

🥑Let Us Help You Beat Stress! , Real Estate - Tread Carefully?, Market Reversal This Week - Is it here to stay?, 🔥Hot Trades - XLF Bull Call Spread, Collectibles - Wizards Too Much & Cracking

The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.

Ben Graham

Weekly Market Report

SPY and QQQ up over 1.47% and have closed above the 20 and 50 EMA lines.

The Fear index as represented by VIX was down about 10%. So, the market is back to "risk on" ?

GLD & SLV seem to have bounced off their lows with SLV up 4.15%

The dollar is at multi-decade highs but is showing some cracks, down 0.21% as the Euro traded up about .34% closing the week with a bullish engulfing candle.

Bitcoin regained 20K and now trades between the 20 and 50 EMA

Agriculture up over about 1.32% (DBA)

Oil lost almost 3% this week as showed by the decline in USO.

Friday 9/16 is the monthly expiration for September

SPY

Bitcoin

Nice jump this week. Watch for the Ethereum merge on or around 9/15.

Gold and Silver

FXE (weekly candles)

FXE (Euro) up about .34% as the dollar declined by about .21%. Bullish Engulfing candle from this week could be, well.. bullish? Compare to the US Dollar below.

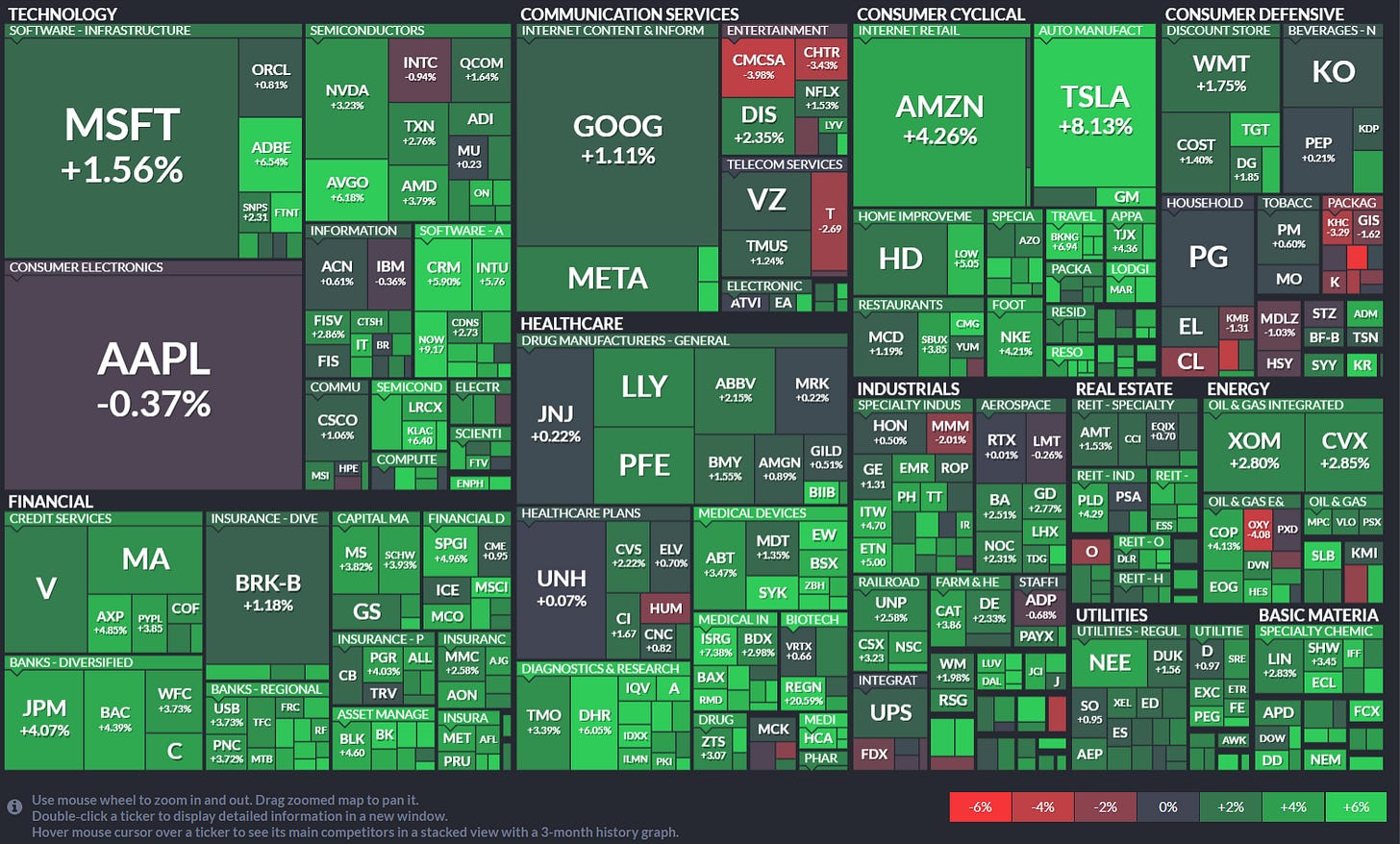

Weekly Market Heatmap

source: finviz

All Sectors were up this week with Consumer Discretionary and Materials leading the pack up over 5% each. No sectors ended red, however Energy preformed the worst only up .80%. Even iPhone 14 Pros could not lift Apple.

Yields & Rates

source: koyfin

All 3 benchmark rates continue to rise and trade over 3% and gain more than 10 Bps each. The 2 year trades at the highest yield, 3.571%, higher than the 30 year and 10 year, remaining in an inverted state.

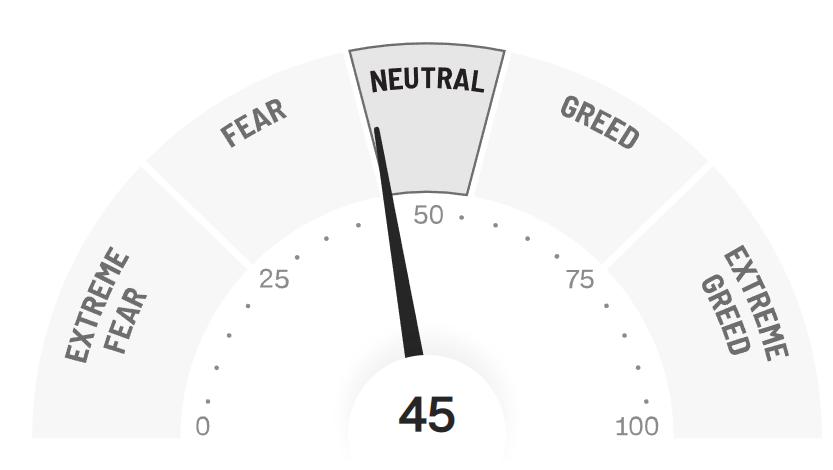

The VIX

The VIX was down 10% for the week. The Fear & Greed Index moved from Fear to Neutral.

The US Dollar

The US Dollar retreated slightly, compare to the Euro above.

Hot Trades - Bull Call Spread - OPENED