Quick Hits for the Week of 9/18/22

🔀Dominate with Diversification! Market Reversal This Week - Is it here to stay? Real Estate - OHI REIT 🔥Hot Trades, Collectibles - Spectacular 🕷Spider-Man, Health - 🧅Onion Power!

Courage isn't a matter of not being frightened. It's being afraid and doing what you have to do anyway.

Doctor Who (3rd Doctor)

Weekly Market Report

After the not so great CPI numbers (inflation) were reported this week, SPY declined -4.27%, closing with a bearish engulfing weekly candle, but is still trading above the weekly 200 SMA at 367. (How's that for glass half full?)

The Fear index as represented by VIX was up about 12% to levels not seen since early July of this year.

Gold futures could not hold 1700 as the dollar rallied and the 2 year yield shot up to 3.865%

Bitcoin could not hold 20K for most of the week.

More Fed rate announcements next week with Costco and FedEx earnings.

SPY

Note: chart below has weekly candles:

Bitcoin

BTC Down almost 9% for the week. The ETH merge started. Defying all other Cryptos, Cosmos/ATOM is strangely up 2.52% for the week. Note: chart below has weekly candles.

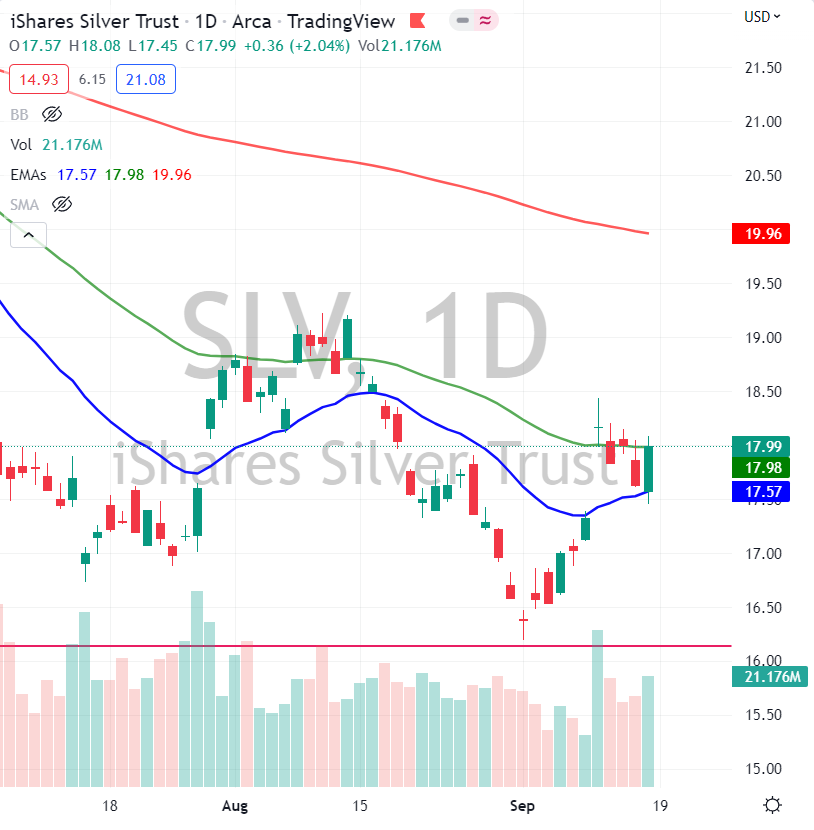

Gold & Silver

GLD is having a hard time holding the 200 EMA as the dollar continues its 20 year rise. Silver on the other hand rose 5%!

Silver rose 5% and is trading between the 20 and 50 day EMAs. Is this a place to hide?

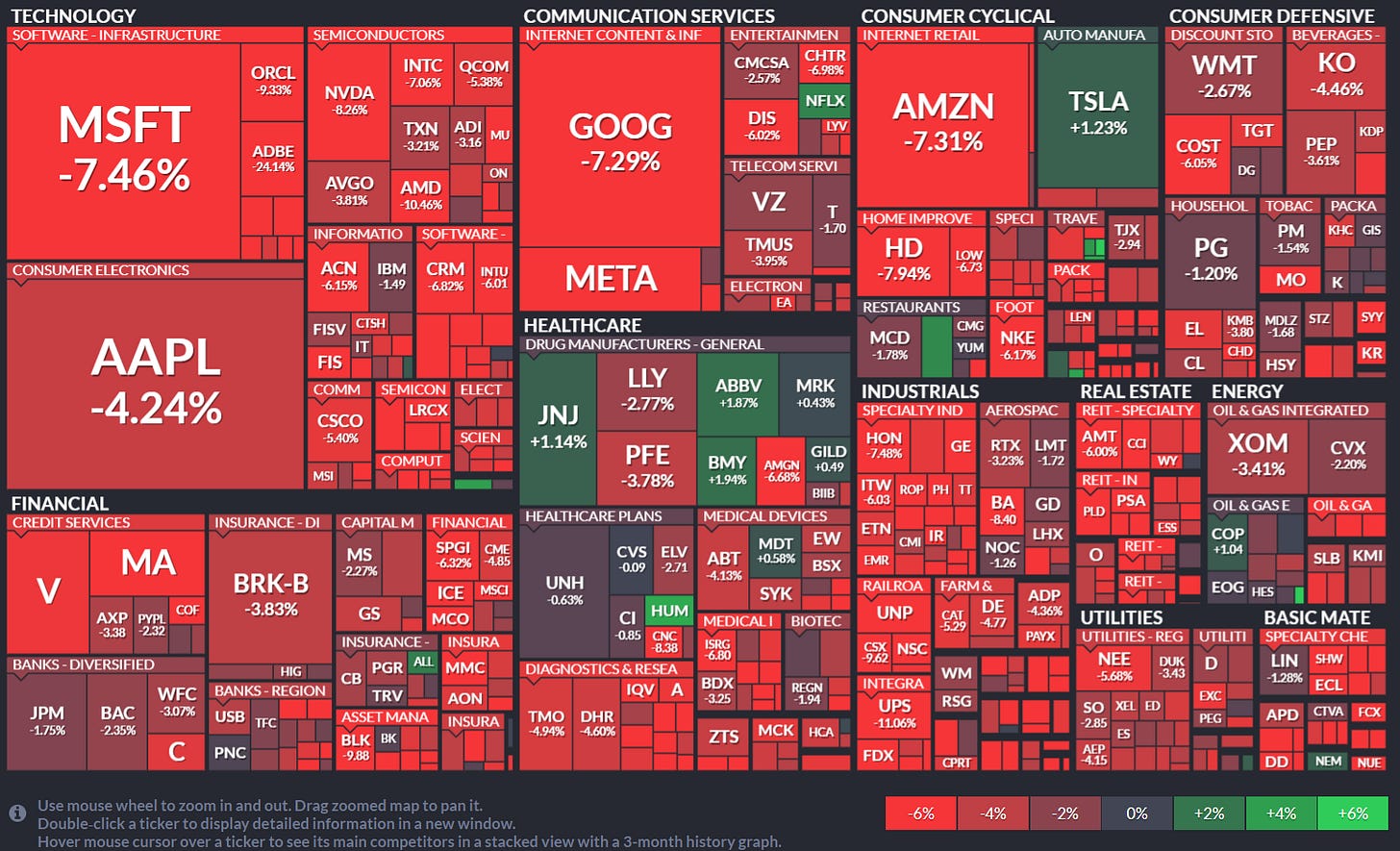

Weekly Market Heatmap

source: finviz

Healthcare was the least crushed, only down -2.35% for the week, while Real Estate, Materials, Technology, and Communications all declined over -6%.

Yields & Rates

source: koyfin

All 3 benchmark rates continue to rise and trade over 3% with the 2 year leading up over 9% this week. The yield curve remains inverted and is steepening, (getting more inverted.)

The VIX

The VIX was up 12% for the week (more volatile and fear). The Fear & Greed Index got more fearful than it was the prior week.

The US Dollar

The US Dollar continues to defy gravity, rising 0.68% this week. Is this the place to hide?

Real Estate - REIT, Omega Healthcare Investors (OHI)

It is no secret that the US population is aging. And this increases the need for healthcare and senior living. This is a macro trend that I like to ride in investing.

Enter Omega Healthcare Investors (OHI). Currently yielding over 8%, talk about an inflation defense system!

REAL ESTATE INVESTING, TRUEWEALTH.MONEYVIKINGS.COM

Hot Trades - OPENED IWM Iron Condor

On 9/14 with IVR% over 50%, I sold a . . .