Quick Hits for the Week of 9/25/22

Balancing Defense With Opportunity (Fight Fear!) BTFD? 🔥Hot Trades, Defensive Rolls, Collectibles - Epic Dominaria United Pack, 5 Concepts for Wealth Building, Health - Coffee & Tea Key to Fighting D

"Success is the sum of small efforts repeated day in and day out."

- Robert Collier

Weekly Market Report

The Fed told us what we expected to hear (+75 Bps) and SPY declined -4.21%.

The Fear index as represented by VIX was up about 8.88% to levels not seen since June of this year. On Friday we briefly exceeded 32.

The 2 year rate is now trading over 4% while the 30 year trades at 3.6% (the inversion continues).

The Fear and Greed index moved to "Extreme Fear".

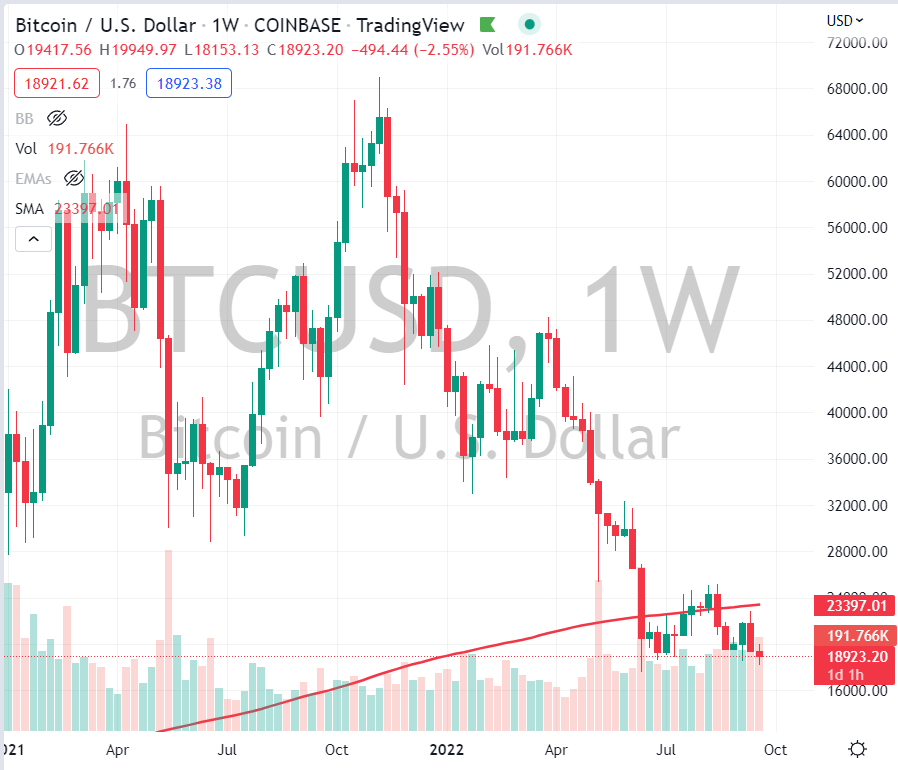

Bitcoin could not hold 19K.

Agriculture, as represented by the DBA ETF was only down -0.73%.

Gold lost -1.07% this week. Not the "hedge" we all thought, but also not down as much as the S&P either.

The Dollar went up +2.78%.

Oil declined about -15%

SPY

Still holding the 200 SMA at 357.76

Bitcoin

Gold

Weekly Market Heatmap

source: finviz

Like last week, Health Care was the least beat up, only down -0.92%, while Energy & Materials were the worst hit.

Yields & Rates

source: koyfin

Note that the 2 year is now over 4%.

The VIX

The VIX was up over 8% for the week (more volatility and fear). The Fear & Greed Index moved to an Extreme Fear reading.

Extreme Fear goes with EXTREME CLOSE-UP!

The US Dollar

Look at that weekly dollar bar.