UIS Covered Call Opportunity - Unisys Corp

We love covered calls at The Money Vikings! Why not try and earn dividends plus options premium at the same time, with this low-risk strategy.

7/2 -DO NOTHING HERE – UIS has not done a whole lot in the last few weeks which is fine for our covered call position. It’s currently trading a few cents below our initial entry, so we’re down in the stock, but the 28$ call has depreciated in value (theta decay) so the option is worth less and we can buy it back to close for cheaper. Currently the net PnL is -$30.00 but let’s continue to wait as there’s nice support at 24, and the option time value should continue to decay. Soon (before 8/3 earnings) we’ll decide if we want to roll it out in time or close the whole position (for a profit we hope!)

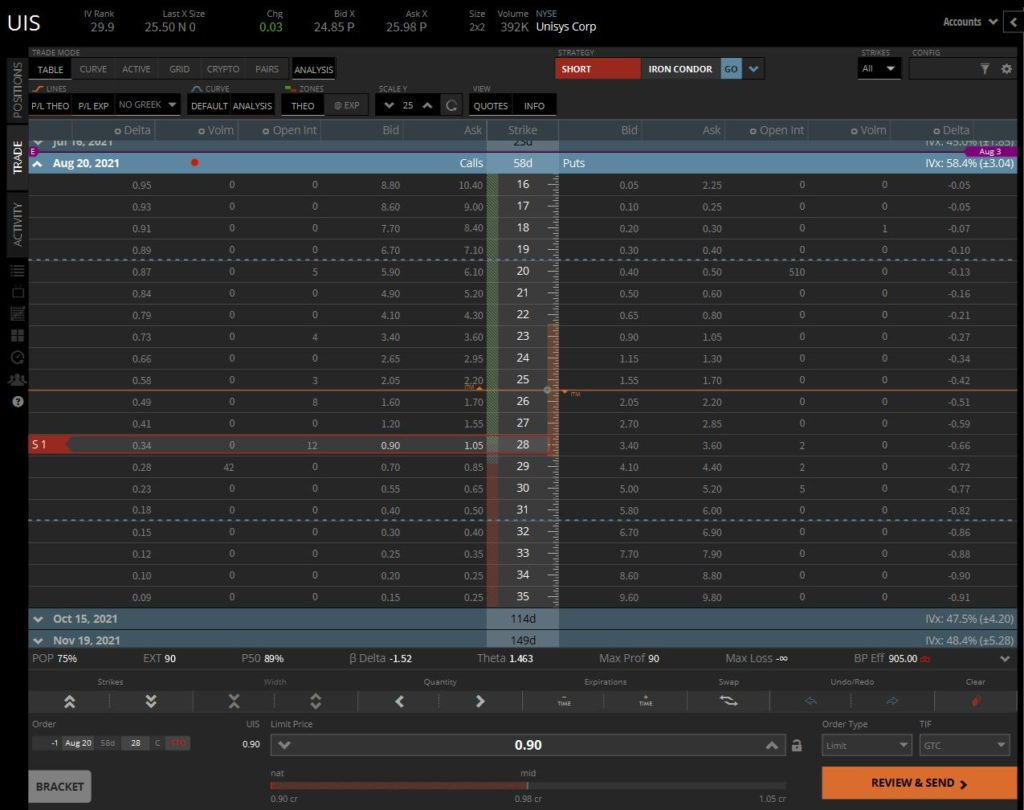

6/23 – I love covered calls. Right now UIS has earnings on 8/3/21 has an Implied Volatility Rank of almost 30%, which means you’ll get more premium than usual. For $25.50, buy 100 shares of UIS and sell the August 20th 28 strike call against it, collecting between .90 and 1.05. You will break even if the stock is above 24.50, but my plan is to sell and possibly roll out another month at 50% before the 8/20 earnings event, collecting around 50$ for the call, and all stock profits up to 28$. Should it exceed 28$ you can hold until expiration and collect up to $350.

6/23 - I love covered calls. Right now UIS has earnings on 8/3/21 has an Implied Volatility Rank of almost 30%, which means you'll get more premium than usual. For $25.50, buy 100 shares of UIS and sell the August 20th 28 strike call against it, collecting between .90 and 1.05. You will break even if the stock is above 24.50, but my plan is to sell and possibly roll out another month at 50% before the 8/20 earnings event, collecting around 50$ for the call, and all stock profits up to 28$. Should it exceed 28$ you can hold until expiration and collect up to $350.

6/26 - Weekly Summary - Entered this position on Wednesday 6/23 and UIS as appreciated to 26.03. This is good. The call has appreciated in value from $100 to $125. While this sounds good, it's a call we sold so now I need to net out -$25 from the gain of about 39$. Over time, the value of the call should start to decrease. I'd say this week the covered call went well, and I'm not making any changes or adjustments. My plan is to buy back the call at 50% of the premium received, or 50$.