Using Python's mplfinance and matplotlib libraries to Generate Graphs for Options Trading

Fun with mplfinance, matplotlib, and yfinance for free!

I’ve been working on some python code and the mplfinance, matplotlib, yfinance python libraries to generate the images below. Many of them I have covered called or cash covered puts in which I roll monthly.

import yfinance as yf

import matplotlib.pyplot as plt

import mplfinance as mpf

# Download data

stock_data = yf.download(symbol, period="1y")

# Extract the call/put information for the current stock

cp_type = next(item['CP'] for item in config['stocks'] if item['ticker'] == symbol)

cp_label = "(CALL)" if cp_type == "Call" else "(PUT)"

# Extract the strike price for the current stock

strike_price = next(item['strike_price'] for item in config['stocks'] if item['ticker'] == symbol)

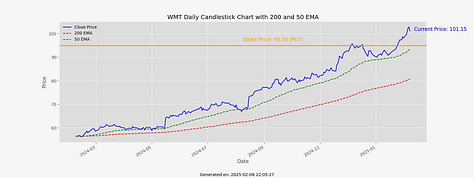

# Calculate the 200-day and 50-day EMA

stock_data['200 EMA'] = stock_data['Close'].ewm(span=200, adjust=False).mean()

stock_data['50 EMA'] = stock_data['Close'].ewm(span=50, adjust=False).mean()

# Create a candlestick chart for the stock (for each day)

fig, ax = plt.subplots(figsize=(16, 6)) # Adjust figure size if needed

# Example plotting:

plt.style.use('ggplot') # Or any style from matplotlib

stock_data['Close'].plot(kind='line', color='blue', title=f"{symbol} Daily Candlestick Chart", ax=ax) # Plot the data with candlesticks

stock_data['200 EMA'].plot(kind='line', color='red', linestyle='--', ax=ax)

stock_data['50 EMA'].plot(kind='line', color='green', linestyle='--', ax=ax)

ax.legend(['Close Price', '200 EMA', '50 EMA']) # Add a legend if needed for clarity

ax.set_title(f"{symbol} Daily Candlestick Chart with 200 and 50 EMA")

ax.set_xlabel('Date')

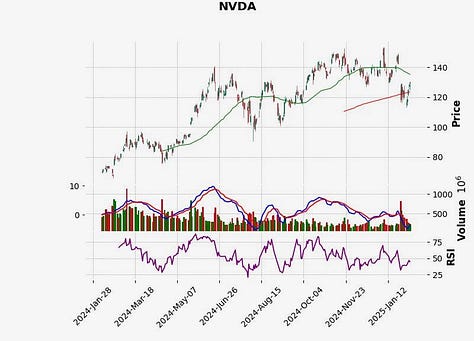

ax.set_ylabel('Price')There are a couple types of graphs. The first type are candlestick charts that have the RSI, MACD, and 50/200 Exponential Moving Averages. The second type is a line graph with the EMAs, but also have a yellow line drawn at the strike of my call or put. It’s a nice visualization for me and gives me a quick sense of where the trade is headed. I’d like to combine the 2 into one and move to a weekly, but also add a simple daily line graph to get a sense of the trading day.

Are there indicators you would like to see added that have helped you trade options? Perhaps Average True Range or Bollinger Bands?

Looking for my trades? Check out Jerry's Active Trades