Weekly Market Newsletter

Prep for the week of 6/12

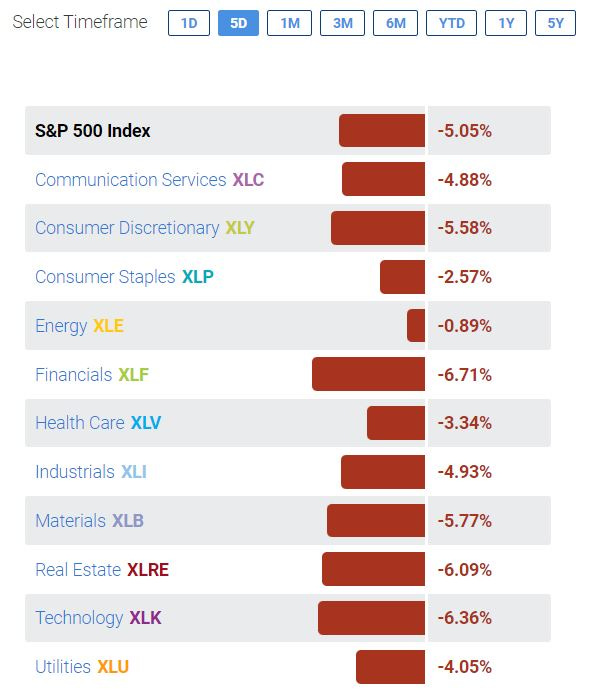

Weekly Market Report — I’ve shifted to weekly bars this week. The next logical supports on SPY (-5.25%) are the May lows around 380.54, and then the 200 EMA (red line), at 363. Not one sector was green this week. Technology and Real Estate were the worst hit, down over -6%.

The Weekly Crypto Report - The decimation of the Bitcoin market continued as BTC trades below 30K, -4.29% for the week. We are looking at weekly bars, and the next line of support is the 200 EMA (red). ETH was down over -14% this week. In contrast, Gold rose +1.37%

Thank goodness for energy, down only -.89% this week, but up +68% for the year. source: finviz

Gold rose +1.37%

With higher than expected CPI numbers, the VIX reversed course on Friday to with increased volatility, but the Fear & Greed Index has basically remained unchanged.

Earnings Next Week

Monday after close: Oracle

Thursday before open: Kroger

Thursday after the bell: Adobe

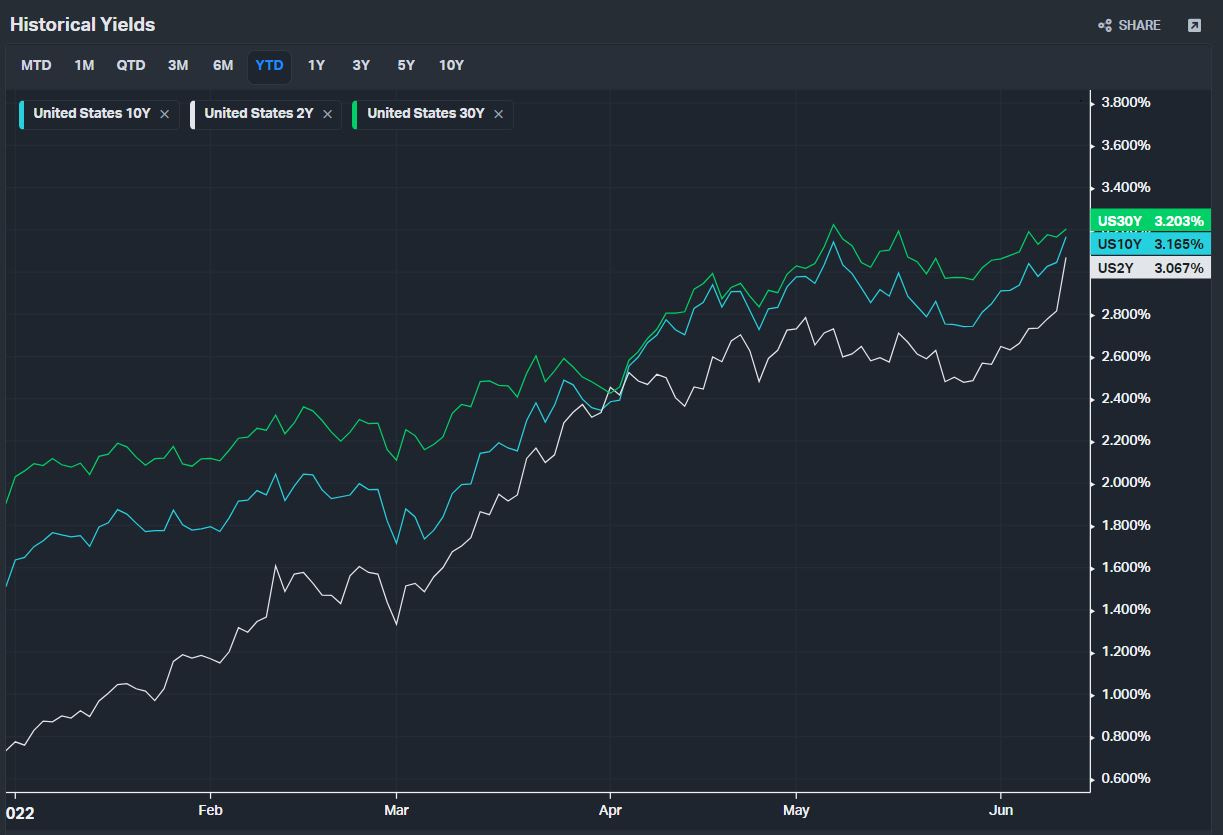

The 2 year rate went over 3% this week. All 3 flagship rates seem to be converging and could invert as they did back in late March, a potential recession indicator.

Not surprisingly, trading inverse to equities, the dollar continues to ascend.

If you found this valuable and would like to help support us, consider doing one of the following:

Sign up for the premium version of this newsletter in substack by entering your email below ($10/month)

Sign up for our MVP service for $10/month: https://moneyvikings.memberful.com/checkout?plan=81265

Learn more: