Weekly Market Report - Prep for Week of 6/16

Time to de-risk, get into a defensive posture, the storm has arrived. Prep for 6/19 - 6/24

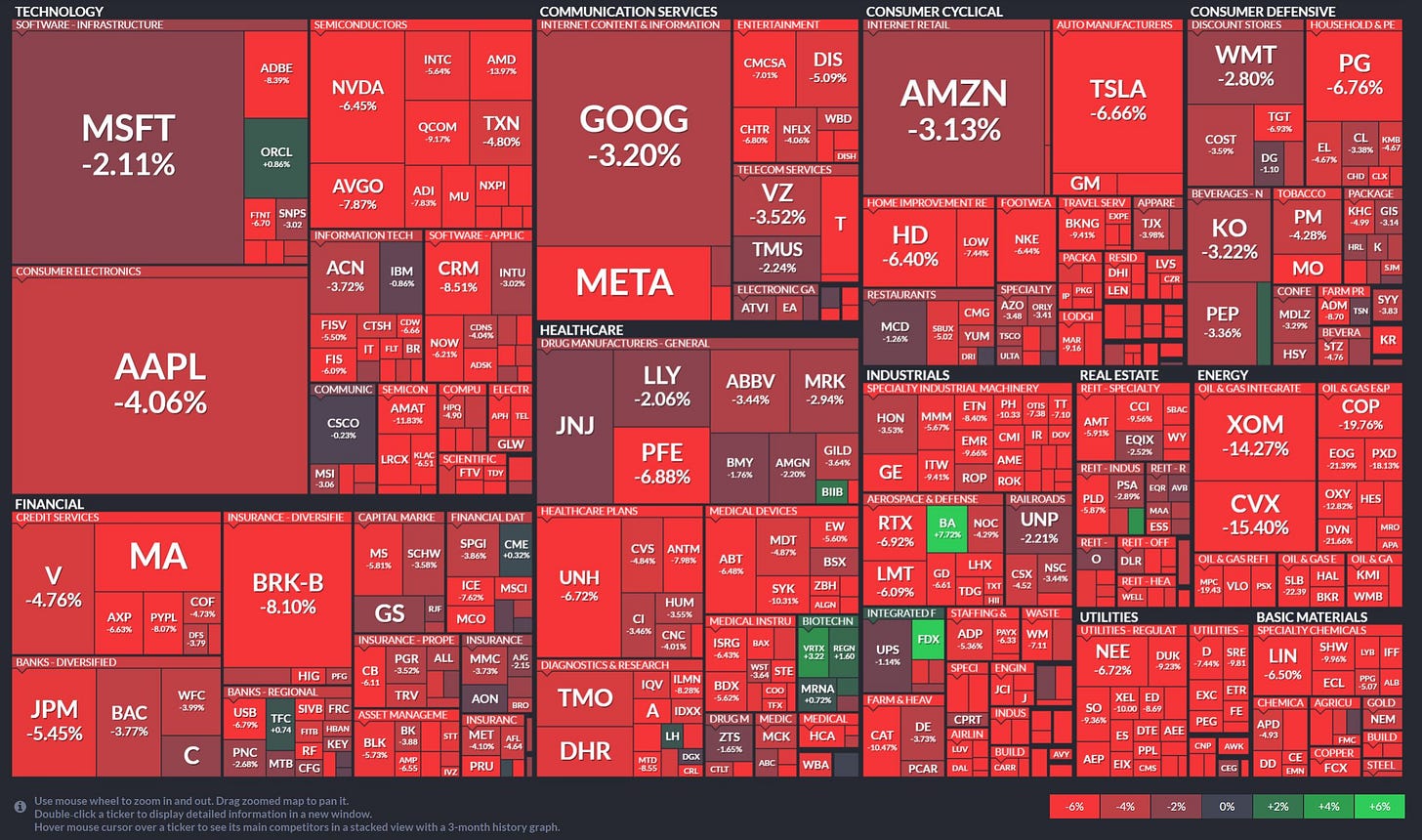

Health Care was only down -4% this week, and seems there may be some good vibrations in BioTech.

source: finviz

SPY

Weekly Market Report - SPY, down over -7% this week, we broke the May 380 support, and are currently testing the 200 Week EMA (red line). All sectors were lower this week, with Energy, a prior leader losing steam -15%.

BTC

The Weekly Crypto Report - Is BTC a non-correlated asset? No, the past 10 days has shown us a .98 correlation with SPY. Is it an inflation hedge? Not exactly, as inflation continues to ascend, BTC has lost over -50% of its value this year. We broke the psychological 20K line this week, and several critical supports, down over -30%.

DXY

The dollar, trading very strong, pulled back a bit towards the end of this week, making what could be a bullish cup and handle formation. It's also interesting that the dollar is trading inverse to the S&P 500, Nasdaq, and Dow over the past 10 days with a -.95 correlation. The reason we care about this is that the dollar going up usually means a market that is going down. I will be looking for some long dollar trades next week with the Small Exchange Small Dollar Futures, or the UUP ETF.

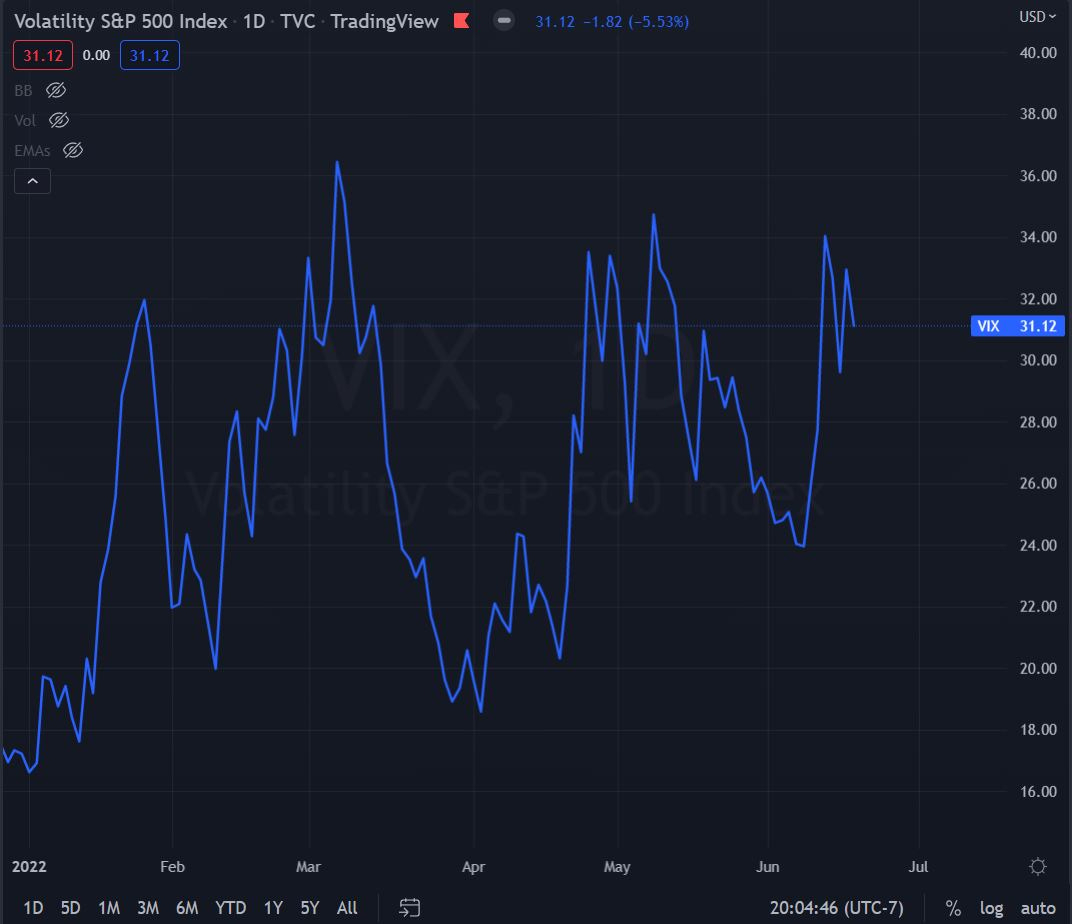

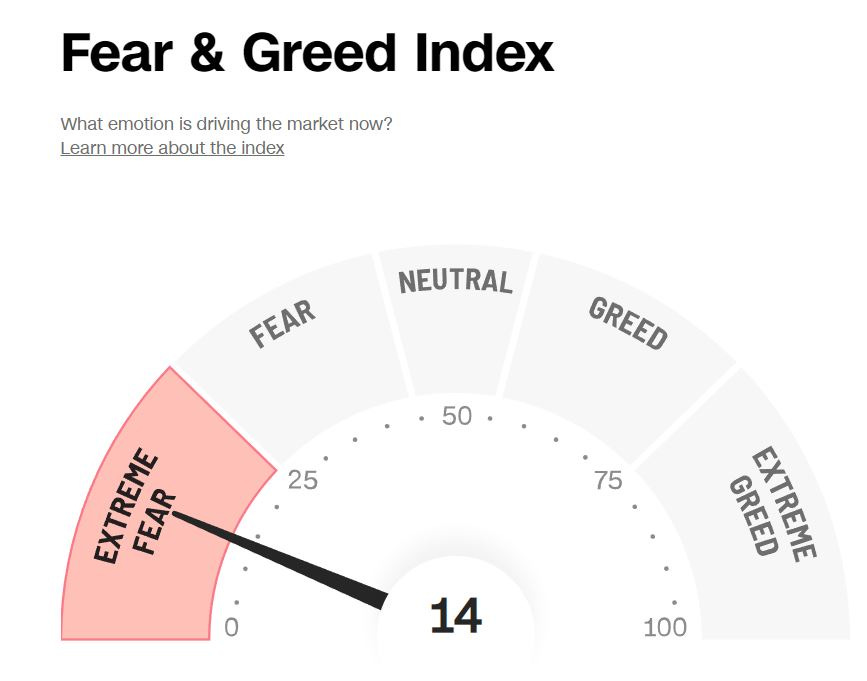

VIX

With the decimation of equities this past week, the VIX is holding above 30. The Fear & Greed Index has also gotten more fearful, down from 24 last week to 14 this week. How low can we go?

Rates

The 2, 10, and 30 year rates continued to trade over 3% this week, also not great for Equities. The inversion of the 10/30 took place leading up to Chair Powell's 75 bps rate hike, and then promptly uninverted. For those premium members on discord who followed our short 10 year, long 30 year futures trade, congratulations on your profits!

HotTrades

QQQ Iron Condor