Weekly Market Report - 5/1/22

It's the end of the world as we know it

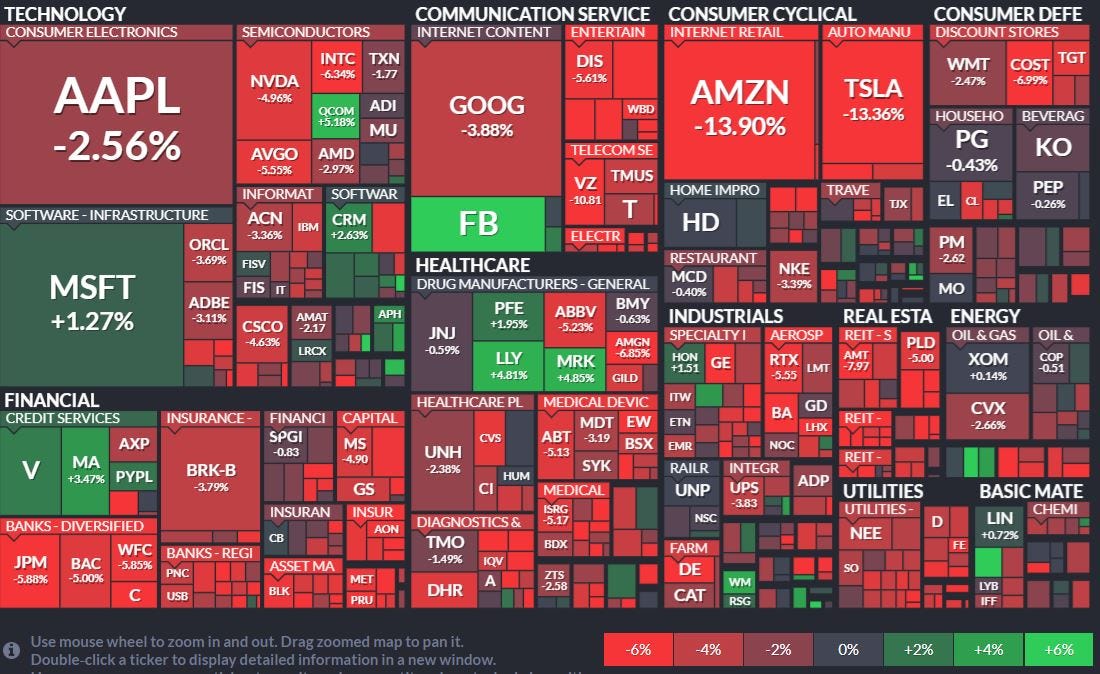

War, inflation, rate hikes, supply chain constraints, China lockdowns and the pandemic--this was an ugly week, no way around it. With Amazon, Microsoft, and Apple reporting earnings, all sectors closed lower. SPY continued to close below the 50 and 200 day, exponential moving averages and a "death-cross" seems imminent (a death-cross is when the 50 EMA green line moves below the 200 EMA red line). Consumer Discretionary, Real Estate, and Utilities were the worst hit. ARKK is now down over -60% for the year. GLD was down almost -2%, and SLV was down over -5%. Natural Gas and Oil were both up +10% and +1% respectively. While XHB (Homebuilders) declined, Home Depot and Lowes were able to eek out a small <1% gain each. Did anyone notice that Sherwin Williams and BABA climbed over +12% this week?

source: finviz