Weekly Market Report - 5/15/22

Lots of red, then some green later in the week, the S&P 500 ended the week down -2.41%. BTC is down over -17% the past week,

Weekly Market Report

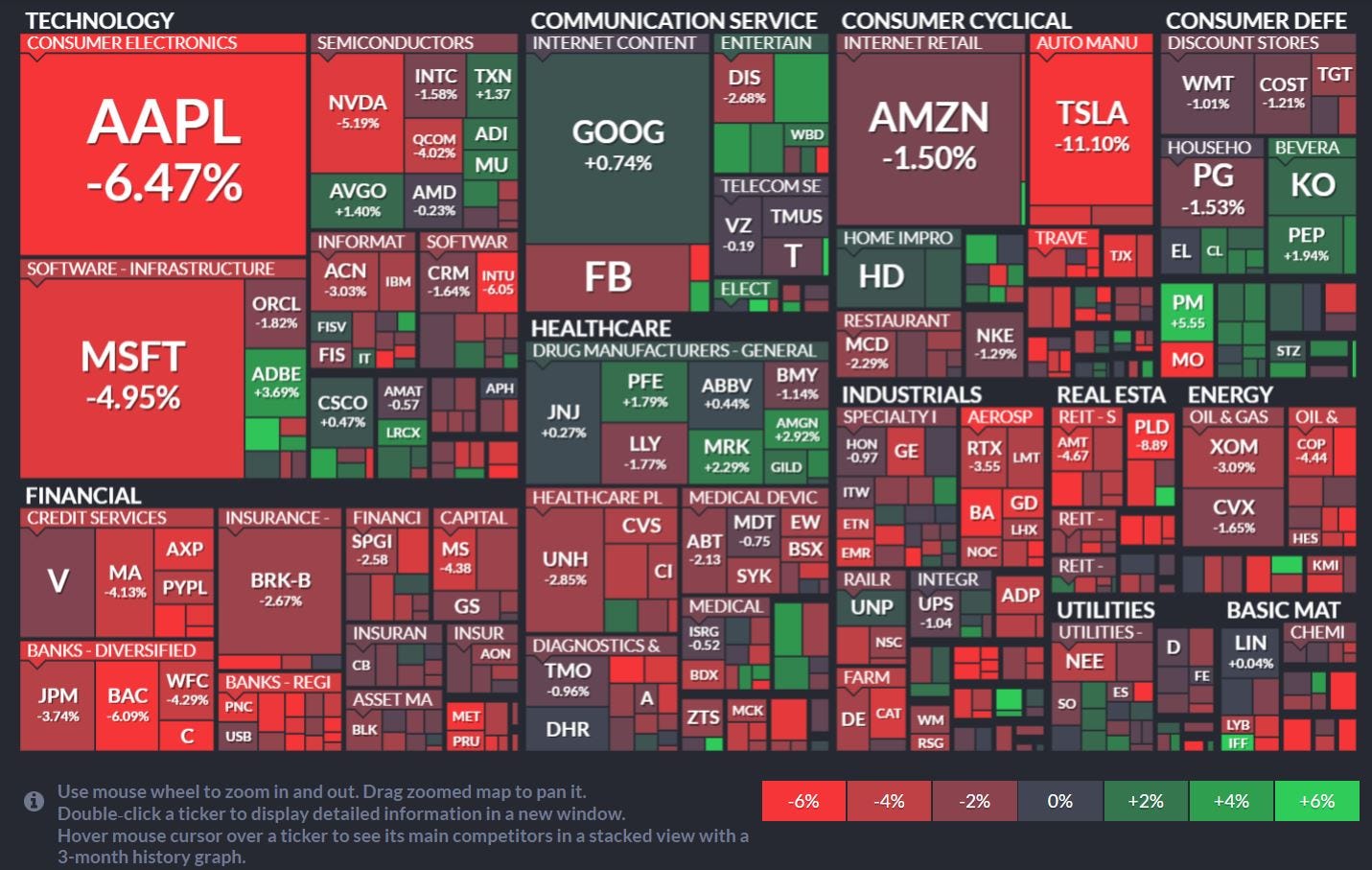

Weekly Market Report - The S&P 500 ended the week down -2.41%, but was even lower at various times this past Wednesday and Thursday. Eventually, a rally on Thursday came, and a gap up on Friday, but it wasn't enough to pull the index into green for the week. All sectors pulled back except for consumer staples. We continue to trade over 7% below the 200 day exponential moving average (red line above).

source: sector tracker

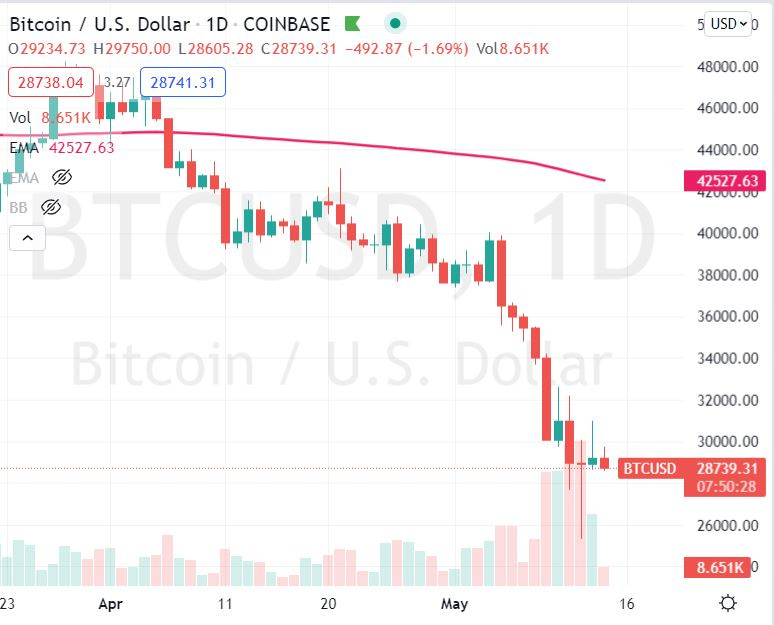

The Weekly Crypto Report - Trading around 30K, BTC is down over -17% the past week, and trades 40% below the 200 day exponential moving average (red line).

Most of the news this week came from the destabilization of the stablecoin UST, and it's partner Terra/Luna. UST is supposed to be pegged to the US Dollar, but went from $1 in value to as low as $0.05. Terra/Luna went from $88 on 5/4 to $0.0002 at the time of this writing. Many exchanges have halted Terra/Luna from trading all together. The lesson here is to diversify and never put all your eggs in one basket.

I continue to accumulate crypto such as BTC and ETH on these dips with the Gemini Crypto rewards credit card.

Finviz Weekly Market Heatmap

Since this is a weekly heatmap, you won't really see much of the green we saw towards the end of the of this week. We are still down on a weekly basis but there are some interesting opportunities out there for the long term investors in both growth and value stocks.

source: finviz

Interest Rate Watcher

All yields were down this week with the 10 year down a whopping 6.82%.The yield curve (distance between 10, 30, and 2 year), looks to be steepening. The 10 year is < 3% now, but for how long?

The VIX

The VIX ended the week below a 30 reading. Is the worst over, or will there be another leg up this next week? Time will tell.

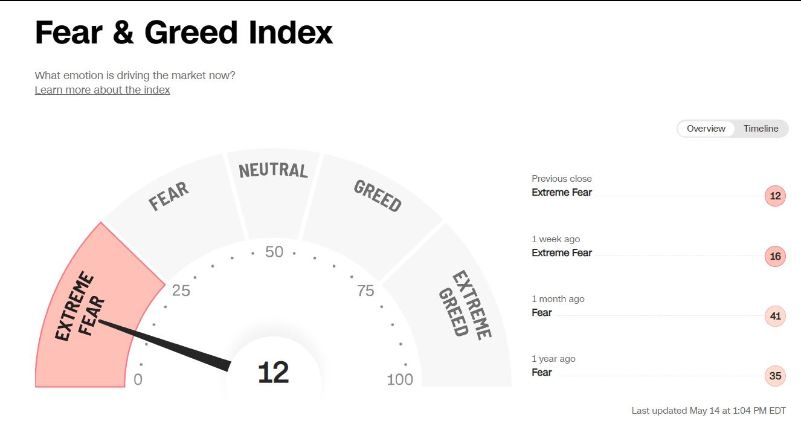

The Fear & Greed Index worsened from a reading of 16 one week ago to 12 this week.

The US Dollar

The US dollar gained almost 1% this week. Betting the dollar will mean-revert lower, I sold an out of the money call option on the Small Dollar Futures index, which I detail below in the Hot Trades section (for premium members.)

All rights reserved. Money Vikings, LLC is neither an investment or financial advisor. Money Vikings, LLC does not provide financial advice and none of the information being provided is to be seen as such. This is to include, but not limited to, any articles, videos and/or any other social media outlet presented by Money Vikings, LLC. All content is the opinions, beliefs, and personal strategies of the author(s) and owner(s) of Money Vikings, LLC (Greg, Jerry, and Bob). Money Vikings, LLC recommends that everyone do their own research, technical analysis, and develop their own conclusions, prior to initiating any trade activity supported by their own understanding, abilities, and risk tolerance. All trades carry inherent risk and proper risk management strategies should be used accordingly. Money Vikings, LLC does not guarantee results and is not liable in any way for losses incurred by any person or organization. Periodically, we may highlight services we are using and may receive compensation from their respective affiliate programs.