Weekly Market Report (5/15/22-5/21/22) & Hot Trades

Monday and Tuesday it looked as if the market was turning around, however the rest of the week it gave back all the gains and more. The S&P 500 ended the week down -3% with Consumer Staples the worst

Energy, Healthcare and Utilities led the week, while Consumer Discretionary, Consumer Staples, and Technology lagged the market. Betting the Target and Walmart drops were a tad overdone, I sold a naked XLP 65 strike put out to July 15th for a $90 credit. (You may want to also buy a 60 put for insurance if you do this because naked puts carry the risk of having to acquire 100 shares of stock at a price much lower than your strike).

Weekly SPY

Monday and Tuesday it looked as if the market was turning around, however the rest of the week it gave back all the gains and more. The S&P 500 ended the week down -3% with Consumer Staples the worst hit, while Energy continued to lead.

Weekly Bitcoin

Trading just a hair below 30K at the time of this writing, BTC is down almost 2% the past week and seems to be range-bound between 31K and 28K.

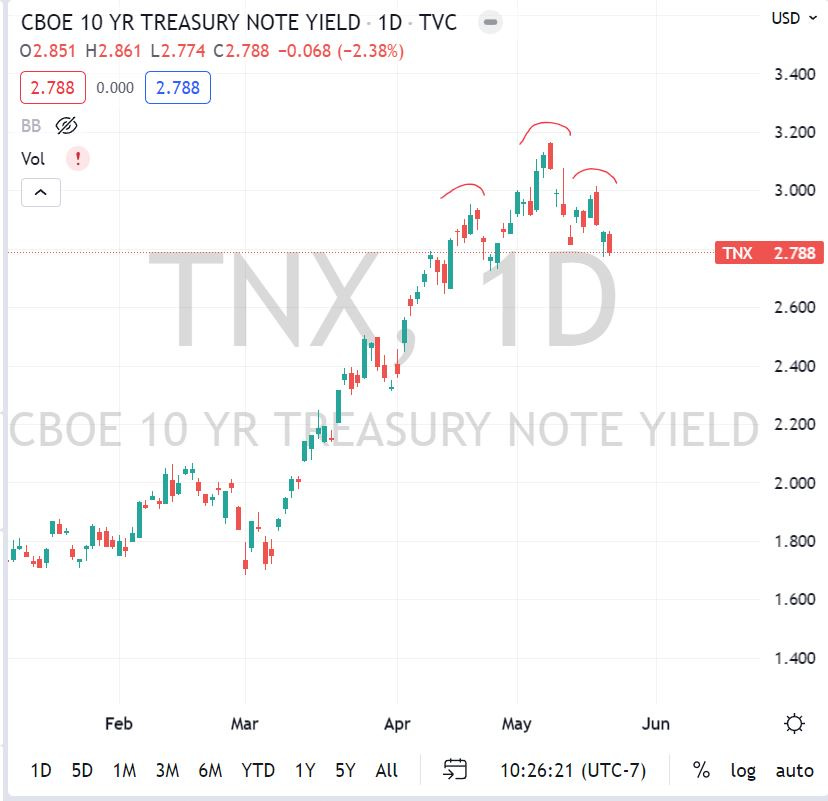

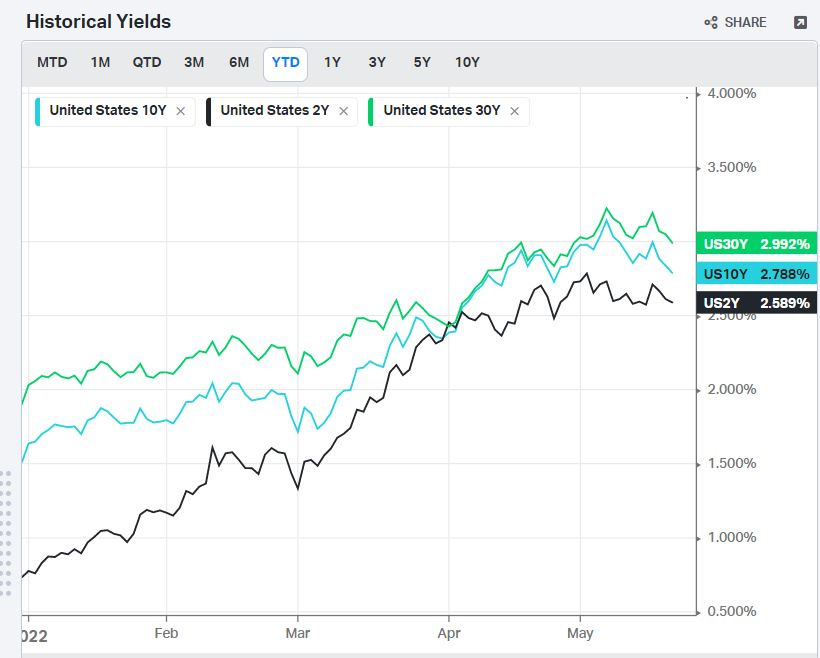

Rates

Watching a possible head and shoulders formation on the 10 year yield. A head and shoulders is often a precursor to a bigger drop. Since yields and bonds trade inversely to each other, does this means bonds are beginning to recover?

Treasury yields for the 30 year, 10 year, and 2 year continued to decrease this week. All are trading below 3%. Time to consider adding bonds to your portfolio?

Dollar

The US Dollar declined by 1.54% this week. Some of our short dollar trades worked out, and I'll continue to look for more opportunities, and call them out on Discord when I see them. (Note: Discord is for premium members).

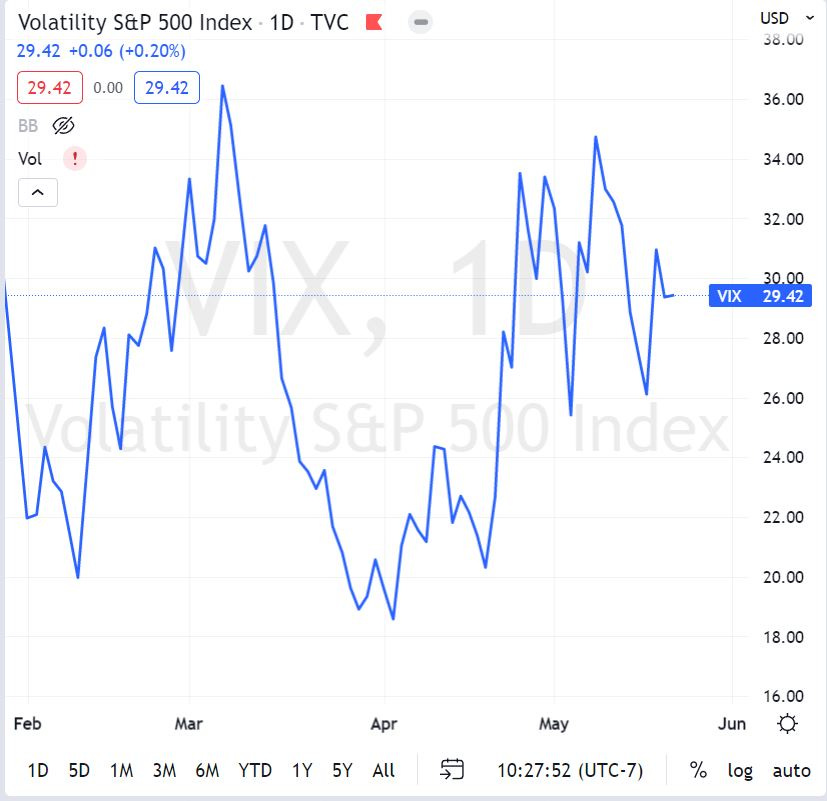

VIX

Like the prior week, we've been rangebound and ended the week below 30, even as the market lost another 3% this week.

Hot Trades - QQQ Iron Condor & Nanos Options