Weekly Market Report 5/31-6/3

Dead Cat Bounce or V-Shaped Recovery?

Weekly Market Report - Big Picture: Year to date, the S&P 500 is down -12.57%. This week the market gained almost 7%, taking out the prior resistance of 408 on 5/17. I'm still very cautious until we begin to retest the 50 moving average (green line) around 426. All sectors were up this week. Energy continues to rally, up 8.27% this week, while the leading sector, Consumer Discretionary, was up a whopping 9.51%.

The Weekly Crypto Report - BTC continues to trade down -4.72% this week, below the psychological 30K mark, and seems to have diverged in correlation from the stock market. I continue to buy on dips, and accumulate though various credit card rewards cards and CashApp Boosts.

A sea of green! Last week, I sold a naked XLP (Consumer Staples) 65 strike put out to July 15th for a $90 credit. This week I was able to close it for a $45 profit. I will continue to monitor for other sectors that this can be repeated.

source: finviz

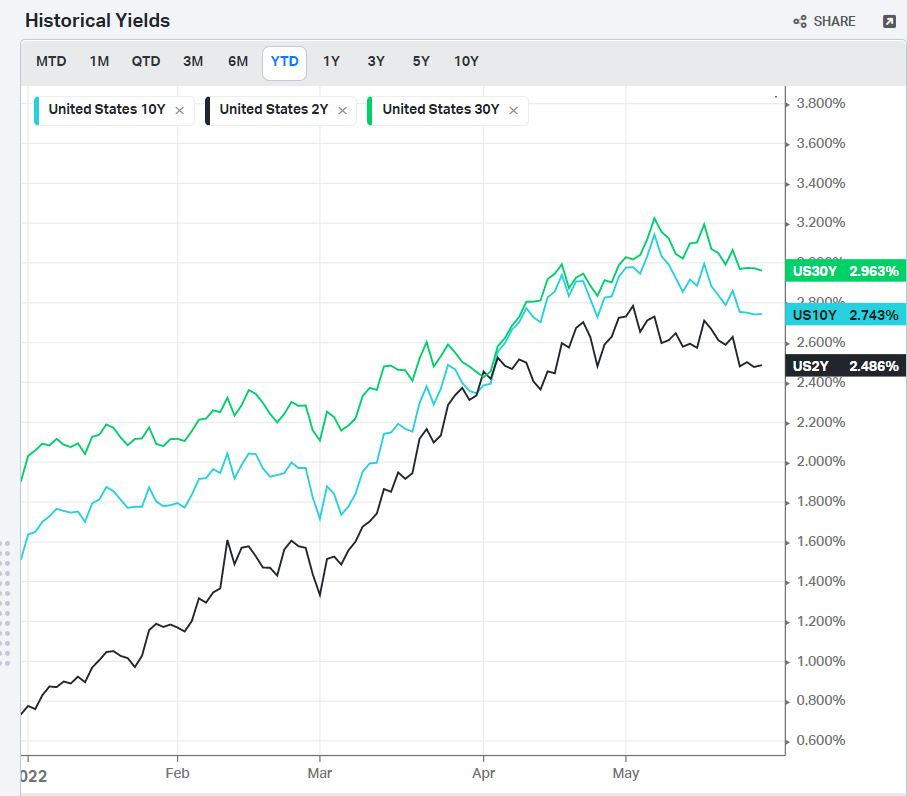

Interest Rate Watcher

Treasury yields for the 30 year, 10 year, and 2 year continued to descend from their highs 2 weeks ago. All are trading below 3%. A shortened trading week with various members of the Fed speaking, perhaps there will be increased volatility in rates and bonds (an option trader's dream 😀!)

Last week we called out a possible head and shoulders formation on the 10 year yield. A head and shoulders is often a precursor to a bigger drop. With a -1.51% decline this week, we continue to watch what the market will bring.

The VIX, The Dollar, Hot Trades. . .