Weekly Market Report — 5/9/2022

Let's Fight Inflation!

Weekly Market Report — Let’s fight Inflation — this week was a roller coaster for sure. With Jerome Powell raising rates 50 basis points (as expected) the market rallied — then gave it all back and then some for the following 2 days.

The S&P 500 index 200 EMA (red line) and the 50 EMA (green line) provided a “death cross”, a technical indicator of a bearish future. Real Estate was hit hard, down -3.80%. Gold was down a bit over 2%. Not all doom and gloom however, the Energy sector gained over 10%.

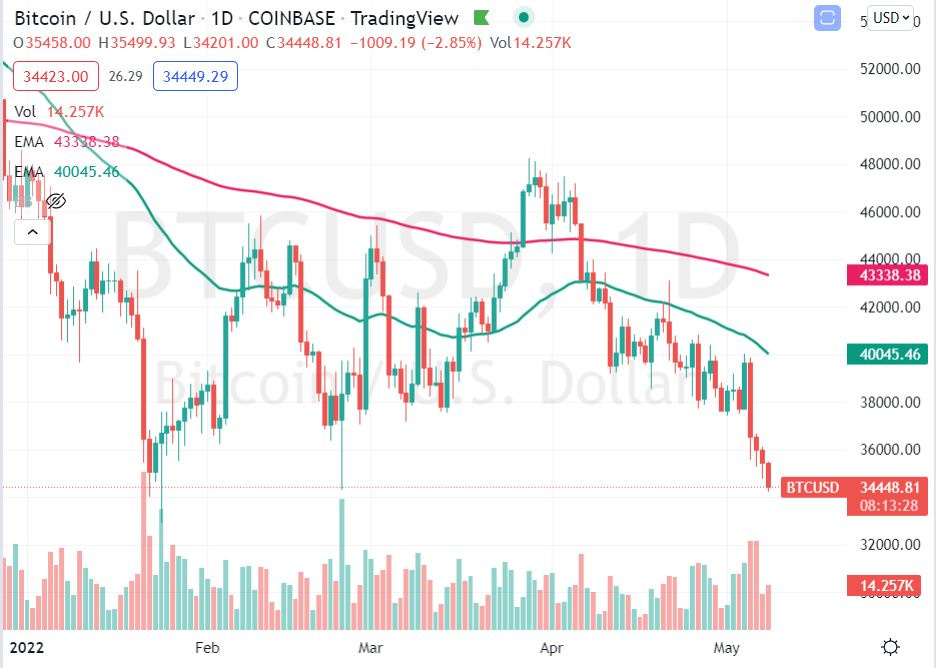

The Weekly Crypto Report — Trading around 34,500, BTC is down over -10% this week, and trading below 35,000 for the first time since January. BTC has a 72% correlation with the S&P 500 right now over the past 10 days. I continue to accumulate BTC with the Gemini Crypto BTC rewards credit card, and look for staking opportunities to earn interest on my long term crypto holds…

The US dollar gained about 0.5% this week, but seems to be bumping up against resistance at 104. The Trade Risk points out the dollar has a strong inverse correlation to risk assets such as Global Equity Markets, and Junk Bonds.

The VIX continued to trade above 30 for most of the week.

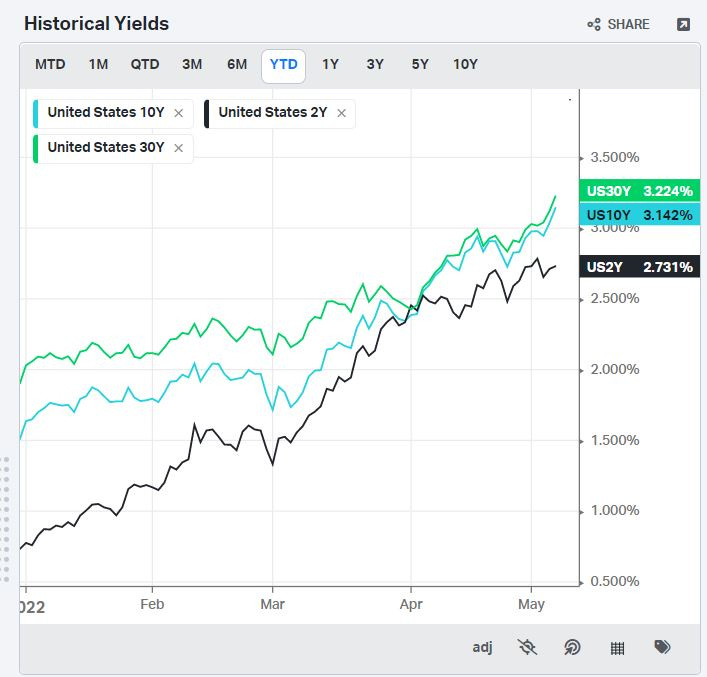

Yields continue to rise. The 30 year and 10 year both exceeded 3% this week and are only 8 basis points away from an inversion (Second time since April). Also worth noting is that the 30 year was up almost 10% just this past week.

All rights reserved. Money Vikings, LLC is neither an investment or financial advisor. Money Vikings, LLC does not provide financial advice and none of the information being provided is to be seen as such. This is to include, but not limited to, any articles, videos and/or any other social media outlet presented by Money Vikings, LLC. All content is the opinions, beliefs, and personal strategies of the author(s) and owner(s) of Money Vikings, LLC (Greg, Jerry, and Bob). Money Vikings, LLC recommends that everyone do their own research, technical analysis, and develop their own conclusions, prior to initiating any trade activity supported by their own understanding, abilities, and risk tolerance. All trades carry inherent risk and proper risk management strategies should be used accordingly. Money Vikings, LLC does not guarantee results and is not liable in any way for losses incurred by any person or organization. Periodically, we may highlight services we are using and may receive compensation from their respective affiliate programs.