Weekly Market Summary - April 25th, 2022

Is this the bottom, or just the beginning?

Weekly Market Report - Once again, the S&P 500 (SPY) ended the week down -2.75%. It continues to trade below the 200 day EMA (red line). The only leading sectors were Real Estate +1.25% and Consumer Staples +0.51%. Energy, which is a leader this year, slid over -4.5%. The worst hit this week was the Communications Sector, down over -7%. While one might expect to hide out in commodities like GLD (-2%), Oil(-4%), and Agricultural products(-5.42%) , none of them performed well this week.

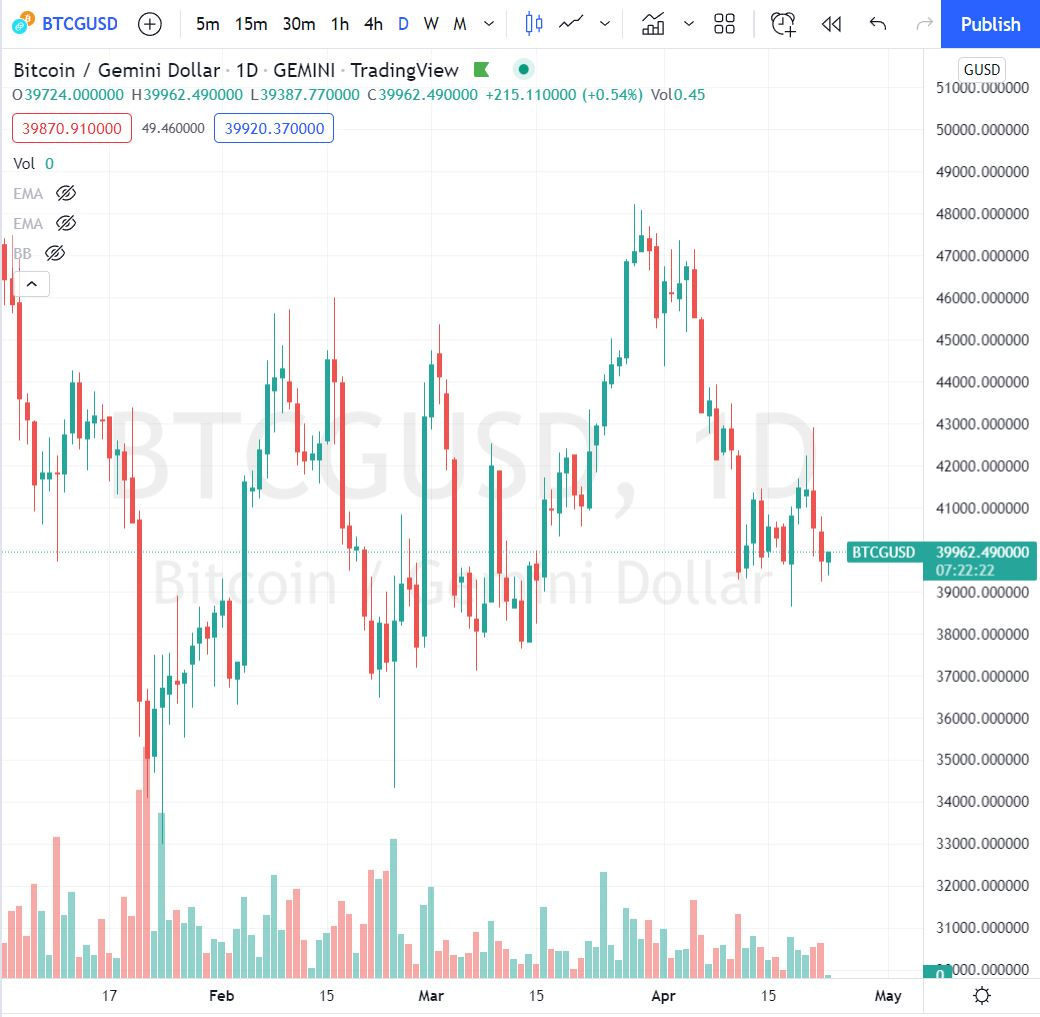

The Weekly Crypto Report - BTC continues to trade in a range, and was relatively flat for the week. Much of the week it traded below 40,000 and remains below the 50 and 200 EMAs. Meanwhile, I'm staking it and earning 6% on BTC.

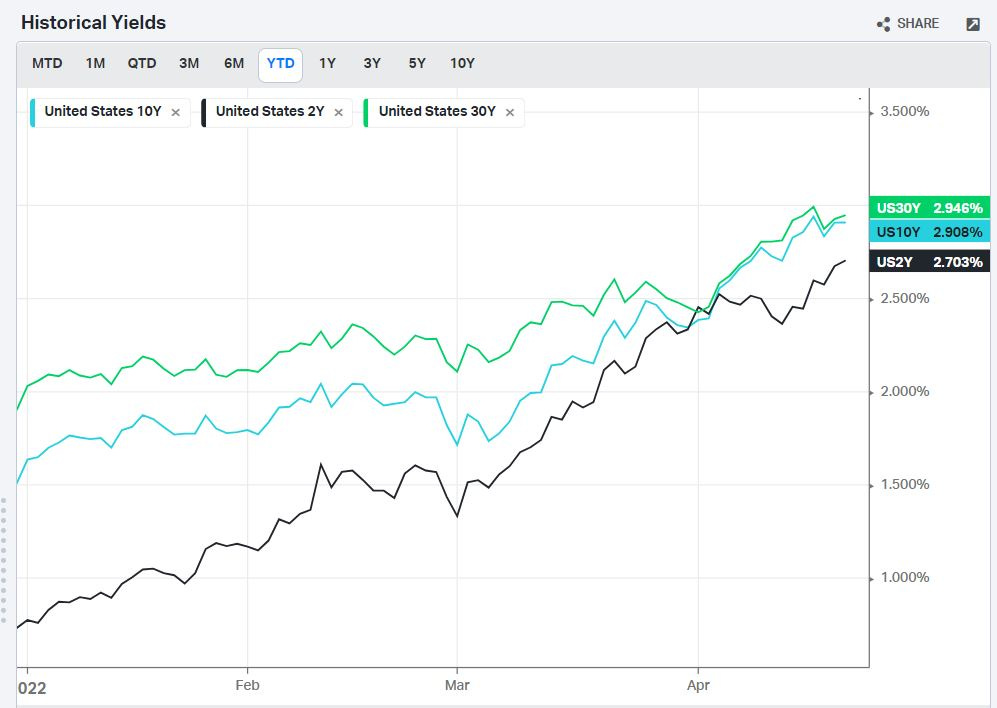

Interest rates continue to climb, and the distance between the 10 year (blue) and the 30 year (green) continue to flatten. For those that participate in our discord, we were able to make about $68 shorting the 10 year and going long the 2 year overnight with a simple pairs trade.

The VIX really jumped the last 2 days of the trading week from around 19 to over 28. The red line on the chart is a 5/18 put I sold at the 21 strike (bullish) to try and collect a little premium from this up move. If you think the VIX will continue to rise, you could also accumulate UVXY.

There seems to be some debate in the media regarding next week as to whether earnings from companies below will help to turn this market around. With positions in may of the companies below such as CocaCola, Whirlpool, Microsoft, Ford, Apple, Amazon, Abbvie, I'm watching carefully and will look for risk defined opportunities to sell premium.

Where are we Hiding Out?

Fundrise did it again and delivered superior results to owners of this crowd funding "eREIT". I am long Fundrise and look forward to many more years of returns.

Fundrise Overview (10-20% + Returns)

Easy way to gain exposure to real estate sector, awesome looking & fun platform, exciting updates, a few clicks to invest

Small minimum investment of $1,000

Management & advisory fees typically add up to 1%, but be aware of other fees, especially for early withdrawal before 1, 3 or even 5 years. I am trying it for 5 years

2017-2021 ROI was over 18.4% net (all investing has some level of risk, past returns are no guarantee of future returns)

Untested platform during a down cycle, not sure what could happen in a crash if investors made a mass run for their money.

Bottom Line Opinion: Worth considering to add diversification to a portfolio once all other fundamental personal finance boxes are checked: maxed 401k, reasonable debt load, emergency fund, secure employment, don't need to access these funds for many years...