Why I Keep a Trading Journal

Personal Analytics For Me!

Work is depleating me in and I have not been able to post as many articles, focus on SEO or even log my trades lately. This has made me soft. I need to make sure I keep my bare bones basic systems in place to continue to grow in my trading and learn. If I’m too busy to invest the 30 seconds it takes to log trade, then the trade isn’t worth it. I need to have a basic level of discipline so I can learn and ask questions in the future that I can’t even dream of right now.

Are those subs worth it? Are you following someone who is recommending trades that aren’t profitable for you? If you are and it’s not working out -- then cancel. You will only know if you have the trade log to prove it. If you look at your account in 6 months you won’t remember if a recommendation came from an IBD “trade of the day” or your uncle’s brother's roommate's sister's aunt, or just a bad one you decided to enter.

How profitable are your trades?

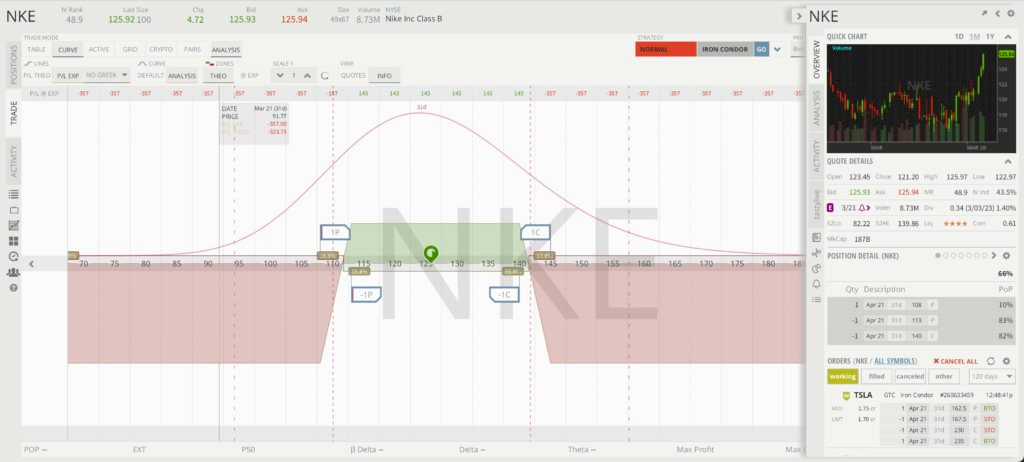

Do you always like to trade SPY a certain way? Is that way profitable? If not, what can you learn? Take a strategy like Iron Condors — are they actually profitable for you? How much return are you making on your covered calls? Is it worth it?

Are all of your trades the same risk / reward?

Are all your trades risking the same amount of capital, or could one of them blow up your account? A Trading Journal could help see the big picture.

Are you mainly defined risk, or undefined risk?

Are all of your trades bearish, bullish, or somewhat neutral? I like to use a Beta Weighted Delta to SPY for this, but a trade journal can also help you work this out.

What is your win rate? Do you win more than 50% of your trades? Does that matter to you? Surprisingly you can still be a profitable trader and have less than 50% win rate if you manage your wins and losses carefully. Are you? Perhaps you only win 25% of the time but your wins are tremendous and huge and your losses are tiny so that is ok. Just having awareness is key here.

What is your average daily, weekly, or monthly P&L? What’s your YTD income? How much BP (buying power) are you using? Is your return trending better, worse, or staying the same? Are you OK with where it is, or do you want it to get better?

What accounts are you trading in - taxable ones, or non-taxable? Taking a loss before the end of the year might be a good strategy in a taxable account, but taking one in a Roth IRA may not give you the same benefit. Good to know.

Are Calendars or Iron Condors giving you higher return? What stocks in those strategies are working?

What was the IVR when you entered the trades? Where was the stock trading when you entered the trade? How much buying power did that trade remove from your account?

My System for Logging Trades in my Trading Journal

What is my “system” you ask? Very simple, and can be done with a google spreadsheet by logging :

Date of Entry

Date of Close

Strategy used

Profit or Loss

Stock/ETF

IVR on entry & close

Stock price on entry and close

Comments or notes about the trade

Link or Image of the P&L graph from my trading software, or a tool such as optionsprofitcalculator.com

Where I got the idea to do it. A newsletter? A comment? A tastytrader I like to follow? An article? A friend? Why did I take the trade?

And follow-up adjustments between open and close, and why they were made.

link to Discord when this trade was first brought up.

Fantastic post! There are lots of articles that stress the importance of a trading journal, but very few offer practical steps on how to do this. Appreciate your step-by-step explanation!

Trading journals are important...just as important as managing risk with a stop loss. Both have significantly changed my P/L.