Money Vikings Investing - Week of 3/26/2023

In This Issue: Let’s Cut Through The Noise, Market Report, Hot Trades GLD Iron Condor, Collectibles - 3 Hot Comics for March, Sorcery TCG, Health - Collagen Supplements

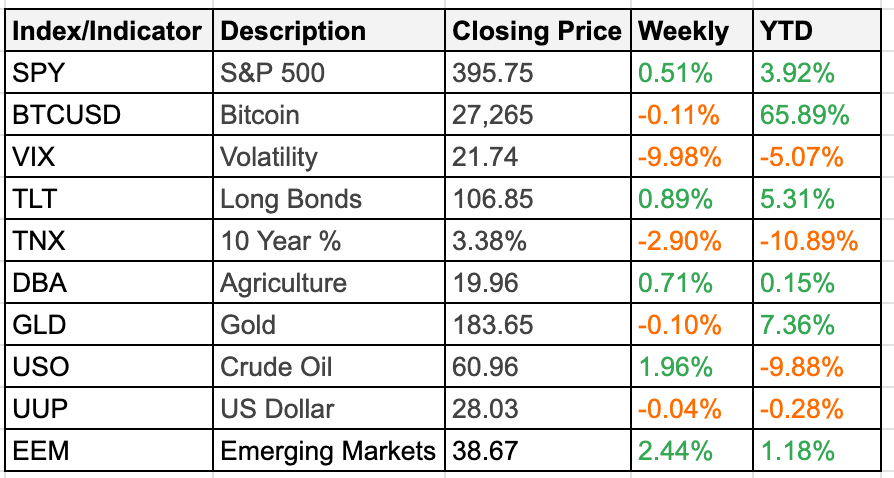

Indexes and Macro Indicators

Thank you again for checking out our Money Vikings content on YouTube, the blog, our book and more. With it all we strive for one main mission: To simply gather the tools and ideas to build a wealthy and healthy life.

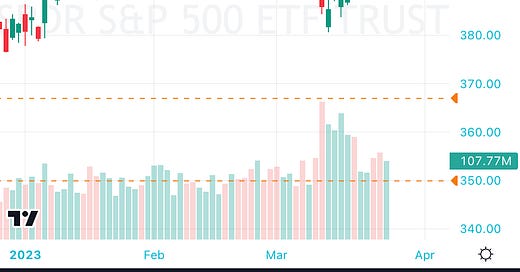

S&P 500

After a fairly volatile week that included a 25 bps rate hike, a Hindenburg aimed at Jack Dorsey’s Block, panic over another bank (Deutsche Bank), and the SEC looking at Coinbase products, we closed with SPY up a half a percent, above the 200 SMA. QQQ gained about 1.36% for the week. The dotted yellow lines represent the short strikes on a SPY Iron Condor the Money Vikings are in right now.

Weekly Finviz Heat Map

Perhaps driven by the decline in rates, Communication Services and Technology were the hottest sectors out there this week. Utilities and Real Estate lagged, which is why I took the opportunity to add some O on the pullback. Not all doom and gloom for Financials either—they were up 0.83%.

Bitcoin

Trading way above the 200 SMA, it is clearly consolidating before its next move.

Yield Curve & Rates

Rates continue to fall, while the 2/10 yield curve “un-inversion” trade does well. If you believe the days of an Inverted Yield Curve are coming to an end, you might look to sell the 2Y and buy the 10Y next week.

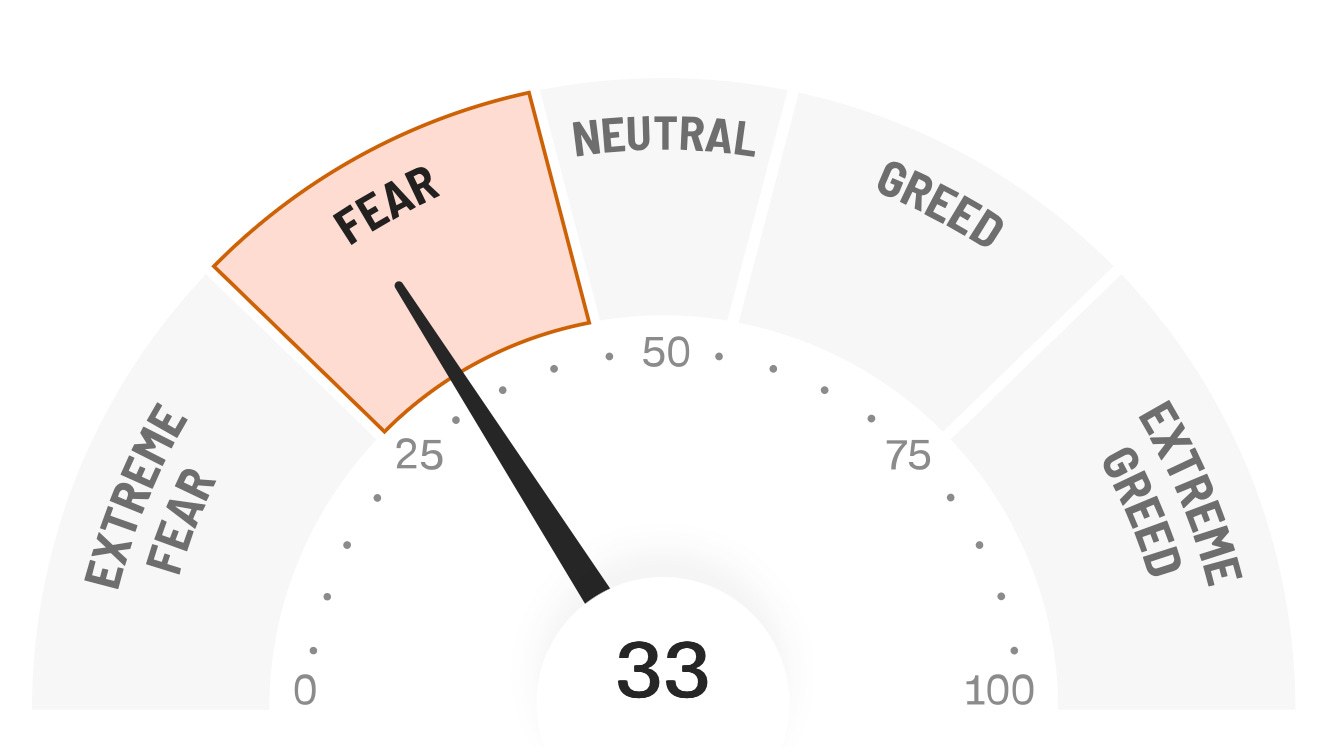

The VIX

Monday and Tuesday the VIX gave up about 5 points, while hovering around 21.50 for the remainder of the week, all while moving +/- 2-4 points each day. The Fear and Greed index moved from “Extreme Fear” to just “Fear”.

HotTrades - GLD Iron Condor

Other Trades from This Past Week

Closed the Natural Gas (UNG) credit spread for a $65 loss

GLD - did a small credit spread at the 183.5/184 strikes and made $14

Sold a COPX covered call out to April for .60cr at the 41 strike

Did a pairs trade which was long +1.74 shares of IWM and short -1 share of QQQ. So far this trade is losing, but on Friday the IWM started outperforming QQQ again.

Did an overnight 4/21 108/113/140/145 NKE Earnings Iron Condor for a $72 profit overnight

Added some Reality Income O shares around $60/share

Followed the Antagonist’s XLK bullish call spread for a $21 profit

Closed a WBA short call at the 37.50 strike for $69 profit, and rolled down to 34.5 strike for a .50 cr. Still holding the long 32.5 call out to June in this poor man’s covered call, which simulates holding 100 shares of WBA at a fraction of the cost.

Adjusted my COIN Iron Condor on concerns the SEC will be investigating their products. I rolled my 90/95 calls down to 80/85 for a .47cr.

Earnings Next Week

Not a ton of exciting earnings next week, but keep an eye on our discord for earnings trade ideas. Become a premium member for potential earnings trades, like the NKE Iron Condor from last week that would have made you $72 or a 20% ROI overnight.

All rights reserved. Money Vikings, LLC is neither an investment or financial advisor. Money Vikings, LLC does not provide financial advice and none of the information being provided is to be seen as such. This is to include, but not limited to, any articles, videos and/or any other social media outlet presented by Money Vikings, LLC. All content is the opinions, beliefs, and personal strategies of the author(s) and owner(s) of Money Vikings, LLC (Greg and Jerry). Money Vikings, LLC recommends that everyone do their own research, technical analysis, and develop their own conclusions, prior to initiating any trade activity supported by their own understanding, abilities, and risk tolerance. All trades carry inherent risk and proper risk management strategies should be used accordingly. Money Vikings, LLC does not guarantee results and is not liable in any way for losses incurred by any person or organization. Periodically, we may highlight services we are using and may receive compensation from their respective affiliate programs.

Copyright © 2023 Money Vikings LLC, All rights reserved.

Great questions hard to say but seems the range for current market is between 17 and 30. Normal seems to be 20-24. I agree when it gets below 20 it tends to spike up. When it’s below 20 I feel like the market is getting a bit complacent. I do like when it’s higher because that means more premium for iron condors and strangles. Because of its mean-reverting properties I like betting it will go down when it gets to extremes (30+) over betting it will go up when it’s low. That being said I would never try to “short” the vix itself by selling calls against it or something. A simple slow decline is fine with me.

With all the volatility lately, the VIX has been bouncing like a ping pong ball. What do you consider the "normal" range for it to be now? And what level would you consider it stretched to the point that it'll likely pull back or rise? For the latter, it seems like whenever it falls below 20, it shoots up. But I'm not sure if recent conditions will change that.