Money Vikings Investing - Week of 4/16/2023

In This Issue: What Financial Crisis?, Market Report, Finviz/Sector Analysis, Hot Trades XLE Cash Secured Put $178 Profit! 💸, Best Comic Collectibles, Investing Trifecta, Podcast, Earnings 🔥

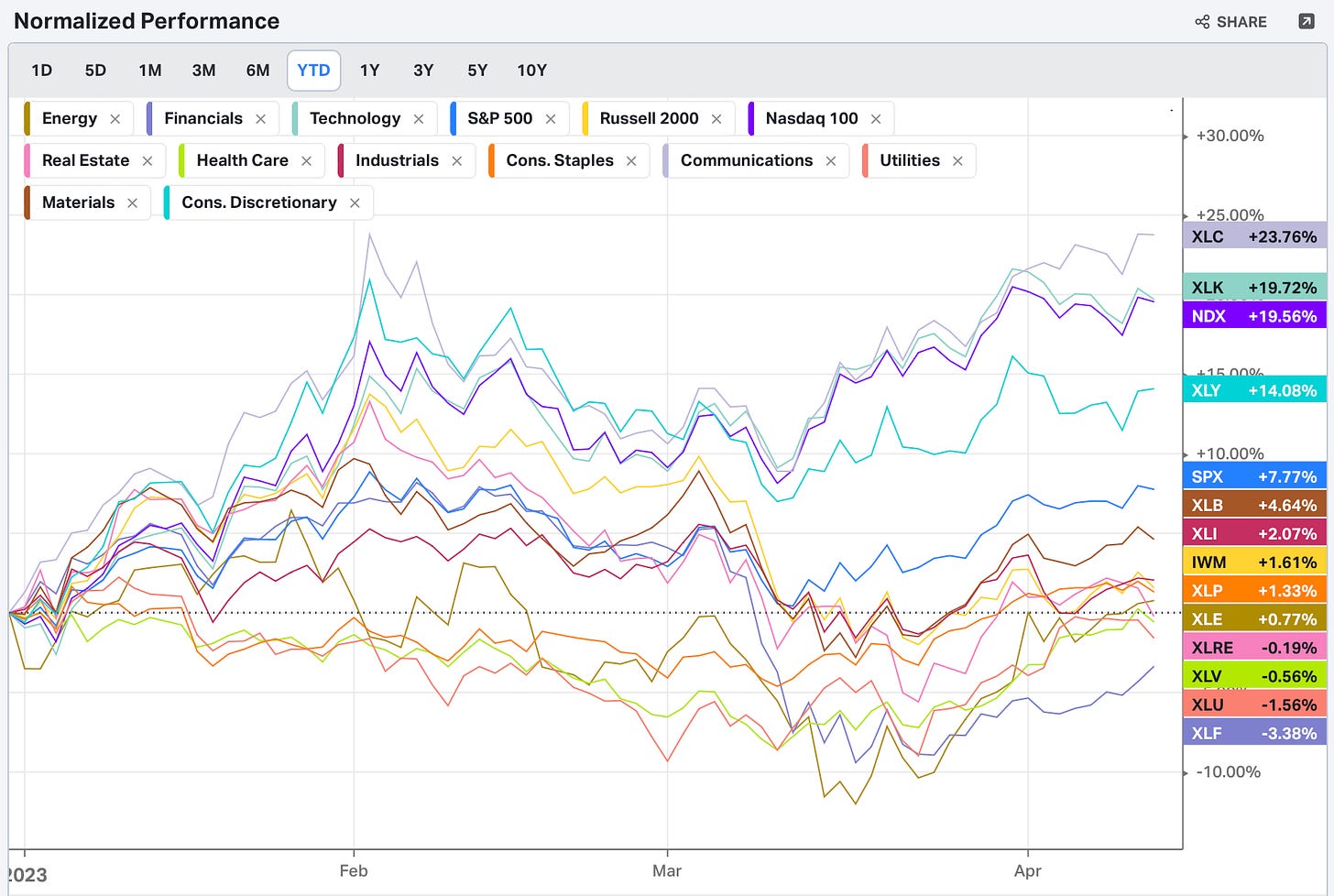

Happy Sunday Money Vikings! An up week for sure, but wild swings in both directions on Wednesday, Thursday, and Friday. Despite all that volatility was down. Energy led, up 3.08% for the week, while Real Estate lagged, down -1.64%. I took the opportunity to add more O (Reality Income) and even got my first of many monthly dividends this last week! Financials (lower left on first heat map graphic) are pretty green, don’t you think?

A few new articles and videos to check out this week on our blog : 5 Ways to Middle Age Happiness, Be an Investing Jedi, an our ever popular Investing Trifecta. Note we are also getting back to publishing some of our content in podcast format for those that like to listen while on a walk or in the gym getting buff 💪

YouTube | Blog | Book | Podcast | Discord & Substack Chat (see link below)

Finviz Heat Maps and Sector Analysis - What Financial Crisis?

Indexes and Macro Indicators

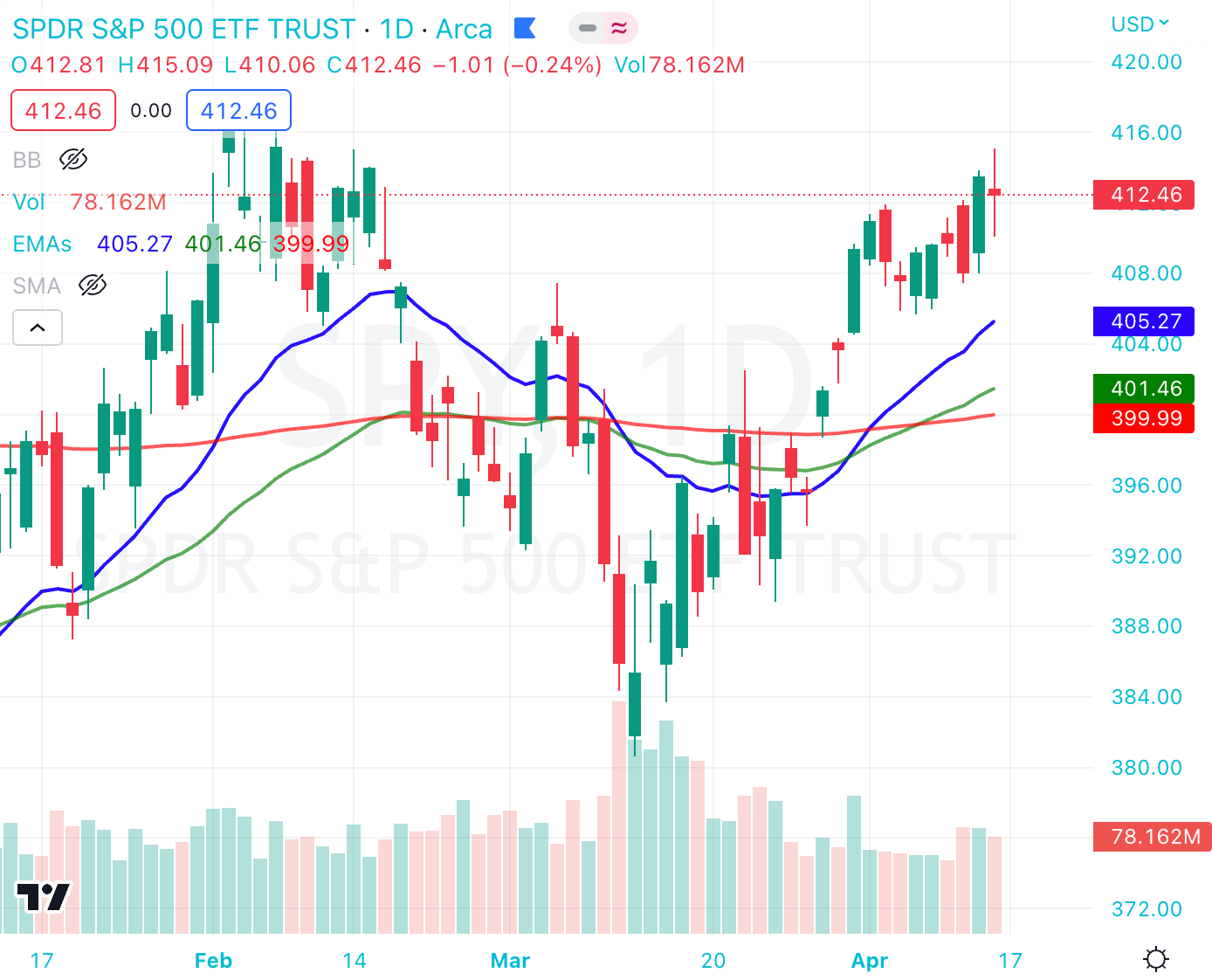

S&P 500

Yield Curve & Rates

Rates are starting to turn up. Spread levels have not changed much for the week, as we still remain inverted around 58 bps below 0. The 2 year still trades above the 30 year and 10 year.

The VIX

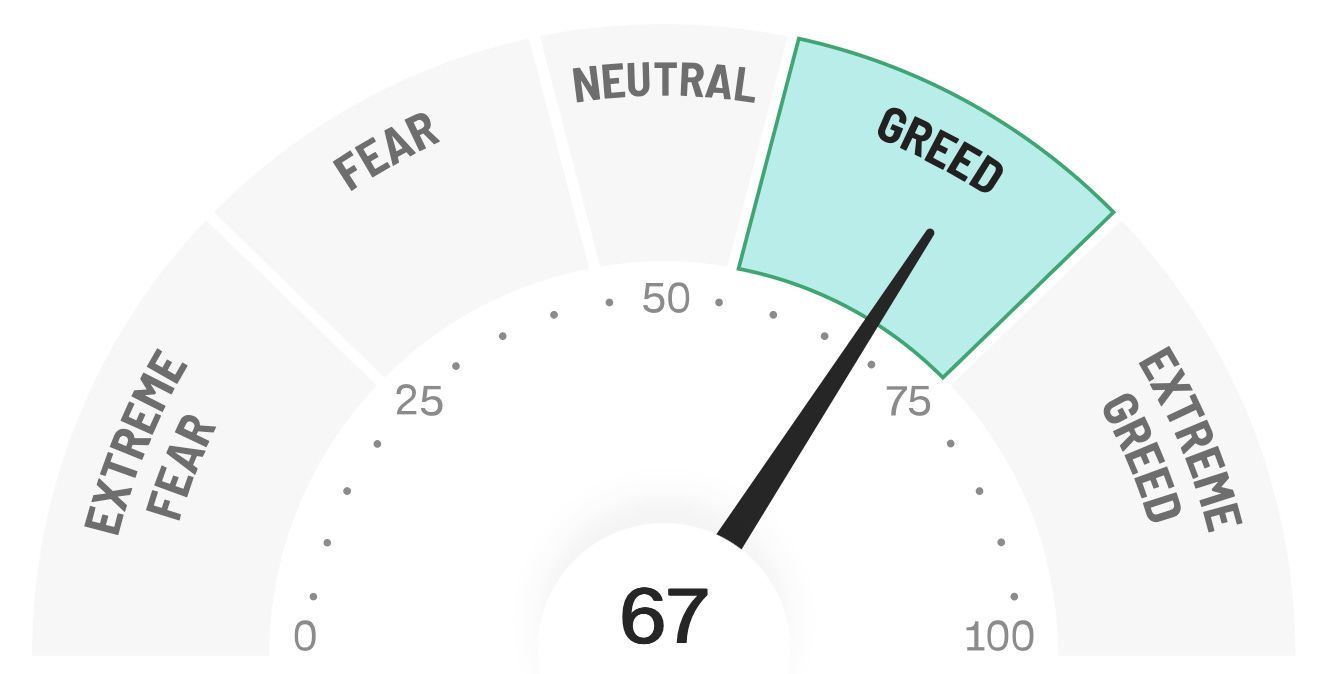

The VIX has not been at 17 since the midwest snow storms (and LA county snow!) on Feb 2nd earlier this year. As a premium seller I dislike low volatility because I don’t collect much premium from opening new covered calls, iron condors, or cash secured puts. All I can do is close trades and wait for it to increase again. On the flip side, buying long calls or puts / hedges are cheaper than usual. The fear and greed index at 67 “GREED” trends towards “EXTREME GREED”. If you look at the put/call ratio, you’ll see that on April 14th, the 5 day average was 0.85 and trending down which means fewer people were buying puts than calls (a bullish sentiment indicator).

Pssst…. one of our other favorite substack publications is the Antagonist, this week in Over the Weekend #15, Jason Milton covers his take on recessions, and why wives are super heroes!

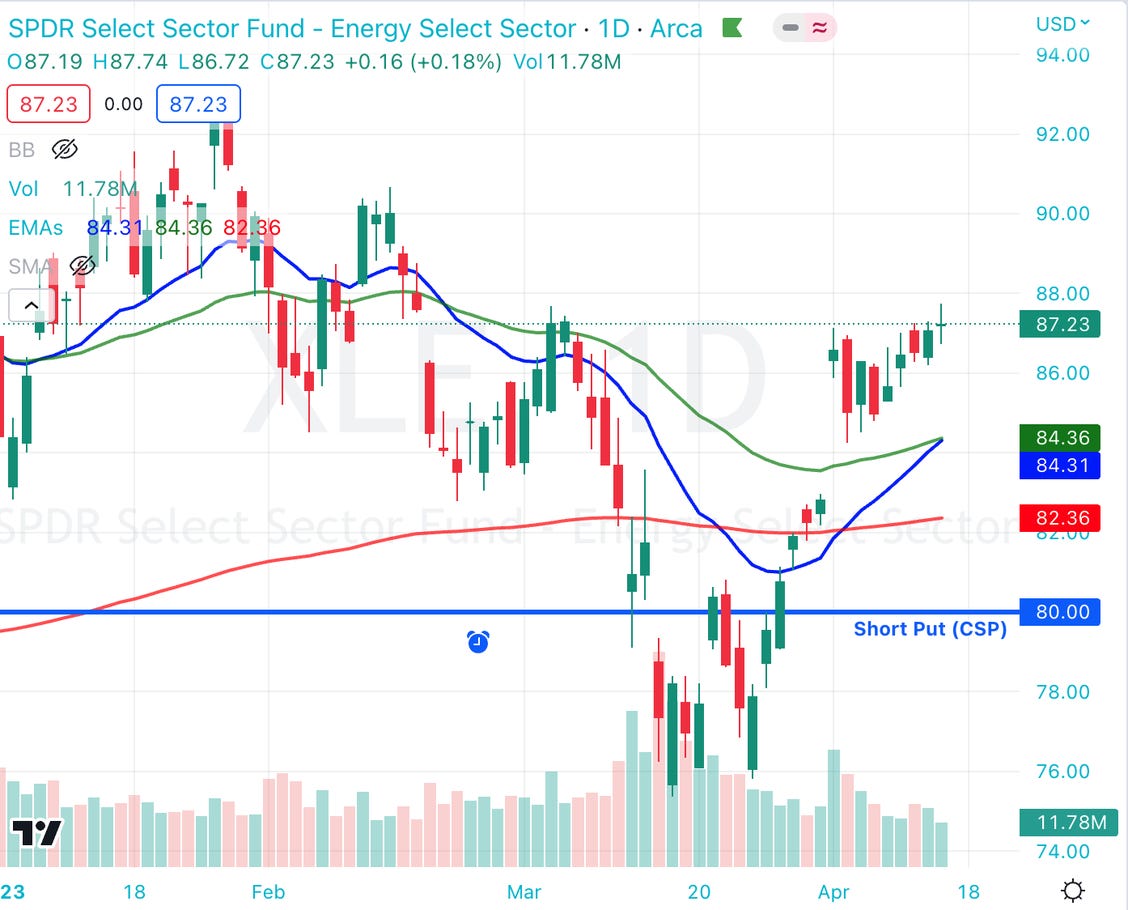

HotTrades - Closed XLE Cash Secured Put for $178 Profit!

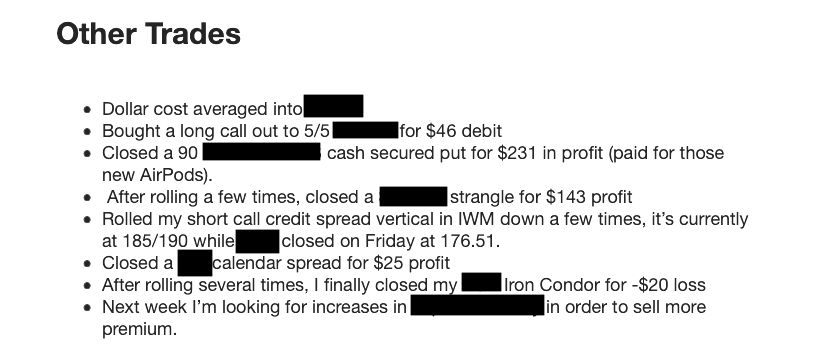

In the Feb 26th newsletter, I called out selling a short 4/21 80 strike XLE Cash Secured Put for a $200 credit. I was able to buy to close this past week for around $20, leaving me with a ~$180 profit. On February 23rd, volatility was 26. I’m waiting for vol to spike up again, and I’ll gladly sell a few more when the VIX and IVR are up again.

Earnings Next Week

Next week earnings start to get very busy. We have earnings from Netflix, Tesla, TSMC, Charles Schwab, Bank of America, Goldman Sachs, and United. A busy week for sure! I’ll be calling out some possible earnings trades on discord, substack chat, and now the new Notes next week.

All rights reserved. Money Vikings is neither an investment or financial advisor. Money Vikings does not provide financial advice and none of the information being provided is to be seen as such. This is to include, but not limited to, any articles, videos and/or any other social media outlet presented by Money Vikings. All content is the opinions, beliefs, and personal strategies of the author(s) and owner(s) of Money Vikings (Greg and Jerry). Money Vikings recommends that everyone do their own research, technical analysis, and develop their own conclusions, prior to initiating any trade activity supported by their own understanding, abilities, and risk tolerance. All trades carry inherent risk and proper risk management strategies should be used accordingly. Money Vikings does not guarantee results and is not liable in any way for losses incurred by any person or organization. Periodically, we may highlight services we are using and may receive compensation from their respective affiliate programs.

Copyright © 2023 Money Vikings, All rights reserved.

I sell puts only on companies I either own or don't mind owning so it's good either way. You'll collect 100% of the premium 100% of the time...lol...but yes, I know what you mean assuming you're closing the transaction before expiration (I do the same).

I love selling cash secured puts...one of my favorite strategies.